On 9 May 2019, the Ministry of National Development (MND) and the Ministry of Manpower (MOM) jointly announced a change in CPF usage and housing loan rules.

Under the new rules, how much CPF monies can be used for a property purchase will depend on the extent its remaining lease can cover the youngest buyer to the age of 95. Do note though, that CPF savings and HDB loans will not be granted to fund the purchase of HDB flats, Executive Condominiums (EC) and private residential properties with remaining leases of 20 years or less.

If the remaining lease of property at the point of purchase is at least 20 years and can cover the youngest buyer until at least the age of 95, CPF usage will be allowed to pay for the property up to the Valuation Limit (VL).

If the remaining lease of the property purchased does not allow you to live up to 95 years old, CPF usage will be pro-rated.

For CPF members above 55 years old, they will need to have a property with sufficient remaining lease to cover them until at least the age of 95 before being allowed to withdraw their CPF savings above the Basic Retirement Sum (BRS).

For those who can't or do not have any property, they need to set aside the Full Retirement Sum (FRS) before they can withdraw whatever is left over in their Retirement Account (RA). [Note: CPF members who reached the age of 55 will have their CPF Ordinary Account (OA) and Special Account (SA) monies transferred into their RA]. This is to ensure CPF members have a home for life and to secure a basic level of retirement income. More details can be found here.

CPF Usage & Housing Loan Rules For Purchase of Multiple Properties

CPF members must set aside their BRS if they have at least one property bought using CPF or the property they are buying can cover them till age 95. However, they must set aside the FRS if they do not have any property that can cover them till age 95.

CPF Usage And Housing Loan Rules for HDB Flats

Previously, HDB flats with leases of 60 years or more can be paid with CPF up to the purchase price or valuation limit (VL), whichever is lower. But, for flats with leases 30 years to less than 60 years which can cover the youngest buyer to the age of 80, CPF usage is capped at a percentage of purchase price or VL, whichever is lower.

But with the updated HDB housing loan rules for new and resale flats, buyers are only eligible to take a loan up to the full 75% Loan-to-Value (LTV) if the remaining lease of the flat can cover the youngest buyer to the age of 95.

If the flat cannot cover the youngest buyer until the age of 95, buyers are still eligible for an HDB housing loan, but the LTV limit will be pro-rated from 75%. This is calculated based on the extent the remaining lease of the HDB flat can cover the youngest buyer until the age of 95. Please refer to the example below to find out how this is derived.

The LTV limit refers to the maximum amount of loan a flat buyer can take up, expressed as a percentage of the purchase price or flat value, whichever is lower. For example, if the purchase price or value of the flat is $500,000, whichever is lower, a LTV of 75% will be $375,000.

The actual loan amount is also subjected to HDB credit assessment, which takes into account the buyers’ income, age and financial situation, among others.

Example: HDB Loan Calculation For Property That Does Not Cover The Youngest Buyer To Age 95

Let’s assume the following:

- Property Price: $500,000 (Lower of Purchase Price or Valuation Limit)

- Remaining Lease of Property: 55 Years

- Age of Youngest Buyer of Property: 25 years old

As the remaining lease of the property does not cover the youngest buyer to age 95, the formula to calculate the pro-rated LTV is:

In other words, instead of getting an HDB housing loan of $375,000 (75% of Valuation Limit), the borrower is only eligible for $262,500 (52.5% of Valuation Limit). You can also derive the loan amount using the online HDB Loan Calculator.

Below are further illustrations of borrowing limits for HDB flats or private properties with different length of remaining leases:

CPF Withdrawal Limit (WL) Rules

In addition to the above rules on the usage of CPF monies for the purchase of a property, borrowers must also take note of the Withdrawal Limit (WL) irrespective of whether they are using bank or HDB loan financing. The WL is capped at 120% of Valuation Limit (VL).

Example:

Purchase Price of Property = $1,100,000

Valuation Price of Property $1,000,000

Valuation Limit = $1,000,000 (lower of the purchase or valuation price)

Withdrawal Limit of Property = $1,200,000 (i.e. 120% of $1,000,000)

However, do take note of the following conditions:

A borrower can use his/her CPF OA funds up to the VL only if the property can cover the youngest buyer till the age of 95. If the property is unable to cover the youngest buyer till the age of 95, the use of CPF funds will be pro-rated.

To be able to use his/her CPF up to the WL, the borrower must first set aside his/her Basic Retirement Sum (BRS) before being allowed to use the excess in the CPF OA for loan repayment till WL.

To reiterate, CPF members will only be able to withdraw above the VL and up to the WL if they are able to set aside the Basic Retirement Sum (BRS). If they have reached their WL, they will have to fork out cash to service the remainder of their housing loan.

If you still find the new CPF usage and housing loan rules confusing or would like to find out more about HDB or private housing policies, please feel free to contact us for an obligation-free information-sharing session. We will be delighted to help clear your doubts and answer any questions you may have regarding the Singapore property market.

HDB and Commercial Housing Loan Rules

For HDB housing loans, the maximum tenure is 25 years. But for commercial bank loans, the maximum tenure is 30 years for HDB flats and 35 years for private properties. In addition, loan limits are also imposed based on the number of outstanding loans and the age of borrowers. [Note: For the purchase of HDB flats, buyers can opt for either an HDB or Bank Loan. But for Executive Condominiums (EC), buyers can only take a Bank Loan].

It is important to evaluate your property financing options and choose one that suits your needs while minimising risks.

HDB Loan Rules

The HDB flat must have a minimum remaining lease of 20 years. And as explained earlier, the amount of loan will be based on whether the remaining lease of the flat can cover the youngest buyer to age 95.

In addition, the loan tenure disbursed will be the shortest of:

- 25 years;

- 65 years minus the average age of the applicants; or

- Remaining lease of the flat minus 20 years.

The difference between the price of the HDB flat and HDB housing loan can be paid using cash or CPF Ordinary Account (OA) monies, or a combination of both.

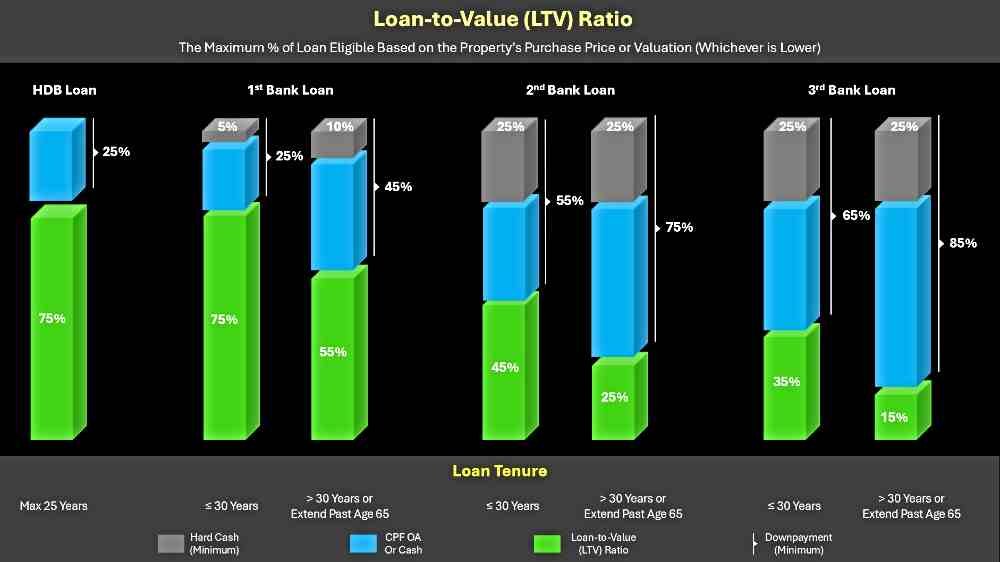

Ordinarily, the Loan-to-Value (LTV) for HDB loans is 75% if the remaining lease of the flat can cover the age of the youngest owner up to the age of 95. Unlike a bank loan, the balance 25% downpayment ca be paid by either cash or CPF OA monies.

Commercial Bank Housing Loan Rules

For the first home loan, the LTV is 75% of the purchase price or value of the property, whichever is lower, up to a tenure of 30 years. Out of the remaining balance of 25%, 5% must be paid in cash and the rest in either cash or CPF OA monies.

However, the LTV will drop to 55% for a tenure above 30 years or when it extends past the borrower’s age of 65. Out of the remaining balance of 45%, 10% must be paid in cash and the rest in either cash or CPF OA monies.

For the second outstanding housing loan, the LTV is 45% for a tenure of up to 30 years. Out of the remaining balance of 55%, 25% must be paid in cash and the rest in either cash or CPF OA monies. For tenure above 30 years or when it extends past the borrower’s age of 65, the LTV drops to 25%. Out of the remaining balance of 75%, 25% must be paid in cash and the rest in either cash or CPF OA monies.

For the third outstanding housing loan and above, the LTV is 35% for a tenure of up to 30 years. Out of the remaining balance of 65%, 25% must be paid in cash and the rest either in cash or CPF OA monies. For tenure above 30 years or when it extends past the borrower’s age of 65, the LTV falls to 15%. Out of the remaining balance of 85%, 25% must be paid in cash and the rest in either cash or CPF OA monies.

Debt Servicing Limits

The quantum of your housing loan can be limited by two debt servicing limits imposed by the Monetary Authority of Singapore (MAS). They are:

- Mortgage Servicing Ratio (MSR)

- Total Debt Servicing Ratio (TDSR)

Mortgage Servicing Ratio (MSR)

It refers to the portion of a borrower’s gross monthly income that is used to repay property loans. It is capped at 30% of a borrower's gross monthly income used to finance his/her purchase of a HDB property or an Executive Condominium (EC).

For example, if your gross monthly income is $5,000, your monthly loan repayment cannot exceed $1,500 (30% x $5,000).

If your property is jointly purchased with your spouse, then both your income can be taken into account.

Total Debt Servicing Ratio (TDSR)

TDSR takes into account all your loan commitments (eg home and renovation loans, car loan, study loan, credit card debts, etc). These loans/debts are capped at 55% of your total gross income.

For example, if your gross monthly income is $5,000, your monthly total debt repayment cannot exceed $2,750 (55% x $5,000), including your monthly mortgage. [NOTE: Those earning variable income such as salesperson, their gross monthly income will be subjected to a 30% haircut before TDSR is applied].

Hence, if you have existing debts, TDSR can directly limit the amount of money you can borrow to finance a property. Whereas for MSR, the amount of money you can borrow is pegged to your income without taking into consideration your other loan commitments.

Both frameworks seek to ensure financial prudence as well as prevent overspending by Singaporeans. Indirectly, they also help to curb property speculation by preventing over-leveraging of one’s finances.

Another factor to take into account when purchasing a property is the stamp duties payable. As it could add substantially to your investment, be sure to budget for it. If you are a foreigner, please take note of the rules on the type of properties that can be purchased.

If you have further queries on CPF usage and housing loan rules, or if you require any advice on the Singapore property market, please feel to WhatsApp or Email us.

Other Property Resources

- Singapore Property Investment - 8 Key Factors

- New Launch Versus Resale Condo - Which is a Better Investment?

- Buying A Property In Singapore: Factors To Consider

- Singapore Property Overview and Investment Guide

- Property Financing Basics

- How to Buy A New Launch Private Property In Singapore

- How to Buy a Resale Private Property

- En Bloc Sale Guide

Reviews of New Property Launches

For reviews of new property launches, please click on the links below. More project information can also be found here.

- Property Launches in Core Central Region (CCR)

- Property Launches in Rest of Central Region (RCR)

- Property Launches in Outside Central Region (OCR)