- Eligibility Conditions to Buy an HDB Resale Flat

- Income Ceiling

- Ethnic Integration Policy (EIP)

- Singapore Permanent Resident (SPR) Quota

- Ownership of Properties

- Minimum Occupation Period (MOP)

- Work Out Your Budget

- Decide Where to Buy Your Resale Flat

- What Housing Loan to Apply

- HDB Flat Application Process - New HDB Flat Eligibility (HFE) Letter

-

HDB Flat Eligibility (HFE) Letter and Resale Process

- Steps 1: Obtain an HDB Flat Eligibility (HFE) Letter

- Step 2: Assess Your Financial Position

- Step 3: Shortlist Flats and Obtain an Option to Purchase (OTP) from the Flat Seller

- Step 4: Confirm Your Preferred Mode of Flat Financing

- Step 5: Submit Request for Value

- Step 6: Convert In-Principle Approval (IPA) into a Letter of Offer (LO)

- Step 7: Submit Resale HDB Flat Application

- Step 8 and 9: Acknowledge Resale Documents and Pay Fees

- Step 10: Approving HDB Transaction

- Step 11: Attend Completion of Sale Appointment

- Frequently Asked Questions (FAQs)

- Other Resources

- New Property Reviews

If you are looking for an HDB flat to start a family and are unwilling to wait about 4 years for a new Built-to-Order (BTO) flat to be completed, your next option is to buy an HDB resale flat, executive condo, or a private property, if you can afford one (refer to "How to Buy A New Launch or Resale Private Property"). But the whole process of buying an HDB resale flat may be a little daunting to some, especially for first-time buyers.

Fret not! Below is a complete step-by-step guide on the whole procedure of buying your HDB resale flat. However, if you are looking for a new HDB flat, please refer to our guide on buying a BTO flat.

Meanwhile, find out more about investing in HDB flats and executive condominiums, and get an overview of Singapore's property market.

Eligibility Conditions to Buy an HDB Resale Flat

Firstly, check the eligibility conditions to buy a resale flat under the various eligible schemes, such as Public Scheme, Single Singapore Citizen Scheme, Joint Singles Scheme, etc. To be eligible, you and your spouse must either be a Singapore citizen or a Singapore permanent resident (SPR). If both of you are SPRs, you must have gained permanent residency for at least 3 years.

Married applicants must also be at least 21 years old. If an applicant is between 18 and 21 years old, parental consent must be obtained. If below 18 years old, a Special Marriage Licence from the Ministry of Family & Social Development (MSF) is required.

Singles are only eligible to buy when they turn 35 years old. However, there are exceptions, such as those who are widowed, orphaned or are single unwed mothers. For more information on this, please refer to the full eligibility conditions for owning an HDB flat.

Income Ceiling

Although there is no income ceiling to purchase HDB resale flats, it will determine the amount of housing grants you are entitled to. Depending on your household income level, you may receive up to $180,000 consisting of a $80,000 Family Grant, $80,000 Enhanced Housing Grant and $30,000 Proximity Grant.

For the Family Grant, $80,000 will be given to those who buy a 2- to 4-room HDB flat, and $50,000 for a 5-room or bigger flat if both applicants are Singapore citizens. If one of them is a Singapore permanent resident (SPR), the grant will be reduced by $10,000. However, the $10,000 will be reimbursed later should the SPR become a Singapore citizen subsequently. The maximum monthly household income ceiling to receive the grant is $14,000. Households which exceed this will not be entitled to it.

For the Enhanced Housing Grant (EHG), the amount disbursed will be based on the average monthly household income, as indicated in the table below. The household income ceiling for EHG is lower at $9,000 though.

| First-Timer Families and Singles under Joint Singles Scheme | Singles under Single Singapore Citizen Scheme | ||

| Average Monthly Household Income | Grant Amount | Average Monthly Household Income | Grant Amount |

| $1,500 or less | $80,000 | $750 or less | $40,000 |

| $1,501 - $2,000 | $75,000 | $751 - $1,000 | $37,500 |

| $2,001 - $2,500 | $70,000 | $1,001 - $1,250 | $35,000 |

| $2,501 - $3,000 | $65,000 | $1,251 - $1,500 | $32,500 |

| $3,001 - $3,500 | $60,000 | $1,501 - $1,750 | $30,000 |

| $3,501 - $4,000 | $55,000 | $1,751 - $2,000 | $27,500 |

| $4,001 - $4,500 | $50,000 | $2,001 - $2,250 | $25,000 |

| $4,501 - $5,000 | $45,000 | $2,251 - $2,500 | $22,500 |

| $5,001 - $5,500 | $40,000 | $2,501 - $2,750 | $20,000 |

| $5,501 - $6,000 | $35,000 | $2,751 - $3,000 | $17,500 |

| $6,001 - $6,500 | $30,000 | $3,001 - $3,250 | $15,000 |

| $6,501 - $7,000 | $25,000 | $3,251 - $3,500 | $12,500 |

| $7,001 - $7,500 | $20,000 | $3,501 - $3,750 | $10,000 |

| $7,501 - $8,000 | $15,000 | $3,751 - $4,000 | $7,500 |

| $8,001 - $8,500 | $10,000 | $4,001 - $4,250 | $5,000 |

| $8,501 - $9,000 | $5,000 | $4,251 - $4,500 | $2,500 |

| More than $9,000 | NA | More than $4,500 | NA |

For the Proximity Housing Grant, $30,000 will be given to applicants who live with either of their parents, and $20,000 if they live within 4 km of them.

For a single, the income ceiling and the respective grants will be half of that for a married couple.

Example

Household Income: $7,000

Resale HDB Flat Purchased: 5-room

Parents: Live within 4 km

Total Grants Received: $50,000 (Family Grant) + $25,000 (Enhanced Housing Grant) + $20,000 (Proximity Housing Grant) = $95,000

Ethnic Integration Policy (EIP)

Buyers must also comply with the Ethnic Integration Policy (EIP) that specifies the percentage of ethnic groups in each block and neighbourhood. For each block, the maximum limits for Chinese, Malay and Indian/Others are set at 87%, 25% and 15% respectively. For the neighbourhood, they are specified at 84%, 22% and 12%.

Singapore Permanent Resident (SPR) Quota

Besides EIP, there is also the Singapore Permanent Resident (SPR) Quota. For Non-Malaysian SPRs, the maximum limits for the block and neighbourhood are set at 8% and 5% respectively. Do note that Malaysians are treated similarly to Singaporeans due to their historical and cultural ties to Singapore. Hence, they will not be subjected to the SPR quota.

Ownership of Properties

You cannot own any properties if you wish to buy an HDB resale flat. These include HDB flats as well as private properties in Singapore or overseas. Should you own any of these, you must dispose of them within 6 months of purchasing your resale flat.

Minimum Occupation Period (MOP)

Check that sellers have completed their 5-year minimum occupation period (MOP). This excludes the period that they did not occupy the flat. For example, if within those 5 years, they had worked overseas for 2 years, these 2 years would not be counted as part of their MOP. Hence, they are not eligible to sell although they have owned the flat for 5 years. Similarly, for an HDB resale flat, you too must complete the 5-year MOP before you can dispose of it.

Work Out Your Budget

After confirming your eligibility to purchase an HDB resale flat, you will need to work out your budget, taking into account the amount of government housing grants you will be receiving. Then find out the transacted prices of HDB resale flats in different locations. Obviously, a flat near town will likely be more expensive than one in the suburbs.

After doing your homework, you will know better the type of flats and the location you can afford. It is also important to be familiar with the commission structure of property agents and the type of marketing services they offer.

Decide Where to Buy Your Resale Flat

One great advantage of buying an HDB resale flat is that you can choose the location of your choice. So, decide where to buy your resale flat – one that is near your parents, a shopping centre, an MRT station or a popular school to enrol your children in?

As compared to BTO flats, most are built in non-mature estates. Of course, some are built in matured estates such as the Prime Location Public Housing (PLH). However, they are not only more expensive, but the chances of getting one are also slim. Perhaps, the most anticipated PLH HDB flats will be those at Telok Blangah along the Greater Southern Waterfront.

As for PLH flats, they come with additional ownership criteria, like subsidy crawl back and a 10-year minimum occupation period (MOP).

Besides Prime Location Housing, the HDB has come out with a completely new categorisation of HDB flats, first announced by Prime Minister Lee Hsien Loong during his National Day Rally speech on 21 August 2023. Instead of classifying HDB flats as mature and non-mature estates, they will be re-classified as Standard, Plus, and Prime HDB flats.

These new HDB flat classifications will take effect for BTO flats launching from October 2024 onwards.

What Housing Loan to Apply

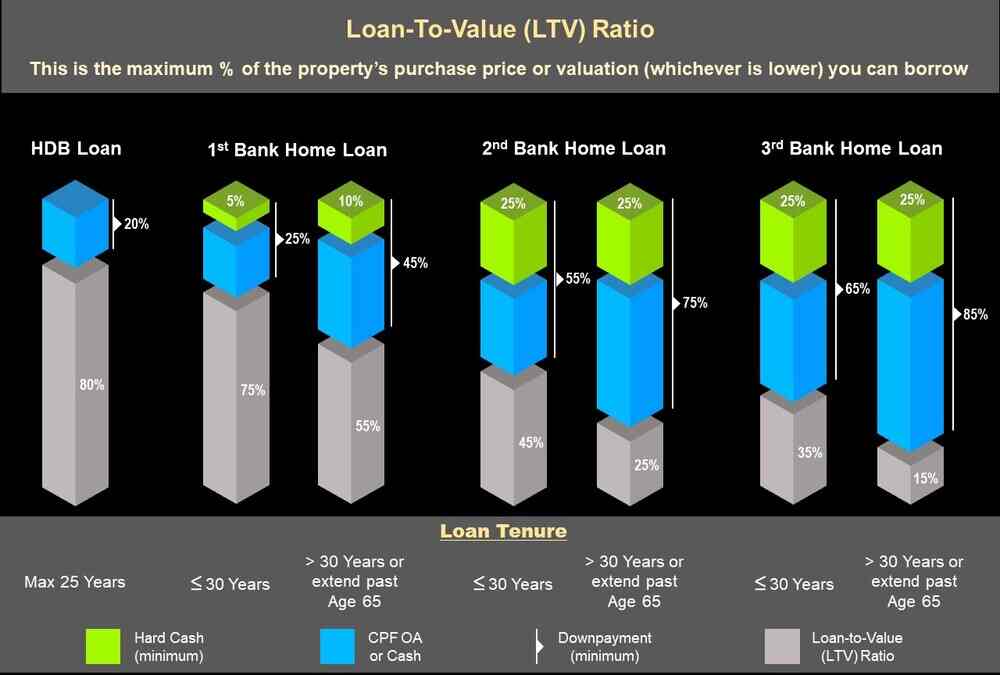

Decide what housing loan to apply for – an HDB concessionary loan or a Bank loan? For an HDB housing loan, you can get up to 80% financing of the purchase or valuation price, whichever is lower. The balance of 20% can be paid in CPF &/or cash. For a bank loan, you can only get up to 75% financing of the purchase or valuation price. The balance of 25% must be paid in cash (minimum 5%) and the rest in CPF (see below).

At the same time, do take note of the Change In CPF Usage And Housing Loan Rules as this will impact the amount of CPF funds you can use for your purchase.

HDB Flat Application Process - New HDB Flat Eligibility (HFE) Letter

Starting on May 9th, 2023, the Housing and Development Board (HDB) will implement a new application process for purchasing a flat. This process involves issuing a new document called the HDB Flat Eligibility (HFE) letter.

The HFE letter aims to provide potential flat buyers with a comprehensive overview of their options for housing and financing before they begin the home-buying process.

The HFE letter will replace the current HDB Loan Eligibility (HLE) letter. It will inform prospective buyers upfront about their eligibility to purchase a resale flat, and the amount of CPF housing grants and HDB housing loans they are eligible for.

Essentially, the HFE letter aims to provide flat buyers with a clear understanding of their options and help them make informed decisions about their home purchases.

The new streamlined HDB flat buying process will integrate different eligibility assessments for HDB flat purchases, housing grants, and HDB housing loans into a single application through the HDB Flat Portal. This new requirement aims to ensure that flat buyers have a comprehensive understanding of their eligibility and financing options before they make any commitments to purchase a flat.

HDB Flat Eligibility (HFE) Letter and Resale Process

The HDB Flat Eligibility (HFE) letter application process consists of two steps that must be completed within 30 calendar days of each other:

Preliminary HFE Check: This gathers basic information about your eligibility.

Apply for HFE Letter: This provides detailed information on your eligibility for buying a flat, grants, and loans.

To offer a seamless experience for the sale/purchase of HDB resale flats, HDB has launched a Resale Flat Listing (RFL) service.

Steps 1: Obtain an HDB Flat Eligibility (HFE) Letter

Firstly, apply for an HDB Flat Eligibility (HFE) letter on My Flat Dashboard for a holistic understanding of your housing and financing options before proceeding with your home-buying process. The HFE letter will inform you upfront of your eligibility to purchase a resale flat, as well as the amount of CPF housing grants and the amount of HDB housing loan you are eligible for.

Step 2: Assess Your Financial Position

After gathering the necessary information of your housing and financing options, set aside some time to assess your financial position before searching for a resale flat. If you require further assistance on this, you may consider approaching a property agent.

Step 3: Shortlist Flats and Obtain an Option to Purchase (OTP) from the Flat Seller

After obtaining the HFE letter and assessing your affordability, you can search for a suitable HDB resale flat that meets your budget and needs. After you have found one, secure an Option to Purchase (OTP) from the flat seller after you have agreed on the flat price. (Note: Flat sellers must have registered their "Intent to Sell" with HDB for 7 days or more).

Step 4: Confirm Your Preferred Mode of Flat Financing

If you intend to get an HDB housing loan instead of a bank loan, you will need a valid HFE letter from HDB before flat sellers can grant you an OTP.

If you apply for an HDB housing loan in your HFE application, the loan outcome will be reflected in your HFE letter accordingly.

However, if you get a housing loan from a financial institution during your HFE application, you must have a valid Letter of Offer (LO) before you exercise the OTP. You may concurrently request an In-Principle Approval and LO from participating financial institutions when applying for the HFE letter during your application process.

Step 5: Submit Request for Value

If you are paying for your HDB flat with CPF savings and/or a housing loan, you must submit a "Request for Value" by the next working day after you receive the OTP. The "Request for Value" will determine the flat’s value and offer a guide on your CPF usage and/ or the amount of housing loan you may receive from HDB or financial institution (FI), unless otherwise advised by the FI.

However, if you are not using your CPF savings and do not need a housing loan to pay for your resale HDB flat, you can skip this.

Step 6: Convert In-Principle Approval (IPA) into a Letter of Offer (LO)

If you have requested an IPA while applying for the HFE letter, you can convert it into an LO at this step before exercising the OTP during the Option Period.

Step 7: Submit Resale HDB Flat Application

After you exercise the OTP, you and the seller must submit the respective resale HDB flat application with the required supporting documents via My Flat Dashboard. Salespersons may submit resale applications on behalf of their clients via e-Resale or Estate Agent Toolkit (for agencies which are subscribers).

Thereafter, HDB will verify the information submitted. Both parties must ensure that they are eligible for the transaction.

Step 8 and 9: Acknowledge Resale Documents and Pay Fees

After HDB receives the complete resale application and the full set of supporting documents from you and the seller, it will verify the eligibility of both parties and accept the resale application within 28 working days. After that, it will prepare the necessary documents for you and the seller to endorse. This will take about 3 weeks after the application has been accepted. You and the seller must acknowledge and endorse the resale documents, and pay the necessary fees.

Step 10: Approving HDB Transaction

After the documents are endorsed and fees paid, HDB will grant an in-principle approval for the resale transaction. The approval will take about 2 weeks after you and the seller have endorsed the resale documents and made the necessary payments.

Step 11: Attend Completion of Sale Appointment

The resale completion takes about 8 weeks from the date of HDB’s acceptance of the resale application, which is the earliest possible date to complete the transaction.

However, if you wish to defer the completion date, please discuss it with your seller and inform HDB with a written confirmation (signed by both sellers and buyers) via MyRequest@HDB. You and the sellers will be notified via SMS of the appointment date and time. You may also log in to My Flat Dashboard to view your appointment details.

If you have any queries about property investment, please WhatsApp or Email us.

Frequently Asked Questions (FAQs)

1. What are the eligibility conditions to buy an HDB resale flat?

To be eligible to buy an HDB resale flat, you must meet several criteria, including having a minimum age of 21 years, meeting the income ceiling, adhering to the Ethnic Integration Policy, and not owning any other properties in Singapore or overseas.

Additionally, you must have obtained permanent residency status for at least three years if you are a Singapore Permanent Resident.

2. What is the HDB Flat Eligibility (HFE) letter, and why is it important?

The HDB Flat Eligibility (HFE) letter is a document that confirms your eligibility to buy an HDB resale flat. It also informs you of the CPF housing grants and the HDB housing loan amount you can receive.

You must have a valid HFE letter when obtaining an Option to Purchase from a seller and when submitting your resale application to HDB.

3. What is the Minimum Occupation Period (MOP) for an HDB resale flat?

After purchasing an HDB resale flat, buyers are required to reside in the flat for a minimum of 5 years, known as the Minimum Occupation Period (MOP). During this time, the flat cannot be rented out, and the owners are not allowed to sell the flat. This requirement ensures that the flat is used as a primary residence.

However, under the new HDB classifications for BTO flats launched from October 2024 onwards, only Standard HDB flats will have an MOP of 5 years. For Prime and Plus HDB flats, they will have an MOP of 10 years, regardless of whether they are first purchased from HDB or in the resale market subsequently.

4. How do I finance the purchase of an HDB resale flat?

When buying an HDB resale flat, you have two main options for financing the purchase: an HDB housing loan or a bank loan.

For an HDB loan, you need to make an initial payment of 20% of the purchase price, which can be paid using your CPF savings and/or cash. For a bank loan, the initial payment is 25% of the purchase price. The remaining amount can be financed through the loan.

5. How long does the HDB resale flat purchase process take?

The entire HDB resale flat purchase process, from applying for the HFE letter to completing the transaction, typically takes around 12 weeks, excluding the initial steps of applying for the HFE letter and searching for a suitable resale flat.

The process involves several steps, including obtaining an Option to Purchase, submitting a Request for Valuation, and completing the resale application.

Other Resources

- Novena Master Plan – Health City Novena to Spur Transformation

- Jurong Lake District Development: A Property Investment Hotspot?

- Woodlands Regional Centre: Property Hotspot In the North Region

- One-North Review: A Singapore Property Hotspot, Education Hub, Food Haven

- Mega Developments In The East Region

- Development of Tampines North

- Tampines Nature Parks An Appeal to Property Buyers

- Tampines Regional Centre – A Vibrant Shopping Haven

New Property Reviews

For reviews of new property launches, please click on the links below. More project information can also be found here.