For most, buying a property in Singapore will entail getting a home loan. Unless of course, if you are wealthy or cash-rich.

Foreigners who are interested in acquiring a property in Singapore can also apply for a housing loan in Singapore, subject to meeting certain credit criteria such as proof of income or net worth statement.

Investing in a property is a huge commitment that is likely to weigh us down financially for the next 20 to 30 years. Whether you are a married couple or a single looking to purchase a BTO flat, an HDB resale flat, an executive condo, a resale private property, or a new private property, one of the most important decisions is how to finance your home.

This is because choosing a well-suited home loan can offer refinancing flexibility in the future and save on home ownership cost while allowing you to adjust loan terms to better meet your financial situation and take advantage of interest rate movements.

As a housing loan can spread over many years, the long repayment periods and accumulating interest can significantly increase the total cost of home ownership.

Choosing A Home Loan

When investing in an HDB flat, applicants have the option of choosing a HDB concessionary loan or a bank loan. In all likelihood, most would apply for a HDB concessionary loan (which is currently fixed at 2.60%), or a bank loan where they have an existing relationship out of convenience. (Note: Buyers of private properties are not eligible for a HDB concessionary loan).

Most borrowers will also tend to focus on the interest rate when deciding on the home loan package. For most bank loans, they may offer similar interest rates. However, on closer examination, there can be big differences in their terms and conditions. Hence, choosing the right one can save you money and provide flexibility in the event you wish to refinance your housing loan in the future.

Some of the factors borrower should look out for include service fees, refinancing restrictions, early loan redemption penalty, and many others. Below, we will highlight some of them.

HDB Concessionary Loan

For many HDB flat applicants, the HDB concessionary loan is their default option, and for good reasons. It is easily approved and if you have sufficient money in your CPF Ordinary Account (OA), you can use it for the downpayment.

HDB also provides up to 75% Loan-To-Value (LTV) financing of the purchase price or valuation of your HDB flat, whichever is lower. You also pay a fixed rate of 2.6% (0.1% plus 2.50% of the CPF OA interest rate), which has remained stable for the last 20 years or more. This provides certainty on your monthly loan repayments while removing any worries over potential future rise in interest rates. In other words, it is a good home loan option for more risk-averse borrowers.

Bank Loan

There are two main types of home loans banks offer – fixed-rate and floating-rate loans. Fixed-rate loans usually charge higher interest rates, but they provide certainty over monthly loan repayments and protect you from future interest rate increases. However, take note that banks only offer fixed rates for the first few years ranging from 1 to 5 years. Subsequently, they will revert to floating rates.

For floating-rate loans, the interest rates are variable. In the past, they were pegged against the 1-, 3-, 6- and 12-month Singapore Interbank Offer Rate (SIBOR) or Swap Offer Rate (SOR). The home loan rate was then fixed at a spread over SIBOR or SOR. For example, SIBOR + 0.5% or SOR + 0.5%.

However, since 30 August 2019, the Association of Banks in Singapore and the Singapore Foreign Exchange Market Committee (ABS-SFEMC) have recommended SORA as the most suitable and robust benchmark. Hence, banks in Singapore have phased out SIBOR and SOR-based home loans since 2020.

What is SIBOR, SOR And SORA

SIBOR stands for Singapore Interbank Offered Rate. It is the interest rate that banks in Singapore charge each other for borrowing or lending money in the interbank market. SIBOR is administered by the Association of Banks in Singapore (ABS) and they are derived randomly from what some banks in Singapore quote on a daily basis.

SOR stands for Swap Offer Rate. It is derived from the interest rate differential between the Singapore and U.S. dollar, as well as the foreign exchange rate between the two currencies.

Both SIBOR and SOR generally move in the same direction, although the latter tends to be more volatile as it affected by the movement in the USD/SGD exchange rate.

SORA stands for Singapore Overnight Rate Average. It is the volume-weighted average rate of actual borrowing transactions in the unsecured overnight interbank SGD cash market in Singapore between 8 am and 6.15 pm daily. The Monetary Authority of Singapore (MAS) will then validate the data and calculates the volume-weighted average rate of all eligible transactions and publish them at 9.00 am the following day.

The versions most used by banks for their floating home loan packages are the 1M and 3M Compounded SORA, which are the average of SORA rates published in the last 1 or 3 months.

Home Loan Quantum

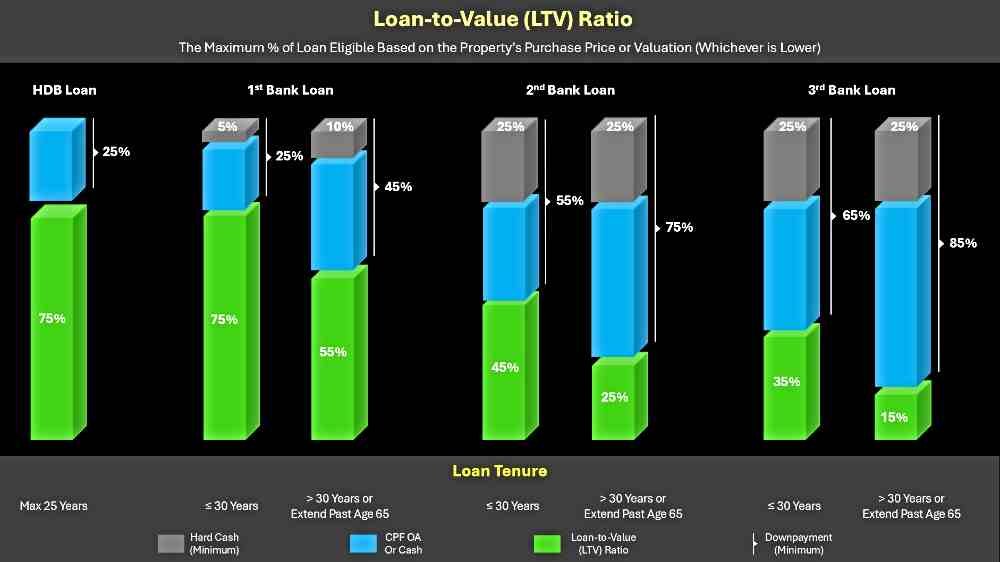

For HDB concessionary loans, borrowers can borrow up to 75% Loan-To-Value (LTV) of the price or value of the property, whichever is lower, provided the lease of the property can cover the youngest buyer to age 95. The balance of 25% can be paid either by cash or CPF OA monies.

The maximum loan tenure is 25 years. But if the HDB flat cannot cover the youngest buyer until the age of 95, the LTV will be pro-rated from 75%. In addition, HDB will not grant any home loan for HDB flats with a remaining lease of 20 years or less.

Bank loans are also subjected to an LTV of 75% of the purchase price or value of the property, whichever is lower, up to a tenure of 30 years. Unlike an HDB loan, for the balance of 25%, 5% must be paid in hard cash and the rest in either cash or CPF OA monies.

This means you will have to fork out more hard cash if you choose a bank loan compared to an HDB loan. Hence, you must consider this when evaluating your financing options.

The LTV will drop to 55% for a tenure above 30 years or when it extends past the borrower’s age of 65. For the balance of 45%, 10% must be paid in cash and the rest in either cash or CPF OA monies (please refer to the infographic below). Further information can be found in “Change In CPF Usage And Housing Loan Rules”.

Home Loan Conditions And Penalties

Besides interest rates, there are terms and penalties that you need to consider when choosing your home loan. These include the following:

Lock-in Period – This is the period where the borrower is “locked in” with the bank to enjoy a promotional interest rate. This “locked in” period can be between 1 to 5 years. This feature prevents the borrower from switching to another bank during this period in return for a lower interest rate. In the event the borrower decides to redeem his home loan in full during the lock-in period due to the sale of the property for example, the bank usually levies a penalty of 1.5% on the outstanding loan amount. This could easily wipe off any savings gained from the promotional interest rate.

Partial or Full Loan Redemption Penalty – Borrowers may choose to redeem their loan partially or fully in cases such as receiving a substantial windfall (eg, a large year-end bonus or striking a lottery) or selling their property. As previously mentioned, such redemptions typically incur a penalty fee of approximately 1.5% of the outstanding loan balance.

However, some banks may provide a certain percentage of loan redemption, say up to 20%, without penalty during the promotional period. Some banks may also require that you to keep a certain minimum loan amount after partial repayment, for example, an amount of $200,000. Hence, you should find out such terms and conditions with the bank before committing.

But for HDB loans, there is no penalty for partial redemption. But for full repayment, a registration fee of $38.30 and a conveyancing fee between $23.95 (1-room flat) to $83.90 (Executive flat) are payable. More details can be found here.

Refinancing Fees – Refinancing means switching to another home loan package with another bank after you have completed your lock-in period. This is to take advantage of the lower interests at that time, if deemed beneficial, after taking into account all the related costs for breaking the home loan.

Alternatively, you may do a re-pricing which is refinancing your home loan with your existing bank. Again, you need to consider the processing fee charged which can range from $200 to $800. Hence, before deciding to refinance or re-price your home loan, work out whether there are any savings left after incurring all the charges.

For borrowers of HDB loans, they can switch to a bank loan in the future if it offers a lower interest rate. But after you have switched, it cannot be reverted to an HDB loan.

Subsidy Clawbacks – Banks usually provide some freebies or subsidies to entice borrowers to apply for a home loan with them. These may include fire insurance premiums, and legal and valuation fees. However, they may come with clawbacks and borrowers will need to refund their banks if they wish to refinance their loans within 3 years for example. The amount of clawback can amount to about $2,000.

Interest Rate Reset Date – If a borrower is on a 3-month SORA-pegged floating-rate loan, for example, the interest rate will only be reset every 3 months. Should the borrower make a partial or full repayment of the loan or wish to refinance it before the interest rate reset date, a breakage fee of 0.5% (depending on the bank) may be levied on the outstanding loan amount.

Late Repayment Penalty - If you fall behind on your monthly home loan repayment, a penalty will be levied on you. This could either be a fixed percentage on the payment due or a flat fee of about $80. In order not to overlook your monthly home loan instalments, it’s prudent to apply for Giro.

Cancellation Fee – Unless you are certain about applying for a home loan from a particular bank, don’t commit to it first. Banks may levy a cancellation fee of about 1.5% on the amount cancelled.

Loan Structure - Most banks structure their home loan packages on a “step-up” basis. This means the loan rate gets progressively more expensive as time passes. But there are some that reward their clients for loyalty, offering “step-down” loan packages which get cheaper the longer you stay with them.

Other Property Financing Factors

Besides the various terms and conditions attached to home loans highlighted above, below are two important property financing factors to take note of as they can limit the amount of housing loan you are eligible for and ultimately, your affordability They are:

- Debt servicing limits

- Property stamp duties

Debt Servicing Limits

How much you can borrow to finance your property can be limited by two debt servicing limits imposed by the Monetary Authority of Singapore (MAS). These are:

- Mortgage Servicing Ratio (MSR)

- Total Debt Servicing Ratio (TDSR)

Mortgage Servicing Ratio (MSR) – MSR currently sets a 30% limit of the borrower’s gross monthly income that can be used to finance his or her HDB home loan. MSR will also apply to the financing of executive condominiums.

For example, if the borrower’s gross monthly income is $5,000, the monthly loan repayment cannot exceed $1,500 (30% x $5,000).

If your property is jointly purchased with your spouse, then both your income can be taken into account.

Total Debt Servicing Ratio (TDSR) - TDSR takes into account all outstanding loan commitments (e.g. home loan, car loan, study loan, credit card debts, and so on). These loans/debts are capped at 55% of the borrower’s total gross monthly income.

For example, if the borrower’s gross monthly income is $5,000, the monthly total debt repayment cannot exceed $2,750 (55% x $5,000). This will include the borrower’s monthly mortgage. [Note: Those earning variable income such as salesperson, their gross monthly income will be subjected to a 30% haircut for calculation of TDSR].

Effectively, both the MSR and TDSR seek to ensure financial prudence as well as prevent over-spending by Singaporeans. Indirectly, they also help to curb property speculation by preventing over-leveraging of one’s income.

Property Stamp Duties

Property stamp duties are taxes on dutiable documents on any immovable properties in Singapore. They are computed on the purchase price or value of the property, whichever is the higher amount, stated in the document to be stamped. They are payable to the Inland Revenue Authority (IRAS).

When buying a property, Buyer's Stamp Duty (BSD) and Additional Buyer's Stamp Duty (ABSD) must be factored in. This is because they can add substantially to the total cost of your property acquisition. Hence, understanding Singapore's property policies is important for thorough financial planning and budgeting.

Buyer’s Stamp Duty (BSD) - When buying a property in Singapore regardless of whether it is a public or private home, the buyer’s stamp duty (BSD) is payable. BSD is levied on the purchase price of your property based on the rate shown below. It can add substantially to the overall cost of your property purchase. Hence, it needs to be factored in to determine the overall cost and your affordability.

| Buyer's Stamp Duty (BSD) | ||

| Higher of Purchase Price or Market Value of the Property | Rates on or before 14 February 2023 | Rates on or after 15 February 2023 |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6% | |

Additional Buyer's Stamp Duty (ABSD) - Additional Buyer’s Stamp Duty (ABSD) is levied on the following:

- Singapore Citizens (SC) buying their second and subsequent residential properties

- Singapore Permanent Residents (SPR) buying their first and subsequent residential properties

- Foreigners (FR) and Entities buying any residential properties (Note: Nationals or Permanent Residents from Switzerland, Norway, United States, Iceland and Liechtenstein are eligible for ABSD remission under Free Trade Agreements (FTAs) and are accorded the same Stamp Duty treatment as Singapore Citizens)

How much ABSD a property buyer will incur will depend on his/her status as indicated below:

| Additional Buyer's Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

More details can be found in “How to Calculate Singapore Property Stamp Duties”.

The Importance of a Good Credit Score

A credit score is a numerical representation of an individual's creditworthiness. In Singapore, it typically ranges from 1,000 to 2,00023.

This score is calculated based on factors that include an individual's payment history, credit utilisation, and the number of credit applications. The Credit Bureau Singapore (CBS) collects and aggregates information on borrowers’ total credit risk profiles which financial institutions use to assess loan applications.

For property investors, maintaining a good credit score is crucial for several reasons.

A higher score improves the chance of getting the loan approved. It may also lead to more favourable loan terms, like lower interest rates. This will help to reduce the overall cost of property financing. A poor score, on the other hand, may lead to loan rejection or higher interest rates.

In addition, a strong credit score may allow investors to secure larger loan amounts, giving them better financing opportunities and helping to enhance long-term investment potential.

Conclusion

Now that you are armed with the necessary information, you will be in a better position to shop for a suitable home loan. It’s important to figure out what you truly need and how you can manage the financing at the present and in the future.

In addition, you will need to take into account the following considerations when taking up a home loan:

- How big a loan you can afford?

- What is the length of the loan?

- How much personal savings and CPF funds are available for the downpayment of your property purchase?

- How much can you afford to set aside for the monthly home loan installments?

- Will there be future cash injections (e.g. year-end bonuses)?

- Any plans for partial or full loan redemption in the future?

Besides the above, you will also need to take into account other costs of home ownership such as renovation and repair costs, utility bills, maintenance fees (for private condos), or conservancy charges (for HDB flats), and property tax.

In addition, take into account the property agent's commission if you have engaged one. If you prefer to purchase an HDB resale flat without using a property agent, you can use the HDB Resale Flat Service to manage the process yourself.

It is also prudent to set aside some savings, in case you need money for other unexpected expenses or contingencies such as loss of job or medical treatments. If you have any queries about property investment or home loan, please feel free to Email or WhatsApp Us.

Other Resources

- The Greater Southern Waterfront – A Property Market Outlook

- One-North - A vibrant high-tech hub in Singapore's District 5

- Jurong Lake District Development: A Property Investment Hotspot?

- Woodlands Regional Centre: Property Hotspot In the North Region

- Novena Master Plan – Health City Novena to Spur Transformation

- Mega Developments In The East Region

- Development of Tampines North

- Tampines Nature Parks An Appeal to Property Buyers

- Tampines Regional Centre – A Vibrant Shopping Haven

A Review of New Property Launches

For reviews of new property launches, please click on the links below. More project information can also be found here.