On 29 September 2022 close to midnight, the Singapore government announced a new round of property cooling measures. They will come into effect on 30 September 2022.

In a joint statement by MAS-MND-HDB, the objective is “to promote sustainable conditions in the property market by ensuring prudent borrowing and moderating demand”.

The latest move is to pre-empt further interest rate increases on expectation of more rate hikes from the US Federal Reserve to tame inflation. In the 21 September FOMC meeting, the Federal Reserve raised its target interest rate by 0.75% to a range of 3.00%-3.25%. It also signaled more large interest rate increases to 4.40% by year-end before topping out at 4.60% in 2023 in its fight to bring inflation under control.

The rise in US interest rates will put upward pressure on Singapore interest rates. This will translate to costlier home financing. For example, Singapore’s 3-month SORA has increased by almost 135 basis points (bp) or 1.35% in the last six months to 1.596%, and it is expected to rise further.

Hence, the latest slew of property cooling measures is aimed at ensuring financial prudence while staving off potential loan default, which can have serious consequences on Singapore’s economy.

Summary of Property Cooling Measures

For easy reference, the latest property cooling measures are summarised below:

For property loans from private financial institutions, the medium-term interest rate floor – which is used to compute the total debt servicing ratio (TDSR) and the mortgage servicing ratio (MSR) – has been raised by 0.5%.

For HDB loans, the interest rate floor is raised to 3%, or 0.1% above the prevailing CPF Ordinary Account interest rate, whichever is higher. At the same time, the Loan-to-Value (LTV) has been reduced to 80% from 85%.

Loans from Private Financial Institutions

- MSR (Residential): 3.50% → 4.00%

- TDSR (Residential): 3.50% → 4.00%

- TDSR (Non-Residential): 4.50% → 5.00%

The actual interest rates charged for mortgages will continue to be determined by the private financial institutions.

HDB Loan

- Home Loan Eligibility (HLE) MSR: 2.60% → 3.00%

- LTV Reduction: 85% LTV → 80% LTV

There is no change to the actual interest rate charged for HDB loan, where its interest rate is reviewed quarterly. It will continue to be pegged at 0.1% above the prevailing CPF OA interest rate and will remain at 2.6% p.a. from 1 October to 31 December 2022.

Other Property Cooling Measures

To moderate the demand in HDB resale market which has seen an increasing number of flats sold above a million dollars, the new measures are as follows:

- Private Property Owner/Ex-Private Property Owner → To wait out 15 months before being eligible to purchase a non-subsidised HDB resale flat, up from 6 months previously (a temporary measure which will be reviewed in future depending on overall market conditions and housing demand).

However, for private property owners/ex-private property owners, the wait-out period to purchase a HDB resale flat or apply for a BTO flat with CPF Housing Grant and Enhanced CPF Housing Grant remains unchanged at 30 months.

Seniors above 55 years-old will also not be affected if they downgrade to a 4-Room or smaller HDB flat.

How the Revised Interest Rate Floor Affects the Loan Quantum and Property Affordability

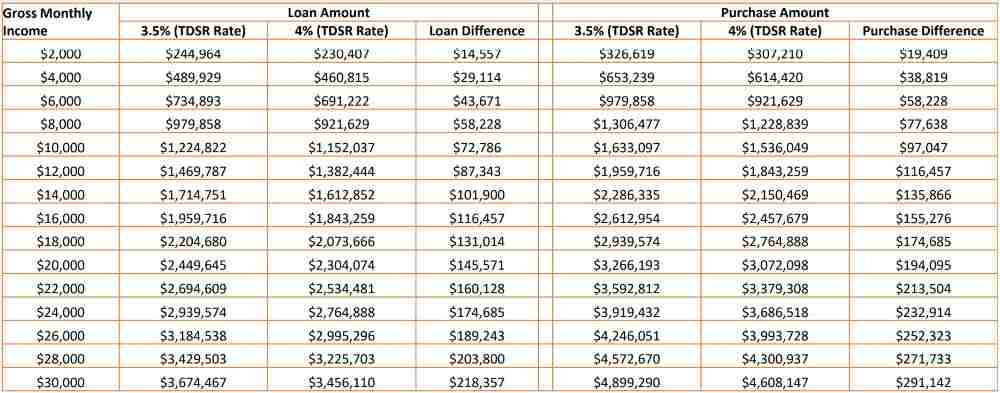

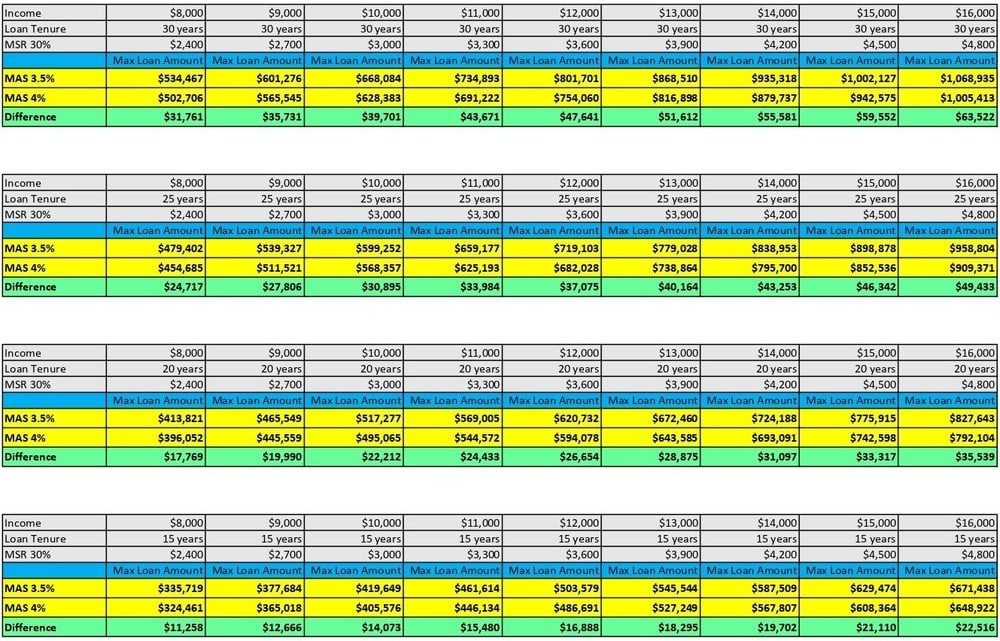

The table below provide an indication on how much it will affect the loan quantum and property purchase price following the latest changes in interest rates. This will enable potential property buyers assess their affordability.

Changes in TDSR Affecting Loan Amount and Property Purchase Price

Changes in MSR Affecting Loan Amount and Property Purchase Price

If you have any questions about the Singapore property market, please feel free to WhatsApp or Email Me.

Meanwhile, please check up on some of these new property launches:

- Newport Residences at Anson Road.

- TMW Maxwell at Maxwell Road.

- J’Den at Jurong East.

- Altura EC at Bukit Batok.

- The Hill @ One-North.

- Pinetree Hill at Pine Grove.

- The Reserve Residences at Beauty World.

- How to Buy A New Launch Private Property In Singapore

- A Complete Guide: Buying A Resale Private Property In Singapore

- En Bloc Sale Process and Guide