Understanding Singapore Property Policies & Financing Options

Navigating Singapore’s residential property market can present significant challenges. Equip yourself with essential information on Singapore property policies, financing alternatives, and in-depth market research to make informed decisions during your property investment journey.

Singapore’s property market stands out as one of the most robust and stable globally. This can be attributed to a series of well-crafted government policies that have effectively deterred speculation while simultaneously promoting responsible property financing for homebuyers and property investors.

Hence, it is unsurprising that the Singapore property market still attracts strong foreign interests despite the heavy imposition of 60% ABSD. This can be attributed to its stable political climate and a resilient economy, while countries such as the United States, Liechtenstein, Iceland, Norway, and Switzerland do not incur ABSD due to their Free Trade Agreements (FTA) with Singapore.

Nevertheless, as property investing is a heavy financial commitment, it is important to be well-informed about key government policies, financing options, and the latest market developments such as new property launches.

Understand Singapore’s Property Policies

Understanding Singapore property policies is crucial when investing in properties because they can significantly impact your investment decisions, costs, and potential returns.

Therefore, understanding them is key to making informed investment decisions and below are some key policies to take note of:

Residential Property Act: It regulates the ownership of residential properties, including the class of properties eligible for foreigners to purchase. Recently, the act was amended to classify land zoned for both commercial and residential use as residential property. This means that foreigners must seek government approval to purchase such properties.

Buyer’s Stamp Duty (BSD): This is a tax payable on the purchase of properties. The rates vary depending on the property’s purchase price or market value (refer to Table 1).

| Table 1: Buyer’s Stamp Duty (BSD) | ||

| Higher of Purchase Price or Market Value of the Property | Rates on or before 14 February 2023 | Rates on or after 15 February 2023 |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6% | |

Additional Buyer’s Stamp Duty (ABSD): This is an additional tax on top of the BSD for certain categories of property buyers, such as Singapore Citizens buying their second and subsequent residential properties, Singapore Permanent Residents, foreigners, and entities.

As of 27 April 2023, the ABSD rate for foreigners has doubled to 60% from 30%, significantly raising their cost of property acquisition in Singapore (refer to Table 2).

| Table 2: Additional Buyer’s Stamp Duty (ABSD) | ||

| Buyer Profiles | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

Free Trade Agreements (FTAs): Nevertheless, foreigners from the United States, Iceland, Liechtenstein, Norway, and Switzerland are not subjected to ABSD due to their FTAs with Singapore. In other words, they will be treated similarly to Singaporeans when purchasing a residential property.

Total Debt Servicing Ratio (TDSR): It is a framework by the Monetary Authority of Singapore (MAS) to ensure financial prudence among borrowers. It aims to prevent over-borrowing by limiting the monthly mortgage repayments of individuals to 55% of their gross monthly income. It also considers other debt obligations incurred such as car loans, personal loans, and credit card debts.

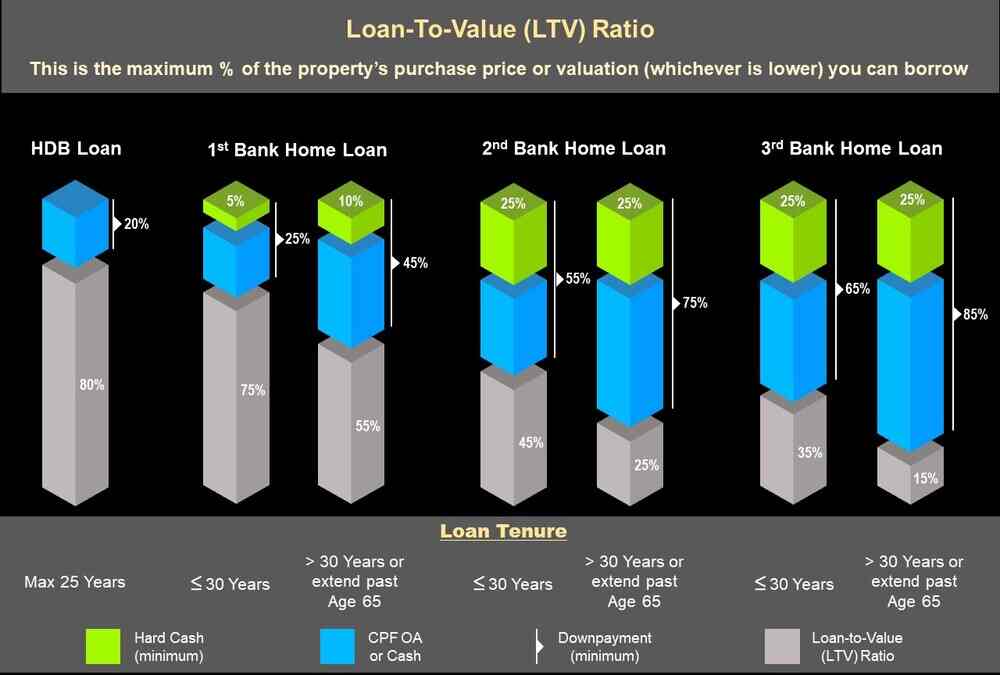

Loan-to-Value (LTV): This refers to the limit to which financial institutions in Singapore will grant borrowers a housing loan. The LTV is set at 75% of the purchase price or value of the property, whichever is lower, up to a tenure of 30 years. However, it will drop to 55% for a tenure above 30 years or when it extends past the borrower’s age of 65. For a second or third loan, the LTV will drop even further, meaning borrowers will need to fork out more cash (please refer to the infographic below).

Lease Decay: Old properties with shorter remaining leases, (eg 30 to 40 years), may face a significantly lower LTV ratio. Financial institutions may consider these properties less valuable collaterals due to their leases running out. Additionally, restrictions may apply to using CPF funds for these properties if their leases do not cover buyers up to the age of 95 years.

Property Tax: This is an annual tax on property owners, based on the annual value of the property. The rates differ for owner-occupied and non-owner-occupied properties, with the latter paying a significantly higher tax rate. Hence, those buying for investment need to account for this “cost” as it will affect the ROI.

Policies on Use of CPF Funds: CPF funds can be utilised to buy residential properties under certain conditions. However, they cannot be used to purchase industrial/commercial property. The amount of CPF funds that can be used to finance a property will depend on several factors. These include:

- Remaining Lease of Property & Age of Buyer: Whether the lease of the property can cover the buyer up to the age of 95 years. If it cannot, it will be pro-rated.

- Retirement Sum: Those buying a second property using CPF must set aside the Basic Retirement Sum (BRS). Only monies in excess of the current BRS remaining in the CPF Ordinary Account (OA) can be used to finance the second property purchase.

Explore Property Financing Options

In Singapore, several property financing options are available. However, the most common are bank loans offered on fixed-rate and floating-rate basis. Understanding how they work in different market conditions and making an informed decision can save you substantial financing cost.

Fixed-Rate Home Loans: They have a fixed interest rate for a certain period, usually between two to five years. After this period, the interest rate changes to a floating rate pegged to a reference rate such as the Singapore Overnight Rate Average (SORA).

Floating-Rate Home Loans: They have interest rates subjected to periodic adjustments. These can be pegged to the Singapore Overnight Rate Average (SORA).

[Note: HDB resale flat abd BTO flat buyers have the option of applying for a concessionary HDB loan or bank loan. However, executive condo buyers can only apply for a bank loan].

Fixed-Rate Or Floating-Rate Loan – Which is preferable?

It depends.

During periods of rising interest rates, a fixed-rate loan will help you lock in the rate. This will protect you from paying more for your mortgage loan when interest rates move higher.

On the other hand, during periods of declining interest rates, a floating-rate loan enables you to enjoy lower interest payments when the rate comes down as you are not tied to a fixed rate.

Other Property Financing Options

Besides fixed-rate and floating-rate home loans, property investors may wish to consider leveraging on their existing property to finance a second property using an equity term loan. But what is it?

Equity Term Loans: An equity term loan is a type of loan that is secured against the equity in your property and usually comes with more favourable borrowing rates. This means that the lender will have a lien on your property, and it has the right to sell it in the event of a loan default.

When taking an equity home loan, the current 75% loan-to-value (LTV) rule applies. In other words, you can only cash out up to 75% of your property value (assuming it is fully paid). However, any CPF savings that have been used to pay for your current properties cannot be cashed out.

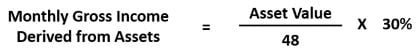

Pledging: It means simply depositing an amount in the form of a fixed deposit with the mortgage lender for a period of 48 months (usually from the start of your loan). This may include liquid assets such as savings or fixed deposits.

Other types of assets may also be pledged, such as company-listed shares, bonds, and unit trusts. However, they are subjected to a 30% haircut.

The amount required is based on how much financing is required and can be calculated as follows:

For example, if you have a monthly income of $10,000 and you pledged $100,000 for 48 months, you will have $2083.33 added to your monthly gross income. This will increase your income to $12,083.33, which will effectively allow you to get a bigger loan from your lender.

Unpledging: Unlike pledging, the borrower only needs to show the mortgage lender an amount of funds during the loan application and when the first loan is being disbursed. In other words, the funds need not be locked up for 48 months.

However, the increase in your “income” for financing your loan will be much lower due to a 70% haircut, as shown by the calculation below:

Based on the same scenario above (pledging) where you have a monthly income of $10,000, but you decide to go for “Show Funds” (unpledging) for $100,000, you will only have $625.00 added to your monthly gross income. Hence, you will only be able to increase your income to $10,625 as compared to $12,083.33 if you do a pledging.

In order to increase your “income” to $12,083.33, you will need to “Show Funds” for $333,333.

Decoupling: It is a process in which a co-owner of a property transfers all his/her share to the other co-owner. This can be done via a sale or gift. (Note: No decoupling is allowed for HDB flats).

In other words, they severe the joint ownership of their property. By doing so, the one receiving the share of the property will end up as the sole owner while the other will be left with no property ownership.

This strategy is often employed so that the one left without any property can buy one without incurring Additional Buyer’s Stamp Duty (ABSD).

However, for decoupling via a gift, it is important to note that there must be no encumbrances. i.e. there must be no outstanding mortgage or CPF charge. Otherwise, extra funds will be required to settle the outstanding mortgage and/or refund of CPF monies.

Be aware that decoupling requires careful financial planning. For example, the one taking over the share of the property may need to take up an additional housing loan to finance it and the usual TDSR framework will apply. After taking into account these Singapore property policies, you will need to assess whether you are capable of financing it alone.

Also, if the value of your existing property is much higher than the second property you wish to invest in, the cost of decoupling may be higher than paying ABSD.

To decouple, you will incur costs such as conveyancing fees, valuation fees, BSD, prepayment of your existing bank loan, and other miscellaneous expenses. Hence, it is advisable to seek the help of a professional property agent to undertake an in-depth evaluation of your financing needs.

How Decoupling Works?

- Transfer of Ownership: The co-owner who intends to buy another property transfers his/her share of the current property to the other co-owner through a sale or a gift. In the case of a sale, a Sale and Purchase agreement needs to be signed and stamped.

- Buyer’s Stamp Duty (BSD): The co-owner receiving the shares will need to pay the standard BSD on the market value of the shares being transferred.

- Additional Buyer’s Stamp Duty (ABSD): If the co-owner receiving the shares already owns more than one property, he/she will also need to pay ABSD.

- Purchase a New Property: This leaves the co-owner who has transferred his/her share of the existing property to purchase a new property without paying ABSD as it will be treated as a first-time home buyer.

Research And Understand the Market

Now that we have covered some key government property policies and financing options, the next step is to research the market and undertake due diligence.

The first step to buying or selling a property in Singapore is to familiarise yourself with the market. This includes researching the current trends, such as the prevailing prices of properties in different areas, any upcoming new launches, and the demand & supply situation.

One of the best ways to acquire knowledge is to read market reports from reputable sources. These reports will provide insights into the current trends and news, as well as historical data that you can use to make informed decisions.

Alternatively, you may seek advice from a real estate agent, who can offer the latest information, insights, and market research, including a comparative market analysis (see chart below). While these services typically require a commission, they can help you make informed decisions to maximise your property investment returns.

Property Price Trend (New Properties): CCR vs RCR vs OCR

- Analysis of 20-year average price performances of new properties in the Core Central Region (CCR) vs Rest of Central Region (RCR), and Core Central Region (CCR) vs Outside Central Region (OCR).

- Percentage of price gains for CCR, RCR and OCR properties over the latest 20-year period.

- Price gap analysis: CCR vs RCR properties and CCR vs OCR properties.

The chart above shows that over a 20-year period, the prices of new properties in CCR, RCR, and OCR have appreciated by 248.57%, 385.63%, and 326.33% respectively.

Meanwhile, the price gap between CCR vs RCR narrowed from 58.79% to 13.97%, while CCR vs OCR narrowed from 71.43% to 40.16%.

From these market data, they show properties in CCR have underperformed those in RCR and OCR. This may potentially point to a likely correction (a re-widening) of the price gaps in the near future. Will this offer an opportunity to invest in a CCR property? Consult a professional property agent if you wish to gain deeper insights into the market. At the same time, you can also find out about any changes in Singapore’s property policies, if any.

Location And Future Development

Location is one of the most important factors to consider when buying a property in Singapore. As the saying goes: “Location creates desirability, desirability creates demand, and demand raises real estate values”

Although properties in prime locations are often more expensive, they are highly sought after for various reasons – prestige, located at the heart of the city with unparalleled access to a wide range of amenities and attractions, near major business centres, high rental demand, etc.

Therefore, it is unsurprising they are popular with foreign investors and Ultra-High-Net-Worth Individuals (UHNWI). Nevertheless, the recent imposition of 60% ABSD will likely curtail their demand for Singapore properties.

But with prices of properties in prime areas having narrowed against those in the city fringe and suburbs (refer to the chart above), they may offer promising investment opportunities.

Besides location, another important investment factor to consider is future developments. For example, if there are plans to build a new MRT station or to rejuvenate the district, they can have a significant positive impact on a property’s value.

However, they are not the only factors to consider. Buying a property must also take into account one’s own needs and preferences. For example, those with young children may want to choose a property that is close to good schools or their parents’ home for child-minding purposes. Or staying near one’s workplace may be preferable due to reduced commuting time.

Set A Realistic Budget And Undertake Due Diligence

Once you understand the market, you need to set a realistic budget for your property purchase and decide how to finance it. If you set your sights too high, you may end up disappointed as your “dream” home is out of your reach.

When buying a property, besides taking into consideration its price, you will also need to factor in additional costs such as stamp duty, legal fees, property tax, and maintenance fees.

It is also important to factor in additional costs that may be involved when buying a resale property. These may include checking for structural defects and renovation costs.

And if you are buying an old resale condominium, it is important to check whether major repairs or upgrading works are required. These may include repainting the entire estate, lift upgrading, roof repairs, or replacement of the plumbing system, all of which will incur significant expenditure.

If the Management Corporation Strata Title (MCST), which manages the property, has insufficient reserves, residents may be required to pay out of pocket. These costs can add up quickly and hence, it is important to undertake due diligence to find out such information.

Legal Checks For Property Purchase

When purchasing a property, conducting thorough legal checks is essential. This process involves verifying the property’s title deed, reviewing all relevant legal documents, and ensuring that the property is free from any encumbrances, such as outstanding debts or liens.

Performing these checks will require the expertise of a conveyancing lawyer. This will help to ensure that the property you are interested in does not have any underlying issues. The law firm can also advise you on the various Singapore property policies and help you navigate complex cases. Acquiring a problematic property can lead to numerous headaches and potentially become a lengthy and costly ordeal to resolve.

If you have enlisted the services of an experienced property agent, he can offer valuable guidance and recommend a reputable conveyancing law firm that charges reasonable fees. A competent legal professional will handle all the necessary legal documentation and checks, as well as help you handle loan disbursement from your mortgage lender.

Ultimately, having the right legal support will provide you with peace of mind throughout the property purchase process.

Property Investment And Timing

The property market in Singapore, like markets globally, is cyclical, with periods of more favorable prices. While predicting the optimal time to enter the market is challenging, exercising patience and waiting for the right opportunity can be beneficial.

Pursuing a quick windfall, such as through an en bloc sale, is not advisable due to the complex process and low success rate.

As the property market is usually in a state of flux, it is difficult to predict where prices will go in the short term. However, the long-term outlook of the Singapore property market is positive, especially with the government committed to maintaining stable and sustainable growth using a slew of property policies that have largely eradicated rampant speculation.

Hire a Real Estate Agent

If you are not too familiar with Singapore’s property market, getting in touch with a real estate agent is advisable as he can offer you a range of services that include the following:

- Update you on the latest developments in the property market.

- Help you gain a deeper understanding of the market with research data.

- Advise, suggest, and find the right property that aligns with your needs or investment horizon.

- Negotiate the price of the property on your behalf and guide you through the entire buying/selling process.

- Financial evaluation and affordability evaluation.

- Advise you on the latest Singapore property policies and how they may affect the market.

- Recommend reputable conveyancing lawyers and offer information on the latest housing loan rates.

Be sure to engage a licensed real estate agent that is registered with the Council of Estate Agencies (CEA), a government statutory board that oversees the regulation and conduct of property agencies.

You may also wish to engage someone from an established property firm with the necessary proptech (property technology) that can provide you with deeper market insights and serve your needs more effectively.

For property sellers, it is important to hire a property agent with the requisite markeing expertise.

Conclusion

In conclusion, having a thorough grasp of Singapore property policies and financing options, as well as undertaking in-depth research of the property market are crucial for making well-informed decisions. These measures significantly enhance the likelihood of making sound investment choices.

It is essential to exercise patience and, when necessary, seek professional advice to effectively grow your assets and plan for future retirement.

New Property Launches

Below is a list of the latest and upcoming new property launches for your information:

- TMW Maxwell, a mixed-use development located at Tras Street.

- Newport Residences, a mixed-use development at Anson Road.

- Skywater Residences, a mixed-use development opposite Tanjong Pagar MRT station.

- Marina View Residences, a mixed-use development that includes a hotel at Marina Bay.

- Watten House, a luxurious condo near Tan Kah Kee MRT station in Bukit Timah.

- Meyer Blue, a luxurious freehold condo at Meyer Road.

- The Hill @ One-North, a mixed-use development in Singapore’s “Silicon Valley”.

- The Continuum, a luxurious freehold condo in District 15.

- Tembusu Grand, a 99-year condo development at Jalan Tembusu in District 15.

- Grand Dunman, a mega condo development near Dakota MRT and Old Airport Road Food Centre.

- Pinetree Hill, a condo development at Ulu Pandan by UOL Group and Singapore Land.

- Kassia, a rare freehold condo at Flora Drive.

- The Arcady, a freehold condo near Boon Keng MRT.

- The Arden, a 105-unit condominium with a unique Co-Space concept.

- J’Den, a mixed-use development at vibrant Jurong East

- Altura EC, an executive condo near Bukit Gombak MRT.

- The Myst, a condominium by CDL near Cashew MRT station in District 23.

- Botany At Dairy Farm, a condo development located near Hillview MRT.

- Lentor Hills Residences, a condo in the leafy Lentor private residential enclave.