This is a complete guide on buying a resale private property in Singapore. It will detail the step-by-step process in landing your dream home.

For a quick access to the various sections of the post, please click on the links in the Table of Contents below. Alternatively, watch the short video for a quick guide.

- Step 1: Evaluate Different Property Types And Prices

- Step 2: Assess Eligibility To Own A Private Property

- Step 4: Take Into Account Property Stamp Duties Payable

- Step 5: Find A Home Loan With Competitive Interest Rates

- Step 6: Shortlist Your Properties For Viewing

- Step 7: Negotiate The Price

- Step 8: Secure Your Option-to-Purchase (OTP)

- Step 9: Finalise Home Loan For Buying A Resale Private Property

- Step 10: Exercise Your Option-to-Purchase (OTP)

- Step 11: Final Inspection Before Completion of Property Purchase

- Step 12: Complete Your Property Purchase

- Other Resources

- Reviews of New Property Launches

Given the high property prices in Singapore, buying a resale private property or a brand new one is a huge financial commitment. To put it in an even starker perspective, Singapore’s property market is the second most expensive in the world after Hong Kong. Hence, investing in private property requires much careful consideration and planning due to the substantial long-term financial commitment involved.

To learn more about property investment, please refer to "Singapore Property Investment – 7 Key Factors".

Step 1: Evaluate Different Property Types And Prices

Do preliminary research on the different types of property in different areas and how much they cost. You can find such information from online property portals or classifieds. Alternatively, you may get in touch with a property agent to advise you. This will not only save you much time, but he or she can also guide you through the entire process of buying a resale private property methodically and smoothly. The services rendered include:

- Recommending properties with promising investment potential

- Sourcing for a property in your preferred location

- Working out your budget and finances.

- Doing background checks on the property you are interested in.

- Evaluating and negotiating the best price for you.

- Recommending conveyancing lawyers and suitable bank loans.

- Guiding you through the whole process and taking care of the necessary paperwork.

And if you are not too sure what are the different bank loans in the market, or you require a recommendation for a conveyancing lawyer, the property agent can also help you with these matters. Typically, the conveyancing fee is around $2,000 to $3,000. But there are some who charge higher. Hence, do check what the services cover. For example, will it include mortgage stamp duty (maximum $500), caveat lodgement charges or any administrative fees? A caveat is a legal document lodged with the Singapore Land Authority (SLA) by the lawyer to protect the buyer’s interest in the property after exercising the Option-to-Purchase or OTP.

It is advisable to engage a conveyancing lawyer before negotiating with the seller. This is because once the OTP is signed, usually you will only have 2 weeks to exercise it. You need a lawyer to vet the OTP and handle all necessary legal matters for you.

As mentioned earlier, a property agent can help you with the entire process of buying a resale private property from start to finish. But, if you are concerned about the commission payable, fret not! Buyers usually don’t need to pay commissions. Your property agent will get a co-broke commission from the seller’s agent. How they share it will be a private agreement between themselves.

Step 2: Assess Eligibility To Own A Private Property

Check your eligibility to own a private property in Singapore. If you are a Singapore citizen, Singapore permanent resident (SPR) or a foreigner looking to buy a condominium, flat unit or strata landed house in an approved condominium development, there is no restriction. However, if you are a SPR or foreigner looking to buy a landed property, there are certain conditions to be met.

To buy landed properties, SPRs must have received their permanent resident status for at least 5 years. For foreigners, they must be deemed to have made exceptional economic contributions to Singapore and on top of that, they need to seek approval from the Land Dealings Approval Unit (LDAU). More information on this can be found in "Singapore Property Rules for Foreigners".

Step 3: Work Out Your Budget and Finances

After doing your homework, you will have a rough sense of how much different properties will cost in different regions. Singapore properties are divided into three main regions, namely Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR). CCR is where the most expensive properties are found as it covers the prime postal districts of 9, 10, 11, Downtown Core and Sentosa. The map below highlights where the three regions cover.

Next, you will need to work out your budget and finances. These will include the following:

- Your personal savings.

- CPF Ordinary Account (OA) monies, if any.

- Outstanding debt (car loan, study loan, credit card, etc), if any.

- Monthly CPF contributions.

- How much of your monthly salary you can set aside to finance your property.

- Other sources of funds (e.g. from parents).

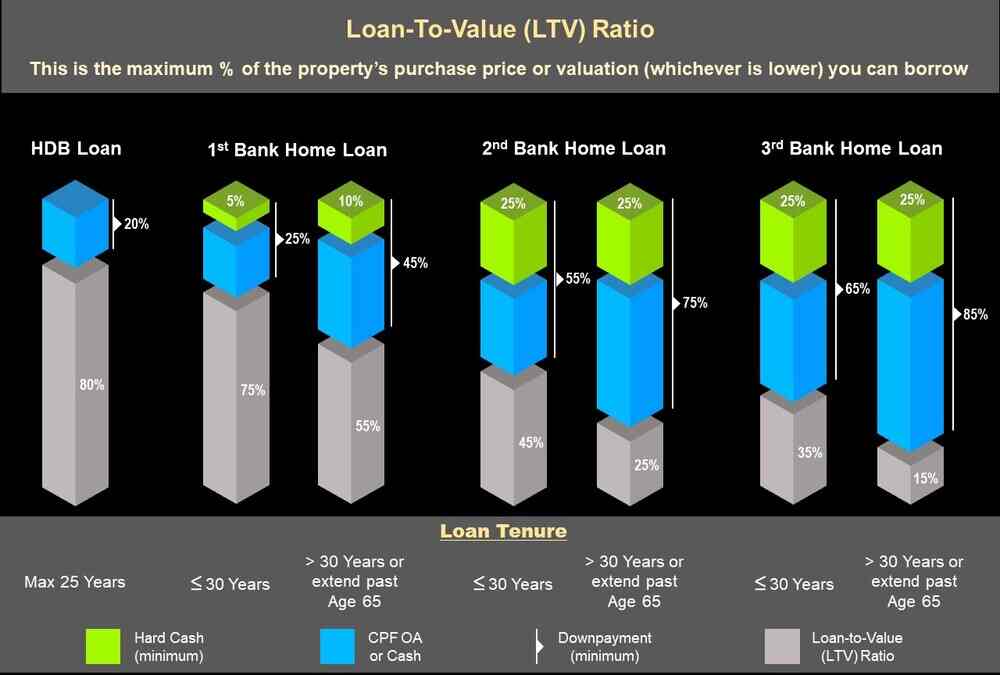

If this is your first property, banks can offer you a Loan-to-Value (LTV) of 75% of your property or valuation price, whichever is lower, and a tenure of up to 30 years. The balance of 25% must be paid in cash (minimum 5%) and CPF Ordinary Account (OA) monies. However, the LTV will drop to 55% for a tenure above 30 years or when it extends past the borrower’s age of 65. The difference of 45% must be paid in cash (minimum 10%) and CPF OA monies. Please refer to the infographic below.

So, be sure you have sufficient hard cash not just for the downpayment, but another related cost as well such as legal fees, stamp duties, mortgage & fire insurance and so on. And since this is a resale property, you will also most likely need to set aside some money for renovation.

If you are buying a second property or a property with a remaining lease that will not cover you till age 95, besides the LTV, you will also need to take note of the rules concerning the use of your CPF funds. A full explanation can be found in "Change In CPF Usage And Housing Loan Rules".

Step 4: Take Into Account Property Stamp Duties Payable

When calculating your affordability, remember to take into account the property stamp duties payable as they can substantially add to the total cost of your property acquisition. There are two stamp duties to take note of – Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD).

Anyone buying properties in Singapore will incur BSD. But Singapore Permanent Residents (SPR) or Foreigners will also incur ABSD. However, there are exceptions for nationals or permanent residents from Switzerland, Norway, the United States, Iceland and Liechtenstein. They are eligible for ABSD remission under the Free Trade Agreements (FTAs) and will be treated the same as Singapore Citizens. For more information, please refer to “How To Calculate Singapore Property Stamp Duties?”.

The rates charged for BSD and ABSD are shown in the table below:

| Buyer's Stamp Duty (BSD) | ||

| Higher of Purchase Price or Market Value of the Property | Rates on or before 14 February 2023 | Rates on or after 15 February 2023 |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6% | |

| Additional Buyer's Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

Step 5: Find A Home Loan With Competitive Interest Rates

Unless you are cash rich and have sufficient CPF funds, you will need a home loan to finance your property purchase. Shop around and find a bank loan with competitive interest rates. There are fixed-rate and floating-rate housing loans, each with its pros and cons. Fixed-rate housing loans may be higher, but they provide you with certainty about your monthly loan repayment whereas floating-rate loans will be subjected to uncertain future interest rate movements.

Besides the housing loan rate, find out what’s the lock-in period, early loan redemption penalty and refinancing charges in the event you wish to re-calibrate your mortgage in the future. With the cost of properties in mind after doing your research, let your banker works out how much you can borrow. To do that, he will need to do a credit assessment by taking into account your personal savings, available CPF funds, monthly income and even how long you have worked in your present job.

Do take note that the loan amount you are eligible for will be subjected to the Total Debt Servicing Ratio (TDSR) imposed by the Monetary Authority of Singapore (MAS). TDSR stipulates that no more than 55% of your income can be used to service your loan repayments. These include not only your home loan but also any outstanding car loan, hire purchase agreements, credit card debt, etc.

If everything goes well, you may wish to obtain an Approval-in-Principle (AIP) to help you expedite the purchase of your property when you have found one. Why not when it’s free anyway!

Step 6: Shortlist Your Properties For Viewing

After doing your background work, it’s time to shortlist your properties for viewing. As mentioned earlier, you can either do it yourself or engage a property agent to help you. Shortlist a few as you may not necessarily get your most preferred one. The best time for viewings is during the busy time of the day and when it’s bright. Things to look out for include the direction of the sun, traffic noise, the property’s view, its surroundings and who your neighbours are! (Bad or noisy neighbours can really give you a big headache).

Next, inspect the condition of the property and the entire development. Unlike a first-hand property where a 12 months defect warranty period is imposed on the housing developer, there is none for a resale private property. Therefore, check thoroughly, especially for older properties. Things to check include:

- Illegal Renovation.

- Structural issues.

- Spalling concrete.

- Watermarks (an indication of water leakage).

- Cracked tiles or flooring.

- Faulty electrical circuitry.

- Defective air-conditioning.

- Choked sewage.

- Poor water pressure.

- Inbuilt furniture that needs to be torn out.

- Signs of termite infestation (a potential nightmare).

In addition, if it is a condominium project, look around the whole development to see how well it has been maintained. You can check with the estate manager whether there are any major repairs that need to be done, such as:

- Re-roofing or water-proofing.

- Re-tiling of common areas.

- Replacement of lifts (an extremely expensive undertaking).

- Replacement of water pump for the swimming pool.

- Replacement of water pipes.

- Replacement of security system.

- Landscaping improvement.

Such rectification works can be very costly and could potentially deplete the maintenance and sinking funds. Should there be insufficient funds, the management council may request an ad hoc lump sum payment from all the property owners.

Last but not least, find out how much maintenance fees and sinking funds you need to contribute each month. As a rough guide, the bigger the development, the less you have to pay as there are more people sharing the burden of up-keeping the estate. This could set you back $200 to $300 per month or more, especially if it offers full facilities such as 24-hour security guards, a swimming pool, a gymnasium, a function room and so on. In fact, some high-end properties have maintenance fees of more than $1,000 per month.

Step 7: Negotiate The Price

It is a very common practice for property owners to mark up their prices and then let you negotiate downwards. Don’t be too deterred if the price markup seems ridiculous. As long as you have done your homework and know what similar properties in the area have been transacted at, bargain hard.

In the meantime, you can get a valuation from your bank so that you won’t get ripped off. Give the seller some time to consider your offer and don’t show you are desperate. At this stage, it’s like a game of bluff. In time to come, a compromise will likely be reached. But if you are not confident about the negotiation, let your experienced property agent help you.

Step 8: Secure Your Option-to-Purchase (OTP)

After successfully negotiating the property price, secure an Option-to-Purchase (OTP) from the seller. An OTP agreement is a legal contract signed between a buyer and seller of a residential property. It basically gives the buyer the exclusive right to purchase the property within an agreed timeframe. The usual timeframe is 2 weeks, but this is negotiable between the buyer and seller. This signals the start of the process of buying the resale private property.

Remember to draw up an agreeable inventory list specifying what comes with the property. This is to avoid any post-completion dispute. If you have hired a property agent, he can help you with this. Items in the inventory list may include lighting, furniture, blinds, curtains or even the number of air-conditioner remote controls (there are cases where owners left only one remote control for the entire property!).

After securing your OTP, get your conveyancing lawyer to review the terms. If everything is in order, you will need to pay the seller 1% of the property purchase price in cash. Thereafter, you have 2 weeks to exercise it. During this period, the seller is not allowed to sell the property to anyone else. Should you decide to back out of the deal, your option fee will be forfeited by the seller.

Step 9: Finalise Home Loan For Buying A Resale Private Property

You will need to finalise your home loan now and decide how to finance your property. Great if you have earlier decided on which bank loan to take. If not, you will need to find one that best suits your needs. Your banker will advise you on the required documents for your loan application. This will include your OTP agreement, latest income tax or CPF contribution history, salary slip for the last 3 months, valuation report and latest loan statements (e.g. car loan, study loan and credit card).

If you don’t have a valuation report, the bank can assist you in acquiring one to expedite your loan application.

Step 10: Exercise Your Option-to-Purchase (OTP)

After receiving the Letter of Offer from your bank, it’s time to exercise your option-to-purchase (OTP). This is done by paying another 4% of the property's purchase price. After which, your conveyancing lawyer will lodge a caveat on the property to signal that you have a legal interest in it.

Within 14 days of signing the OTP, you will need to pay Buyer’s Stamp Duty (BSD), and Additional Buyer’s Stamp Duty (ABSD) if applicable. You can head over to the IRAS e-Stamping Portal to make your payment.

Step 11: Final Inspection Before Completion of Property Purchase

Agree with the seller on the completion date beforehand to enable the seller enough time to move out. The whole process should take no more than 10 - 12 weeks upon the signing of the OTP. After the seller moves out, you’ll need to make a final inspection to confirm that it’s vacant and in the right condition. You’ll also need to ensure that items stated in the inventory list are intact.

Meanwhile, your conveyancing lawyer will conduct relevant legal checks to ensure the proper transfer of the property to you. Your lawyer will also conduct a bankruptcy search to ensure the seller has no difficulty in disposing of the property. If it is found that the buyer is a bankrupt, his official assignee must consent to the sale.

Once everything is in order, you will be required to submit the required documents and money needed to complete the sale successfully. These include your legal fees and the balance of the cash portion not covered by your CPF and bank loan.

Step 12: Complete Your Property Purchase

On completion day, your lawyer will finalise the transaction and get you registered as the property’s new owner. You will need to drop by at your lawyer’s office and settle any outstanding payments. Thereafter, your conveyancing lawyer will hand over the house keys to you.

And that’s about it! Hope you have found this guide on buying a resale private property useful. But for those who are looking at new property launches, please WhatsApp or Email us.

Other Resources

- The Greater Southern Waterfront – A Property Market Outlook

- One-North - A high-tech hub

- Jurong Lake District Development: A Property Investment Hotspot?

- Woodlands Regional Centre: Property Hotspot In the North Region

- Novena Master Plan – Health City Novena to Spur Transformation

- Mega Developments In The East Region

- Development of Tampines North

- Tampines Nature Parks An Appeal to Property Buyers

- Tampines Regional Centre – A Vibrant Shopping Haven

Reviews of New Property Launches

For reviews of new property launches, please click on the links below. More project information can also be found here.

- Property Launches in Core Central Region (CCR)

- Property Launches in Rest of Central Region (RCR)

- Property Launches in Outside Central Region (OCR)