The Singapore property market has attracted strong interest from both locals and foreigners for good reasons.

This is because Singapore offers a stable and well-regulated property market with a range of property options available for investors. Whether you’re a novice or a seasoned property investor, it’s essential to understand key aspects of the Singapore property market before investing.

In this overview, we will cover some important attributes of Singapore’s property market. These include the different housing types, property regulations, financing frameworks, and investment factors to facilitate informed decision-making.

Singapore Property Market – 3 Main Regions

The Singapore property market is divided into three main regions, namely the Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR).

Core Central Region (CCR): It covers Singapore’s central area, including the Downtown Core, Orchard Road, and Sentosa. Properties in CCR tend to be the most expensive and prestigious.

Rest of Central Region (RCR): It comprises areas around the fringes of the CCR and includes popular residential areas like One-North, Katong, and Bishan. Properties in RCR are more affordable than CCR but still command higher prices than those in the suburbs.

Outside Central Region (OCR): This region covers the rest of Singapore, including suburban and industrial areas like Woodlands, Sengkang, and Jurong. Properties in OCR are generally more affordable than those in CCR and RCR, making them attractive to first-time homebuyers and investors.

Understanding the Singapore Property Market

As the Singapore property market is well-regulated and relatively stable compared to many countries in other parts of the world, it has appealed to both local and foreign investors. In order to maintain its stability, the government has implemented a slew of property regulations such as the Total Debt Servicing Ratio (TDSR), Mortgage Servicing Ratio (MSR), Additional Buyer’s Stamp Duty (ABSD), and Seller’s Stamp Duty (SSD). These regulations have largely tempered property speculations that could destabilise Singapore’s economy.

The TDSR limits the amount of debt borrowers can take on relative to their income, while the ABSD imposes additional stamp duties on the purchase of a second property by Singapore citizens, and the purchase of any properties by Singapore permanent residents and foreigners. SSD is imposed when property buyers dispose of their property within three years of their purchase.

Hence, It’s crucial for investors to take into account these measures and taxes as they can affect their affordability and ROI when investing in the Singapore property market.

Total Debt Servicing Ratio (TDSR)

The Total Debt Servicing Ratio (TDSR) was first implemented in Singapore on 28 June 2013 by the Monetary Authority of Singapore (MAS), the country’s de facto central bank.

The imposition of the TDSR is to encourage prudent borrowing and ensure that borrowers do not take on more debt than they can comfortably service.

It also helps to deter speculation in the Singapore property market, ensuring its stability and preventing any potential property bubbles from forming which could destabilise the wider economy.

The TDSR framework requires financial institutions to take into account borrowers’ total debt obligations when assessing their ability to service the mortgage.

This includes existing debts such as car loans, hire-purchase agreements, and any secured/unsecured loans, including revolving credit. Together, the total monthly repayment cannot exceed 55% of their gross monthly income.

Over the years, the property financing framework has become more restrictive as the Singapore government fine-tuned its policies to prevent property prices from running far ahead of economic fundamentals.

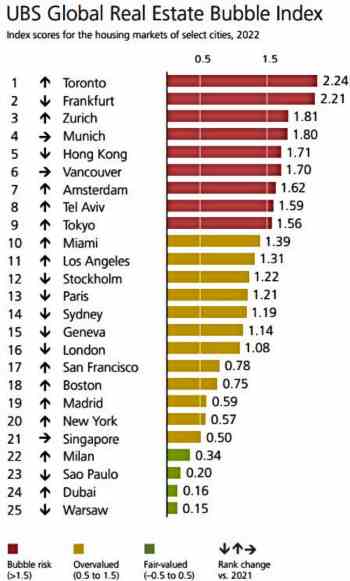

As can be seen from the UBS Global Real Estate Bubble Index chart, the Singapore property market is ranked near the bottom, attesting to the effectiveness of these policies implemented by Singapore’s government to prevent the formation of property bubbles.

Additional Buyer’s Stamp Duty (ABSD)

The Additional Buyer’s Stamp Duty (ABSD) is a tax levied by the Singapore government on the purchase of residential properties. It was first introduced in 2011 as a measure to control demand and curb speculative activities in the Singapore property market.

Since then, there have been various upward revisions, with the latest being implemented on 27 April 2023, which saw a doubling of the ABSD rate from 30% to 60% for foreigners purchasing any residential properties in Singapore.

The ABSD rates vary depending on the residency status of the buyer and the number of properties owned according to the following table:

| Additional Buyer’s Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

The ABSD is in addition to the usual Buyer’s Stamp Duty (BSD) payable on the purchase of any property in Singapore. Like ABSD, the BSD rates are also tiered based on the purchase price of the property. You can check out how stamp duty rates are calculated from the following table:

| Higher of Purchase Price or Market Value of the Property | Residential Property | |

| Rates on or before 14 February 2023 | Rates on or after 15 February 2023 | |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6% | |

It’s essential to take into account the ABSD when you plan to invest in the Singapore property market as it can significantly increase your upfront cost of acquisition. This is especially for foreign buyers and those who already own multiple properties.

Types of Properties in Singapore

The real estate market in Singapore presents a variety of property options, each possessing distinctive attributes and investment prospects. It’s essential to understand the different types of properties, their eligibility criteria, and investment potential in order to achieve your financial goals.

Housing And Development Board (HDB) Flats

HDB (Housing Development Board) flats are public housing built and managed by the government agency known as HDB or Housing Development Board.

These flats are meant to provide affordable housing for Singaporeans, especially young couples planning to start a family. Hence, they are typically priced lower than private residential properties.

First-time buyers of HDB flats can receive generous government grants. Hence, it is unsurprising that Singapore has one of the highest home ownership in the world (close to 90%). However, there are certain eligibility criteria to be met.

Meanwhile, BTO flats launched from October 2024 will come under new classifications – Standard, Plus, and Prime. The different categories of HDB flats will have different ownership criteria and government housing subsidies.

BTO flats usually take 3-4 years to complete, and sometimes even longer. For those with a limited budget who require a home fast, they may consider buying a HDB resale flat through the HDB Resale Flat Listing Service.

There are also various schemes and conditions in the application of HDB flats. For instance, individuals intending to purchase an HDB flat must form a family unit and they must not have a household income exceeding $14,000 per month.

Additionally, there are restrictions on the ownership and rental of HDB flats. As HDB flats are meant for owner-occupation, they must stay in the property for a minimum of 5 years before they can sell. HDB flat owners are also not allowed to rent out their flats entirely or sublet to others without prior approval from HDB.

Foreigners are not eligible to purchase HDB flats while a Singapore permanent resident (SPR) families can only buy HDB resale flats after they have received their SPR status for at least three years.

Despite these restrictions, HDB flats can be a great option for those looking for affordable homes.

Nowadays, HDB flats are generally well-connected by public transportation and are located near amenities such as schools, parks, food centres, and shopping malls. It is the most common housing option in Singapore, making up 80% of the Singapore property market.

At the same time, the government has introduced various policies to upkeep HDB flats and estates. These include the Home Improvement Programme (HIP), Neighbourhood Renewal Programme (NRP), and Lift Upgrading Programme (LUP). These programmes have helped to ensure HDB flat dwellers enjoy a quality living environment.

[Important Note: In order to keep HDB flats affordable, only 30% of a household’s monthly income (Mortgage Servicing Ratio) can be set aside for monthly mortgage payments. This more stringent home financing framework will have a limiting effect on the potential capital appreciation of HDB flats].

Executive Condominiums

Executive Condominiums (ECs) are a unique public-private hybrid housing option in Singapore.

They are built and developed by private developers but are subjected to certain eligibility and ownership conditions set by the HDB.

ECs are almost similar to mass-market private condominiums as they offer a range of amenities such as swimming pools, playgrounds, gyms, and clubhouses. They are sold at a lower price compared to private condominiums, but they come with stringent ownership criteria.

For example, to purchase a new EC, the household income ceiling must not exceed $16,000 per month, and owners must fulfil a 5-year Minimum Occupation Period (MOP) before they can sell the property in the open market to Singaporeans and Singapore permanent residents. Only after 10 years are they allowed to be sold to foreigners.

Nevertheless, ECs provide a good investment option for those looking for a more affordable housing option that provides a comparable standard of living to private condominiums.

They are specifically designed to meet the needs of the “sandwich” class that can’t afford private properties but earns more than the $14,000 monthly income cap that renders them ineligible to apply for a new HDB flat.

Private Condominiums

Private condominiums are residential developments that are privately owned and managed by a Management Corporation Strata Title (MCST). They are more upscale and luxurious than HDB flats and offer a wide range of amenities and facilities such as swimming pools, gyms, tennis courts, and 24-hour security.

They are the second most common housing type in the Singapore property market. Developed and sold by private developers, investors can either choose to buy a new launch (Building Under Construction) or a completed resale condominium.

As private condominiums offer a higher standard of living, they are popular among those looking for a more exclusive place to stay. Unsurprisingly, they cost more than HDB flats and executive condominiums.

However, they come with a higher maintenance cost compared to HDB flats. These include maintenance fees and sinking funds that go towards the upkeep of the estate.

Buyers of condominiums will enjoy exclusive rights within the interior space of their own units. However, the land on which the entire development is built will be owned collectively according to their share values.

Landed Property

Landed property is a type of residential property in Singapore that comes with land ownership and they include bungalows, semi-detached houses, and terrace houses. They are typically more spacious than other types of residential properties.

Landed properties are known for their exclusivity. They are usually bigger than other types of housing in Singapore and owners have exclusive rights to the land within their boundary, which include any outdoor spaces such as the front and back yards.

Hence, they usually come with a higher price tag compared to other housing options. But they offer homeowners more privacy and space for gardening, landscaping, and other outdoor activities within their compounds. Some may even come with private parking porches.

However, there are restrictions with regard to the purchase of landed properties by Singapore permanent residents and foreigners. Generally, they are not allowed to purchase a landed property without the approval of the Land Dealings Approval Unit.

Singapore Property Market – Factors to Consider

For property investment in Singapore, there are many important factors to consider. These include the property’s location, price, rental yield, potential transformation of the surrounding areas, and prospect for capital appreciation.

In addition, you must also take into consideration the property agent’s commission that may be incurred if you are buying a resale property. Although the commission rate is negotiable, it will also depend on the type of marketing services rendered.

Location of the Property

Location is one of the most important factors to consider in property investment as it has a significant impact on a property’s value, rental yield, and capital appreciation prospects.

For example, properties located in areas with excellent connectivity, such as near MRT stations and bus interchanges, tend to have higher values and rental yields. This is due to the convenience and accessibility they provide.

Similarly, properties located near schools, hospitals, shopping malls, and other amenities also tend to command higher prices and rental yields.

As the proximity of such amenities helps to elevate the standard of living, they will naturally help to drive up property values. Therefore, it’s essential to take into consideration a property’s location and assess how it can help to realise your investment objective.

Price of the Property

Besides the location of the property, it is also very important to consider its entry price.

Other than evaluating the affordability of the property, it is also imperative to assess its value relative to the surrounding properties to ensure it is fairly priced. At the same time, it is essential to carry out research to assess how properties nearby have performed, which can provide indications of the property’s capital appreciation potential.

Although the Singapore property market is known for its stability and relatively steady price appreciation over the years, not all properties enjoy the same rate of growth. To choose a property with promising investment potential, it is vital to undertake in-depth research. To achieve this, finding a reputable and experienced property investment consultant is crucial.

Rental Yield

Another key factor to consider when investing in the Singapore property market is rental yield.

Rental yield refers to the return on investment of a property, typically expressed as a percentage, calculated by dividing the annual rental income by the property’s value or cost. This is known as the gross rental yield before deducting expenses such as property management fees, maintenance costs, and taxes.

Typically, a smaller condominium development necessitates a higher maintenance fee per unit in comparison to a larger one. This is because there are fewer owners to share the expenses for the upkeep of the property.

Hence, it is vital to take into account all related costs in owning a property to maximise your return on investment.

A high rental yield means that the property can generate an attractive and steady stream of income for the investor, which can be used to finance the purchase of the property.

Capital Appreciation Potential

Capital appreciation refers to the increase in the value of a property over time, which will result in a profit when the owner decides to sell it.

Properties in Singapore have consistently experienced significant increases in value over time, which makes them an appealing choice for investors. Additionally, they can serve as an effective hedge against inflation.

There are many factors that can impact a property’s capital appreciation potential. Besides location, the other key factors are:

Transportation – Properties located close to public transportation such as a MRT station are known to command a premium as it provides convenient commutes. A reduction in travelling time will translate to more free time to spend with family and friends.

Amenities – The property’s proximity to shopping malls, food centres, healthcare facilities, and schools provides convenient access to essential services and daily needs, elevating the standard of living for residents.

Transformation – Understanding the URA master plan for various areas and spotting the right opportunities can result in high investment gains. For example, potential property hotspots like Jurong Lake District, One-North, Woodlands Regional Centre can offer promising investment opportunities.

En Bloc Sale Potential – It can offer significant capital appreciation, as developers often pay above market value for entire residential projects with attractive redevelopment potential. However, property investors should not solely rely on this aspect due to the complex process and low success rate.

Economic And Political Stability – Singapore’s economic and political stability, transparent legal framework, and pro-business environment are important factors that have attracted foreign investors. Hence, it is unsurprising that Singapore has been seeing a sharp increase in family offices being set up to manage their wealth.

Government Policies – Singapore’s housing policies have exerted substantial influences on the property market. This is exemplified by the implementation of a slew of property cooling measures over the years that have effectively curbed speculation and the formation of property bubbles. This proactive approach has significantly mitigated the severity of boom and bust cycles, distinguishing it from the devastating economic effects that have afflicted many other nations.

Conclusion

Investing in the Singapore property market has remained attractive despite the high property taxes and a challenging global economic environment for several reasons.

Firstly, Singapore’s stable political and economic climate provides a secure investment environment.

Secondly, the city-state’s robust infrastructure and efficient governance ensure high-quality residential developments that are highly coveted. Additionally, Singapore’s strategic location as a global business hub attracts international investors and expatriates, driving demand for rental properties.

Thirdly, the government’s proactive measures to manage property price fluctuations have helped maintain a sustainable and stable market.

Finally, Singapore’s reputation as a safe haven for capital and wealth preservation over the long term makes it an appealing choice for property investors.

If you have any queries about the Singapore property market, please WhatsApp or Email me. Meanwhile, below are some new property launches that may be of interest to you:

Core Central Region

- Skywaters Residences, a mixed-use development at Anson Road set to become Singapore’s tallest building.

- Newport Residences, a mixed-use development at the corner of Keppel Road and Anson Road.

- TMX Maxwell, a mixed-use development at Maxwell Road opposite The URA Centre.

- Marina View Residences, an upscale mixed-use development in prime District 1.

- Watten House, a freehold condo a short walk from Tan Kah Kee MRT station.

Rest of Central Region

- Meyer Blue, a luxury condo development next to East Coast Park at District 15

- The Arcady, a freehold condo near Boon Keng MRT station

- The Reserve Residences, an integrated development by Far East Organisation at Jalan Anak Bukit.

- The Hill @ One-North, a mixed-use development next to One-North Park.

- The Continuum, a freehold condo by CDL at Thiam Siew Avenue.

- Grand Dunman, a mega condo development beside Dakota MRT in District 15.

- Pinetree Hill, a condo development near the idyllic Sungei Ulu Pandan.

Outside Central Region

- Kassia, a freehold condo at Flora Drive in District 17

- Sora, a 99-year leasehold condo next to Jurong Lake Gardens

- Lentor Hills Residences, a condo development located near the Hillock Park.

- The Arden, a small condo development near Phoenix LRT station.

- Lakegarden Residences, a condominium beside the idyllic Jurong Lake Gardens.

- J’Den, a mixed-use development linked to the future Jurong East integrated development.

- The Myst, a condominium a short walk from the Cashew MRT station and nature park.

- Altura, an executive condo near Bukit Batok Hillside Park.