Although many Singaporeans aspire to own private properties, would investing in HDB flats be a good option? It can certainly be for first-time buyers such as young couples looking for their first matrimonial home. First of all, HDB flats are highly subsidized and home ownership is a key national policy to encourage Singaporeans to have a stake in the nation.

But for those who are not eligible to apply for a new HDB flat due to their household income ceiling exceeding $14,000 per month, executive condos (ECs) may be a good investment option. You can also learn more about ECs by referring to executive condo guides and FAQs and eligibility criteria.

Meanwhile, this post will cover the following:

- Is Investing In A Resale HDB Flat A Better Option?

- Options After Repaying Housing Loan

- Additional Buyer’s Stamp Duty (ABSD) & Buyer’s Stamp Duty (BSD)

- Restriction on the Use of CPF Funds

- Total Debt Servicing Ratio (TDSR)

- Investing In HDB Flats - Rental Yields

- Depreciating Values of Ageing HDB Flats

- Investing In HDB Flats - Still Viable?

- Other Resources

- Reviews of New Property Launches

As a first-time buyer, you have a choice of applying for a new Built-To-Order (BTO) flat if you are prepared to wait a minimum 2.5 years. If not, you can consider a resale flat. [NOTE: Singapore Permanent Residents (SPR) are not eligible to purchase new HDB flats if their family unit does not include a Singapore Citizen]. Hence, if they are thinking of investing in HDB flats, they are only eligible to purchase HDB resale flats. They will also not be entitled to any government housing grants. More information can be found here.

For HDB resale flats, first-time buyers can also receive up to $80,000 Enhanced Housing Grant (EHG) if your household income does not exceed $9,000. How much you will receive will depend on the level of your monthly household income as indicated in the table below.

| First-Timer Families and Singles under Joint Singles Scheme | Singles under Single Singapore Citizen Scheme | ||

| Average Monthly Household Income | Grant Amount | Average Monthly Household Income | Grant Amount |

| Not more than $1,500 | $80,000 | Not more than $750 | $40,000 |

| $1,501 - $2,000 | $75,000 | $751 - $1,000 | $37,500 |

| $2,001 - $2,500 | $70,000 | $1,001 - $1,250 | $35,000 |

| $2,501 - $3,000 | $65,000 | $1,251 - $1,500 | $32,500 |

| $3,001 - $3,500 | $60,000 | $1,501 - $1,750 | $30,000 |

| $3,501 - $4,000 | $55,000 | $1,751 - $2,000 | $27,500 |

| $4,001 - $4,500 | $50,000 | $2,001 - $2,250 | $25,000 |

| $4,501 - $5,000 | $45,000 | $2,251 - $2,500 | $22,500 |

| $5,001 - $5,500 | $40,000 | $2,501 - $2,750 | $20,000 |

| $5,501 - $6,000 | $35,000 | $2,751 - $3,000 | $17,500 |

| $6,001 - $6,500 | $30,000 | $3,001 - $3,250 | $15,000 |

| $6,501 - $7,000 | $25,000 | $3,251 - $3,500 | $12,500 |

| $7,001 - $7,500 | $20,000 | $3,501 - $3,750 | $10,000 |

| $7,501 - $8,000 | $15,000 | $3,751 - $4,000 | $7,500 |

| $8,001 - $8,500 | $10,000 | $4,001 - $4,250 | $5,000 |

| $8,501 - $9,000 | $5,000 | $4,251 - $4,500 | $2,500 |

| More than $9,000 | NA | More than $4,500 | NA |

For those unwilling to wait for a BTO flat, investing in a resale HDB flat can be a good alternative. Although more expensive than new BTO flats, first-timers can receive up to $190,000 in housing grants to offset the higher prices. To view the listing of HDB resale flats, buyers can register for access to the HDB Resale Flat Listing Portal.

These housing grants consist of $80,000 Family Grant, $80,000 Enhanced Housing Grant (EHG), and $30,000 Proximity Grant (refer to the illustration below.). These grants will help to narrow the price difference between a new BTO and a resale HDB flat. In addition, if you are fortunate enough to find a well-maintained resale flat, you can save more on renovation when compared to a new BTO flat.

Such housing grants are helpful for people unwilling to wait for new BTO flats, those in need of housing urgently and those who wish to live near their parents. In other words, investing in resale flats provides the flexibility of choosing which part of Singapore to live in.

Whereas for BTO flats, most are in non-matured estates. Although some BTO flats are offered in matured estates, they face very high demand and are subjected to balloting. An example was the February 2019 Whampoa/Kallang BTO launch where 10 couples vied for one unit.

If you are a first-timer applicant and is unable to choose your choice BTO unit or refuses to select a unit, your first-timer status will be suspended for a year in future HDB Sales Exercise. The indefinite wait to secure your choice unit can be very frustrating. Are you prepared to bid your time?

Is Investing In A Resale HDB Flat A Better Option?

Investing in a resale HDB flat can be a better option if you are unwilling to wait to secure your "choice" BTO flat. One of the main reasons is, property prices tend to rise over time. The longer you wait, the more you are likely to pay in the future (refer to HDB resale price index below). There are exceptions of course, such the impact of global financial crisis and change in government policies. Another important factor is lease decay, which we will elaborate later in this article.

If you aspire to own a private property in the future, why not grab the generous government housing grants and complete your loan repayment as soon as possible? After pocketing the grants, you can decide whether to sell off your HDB flat or rent it out to finance a private property.

Do note that there is a Minimum Occupancy Period (MOP) of 5 years before you can rent out or sell off, regardless of whether it is a BTO or resale HDB flat. In addition, you are also not allowed to buy a private property locally or abroad during this period. So, this may be a good time for you to slowly accumulate your savings for future property investment while establishing your career.

Investing in a resale HDB flat also has the added advantage of choosing one in an area with good capital appreciation potential. For example, a flat that is near an MRT station, shopping mall or a good school. Of course, such a unit will cost slightly more. But you can command a higher rent, or if you decide to upgrade to a private property in the future, you should be able to sell it off easier and at a better price too.

One advice for anyone who aspires to invest in a private property in the future but wish to retain their HDB flat for investment is to start with a smaller 3 or 4-room HDB flat (more on this below). According to HDB median resale prices (see below), a 3-Room unit cost $344,381 (as of 30 March 2023).

| Median HDB Resale Flat Prices (as of 30 March 2023) | ||||

| TOWNS | 3-ROOM | 4-ROOM | 5-ROOM | EXECUTIVE |

| Ang Mo Kio | $378,000 | $555,000 | $868,000 | - |

| Bedok | $360,000 | $480,000 | $650,000 | - |

| Bishan | - | $669,400 | $877,500 | - |

| Bukit Batok | $360,000 | $514,000 | $700,000 | - |

| Bukit Merah | $400,000 | $775,400 | $899,000 | - |

| Bukit Panjang | $375,000 | $480,000 | $590,000 | $780,000 |

| Bukit Merah | - | - | - | - |

| Central | $450,000 | - | - | - |

| Choa Chu Kang | $389,500 | $500,000 | $588,000 | $679,000 |

| Clementi | $378,000 | $574,900 | - | - |

| Geylang | $335,000 | $576,500 | $781,500 | - |

| Hougang | $380,000 | $518,000 | $627,500 | $845,900 |

| Juong East | $360,000 | $465,000 | $643,000 | - |

| Jurong West | $358,000 | $481,500 | $566,000 | - |

| Kallang / Whampoa | $380,000 | $788,000 | $800,000 | - |

| Marine Parade | $430,000 | - | - | - |

| Pasir Ris | - | $520,000 | $641,000 | $796,000 |

| Punggol | $451,000 | $575,900 | $700,000 | - |

| Queenstown | $390,000 | - | - | |

| Sembawang | $432,500 | $535,000 | $579,000 | - |

| Sengkang | $443,400 | $548,000 | $580,000 | $710,000 |

| Serangoon | $386,500 | $539,000 | - | - |

| Tampines | $410,000 | $536,500 | $652,500 | $850,000 |

| Toa Payoh | $340,000 | $780,000 | $865,000 | - |

| Woodlands | $395,000 | $495,000 | $580,000 | $762,500 |

| Yishun | $372,000 | $474,000 | $620,000 | $788,000 |

If both you and your spouse are first-time buyers, you can receive government housing grants of up to $190,000. This will lower your financial outlay substantially. The rationale of buying a smaller flat, instead of a 5-room, is to pay off your mortgage in the shortest time possible, if you are thinking of getting a second property (private) for investment after fulfilling your 5-year Minimum Occupation Period (MOP).

The last thing you want is to prolong your loan repayment period because this will adversely impact the amount of loan you are eligible for when buying your next property (more about loan financing below). Assuming you held on to your HDB flat and buy a private property, do take note that this will be considered your second property. Hence, Additional Buyer's Stamp Duty (ABSD) applies.

Of course, if you wish to sell off your HDB flat after the 5-year Minimum Occupation Period (MOP) to invest in a private property, then you don't have to incur ABSD. There are many permutations at play and below is just one example of property financing. If you require any assistance to help with your financial assessment, please Contact Us.

Example: Financial Calculation For The Purchase of A HDB Resale Flat

Let’s assume that you are buying a 3-Room HDB resale flat for $344,381 and has a monthly household income of $5,000. If you are a first-timer buyer, you will be entitled to the following housing grants:

- 80,000 Family Housing Grant

- $45,000 Enhanced Housing Grant (EHG)

- $30,000 Proximity Grant (living with parents) or $20,000 (living within 4km of parents)

Let’s also assume that you will be living with your parents. Hence, the total housing grant you will receive is $155,000. Therefore, buying a HDB flat should be a priority to kick-start your property investment by taking advantage of the government's rather generous housing grants.

Based on the above scenario, this is what we have now:

- Purchase Price of a 3-Room HDB Resale Flat: $344,381

- Total Housing Grants received: $155,000

- Purchase Price of a 3-Room HDB Resale Flat after grants: $189,381

To work out the financial commitment and minimum loan repayment period for the purchase of the HDB resale flat, let us assume the following:

- Buyer’s Age: Below 35 years

- Monthly Household Income: $5,000

- Employee CPF Contribution: $1,000 (20% x $5,000)

- Employee Take Home Pay: $4,000 ($5,000 - $1,000)

- Negligible CPF savings available

From the above information, we can work out the shortest housing loan repayment period and monthly installment based on the following:

- HDB Concessionary Loan Rate: 3.00%

- Mortgage Servicing Ratio (MSR): $1,500 (30% of $5,000) - see below for an explanation

- Total Employee + Employer CPF Contributions in Ordinary Account: $1,150 (23% of $5,000)

- Total Monthly Loan Repayment: $2,650 ($1,500 MSR + $1,150 CPF)

- Shortest Loan Period: 6.6 years (79 months)

The shortest loan repayment period of 10.1 years is derived by taking into account the maximum allowable under the Mortgage Servicing Ratio (MSR) plus your monthly CPF Ordinary Account (OA) contributions.

The MSR is currently set at 30% of your monthly household income, meaning a maximum of 30% of your household income can only be used to repay your housing loan. This works out to be $1,500 (30% x $5,000).

As for your monthly CPF contributions (Employee + Employer) in your OA, it is currently at 23% if you are below 35 years of age (see table below). Hence, the total CPF OA contributions that can be used for your housing loan is $1,150.

Therefore, you will have a maximum of $2,650 ($1,500 + $1,150) for your monthly loan instalment, which will enable you to pay off your housing loan in 6.6 years (79 months).

Of course, you can pre-pay your loan early if you receive an unexpected windfall during the course of your loan repayment period (Note: For HDB loan, there is no pre-payment penalty. But for a bank loan, you can expect to pay a penalty of about 1.5% of the undisbursed loan amount). You may wish to find out what are the factors to look out for when choosing a home loan.

The above is just one example of the affordability of buying your first HDB resale flat. Of course, this is just one of many permutations depending on the property price, your level of income, personal savings and available CPF funds, as well as parental financial support (if any).

Another factor you need to consider is whether the balance of your $2,500 monthly disposable income (after deducting your personal monthly CPF contributions (20%) and loan instalment) is sufficient for your living and lifestyle expenses. These will include recurring costs such as property tax, conservancy charges, utilities and perhaps, your holiday expenses.

DISCLAIMER: The above is just a simple illustration. Besides the housing loan, there are many other cost considerations. These include stamp duties, conveyancing fees, property agent commission and renovation costs. Hence, it is advisable to consult a licensed property agent to help you assess your affordability and provide the necessary information for your property investment.

Options After Repaying Housing Loan

After you have repaid your housing loan, you may consider the following property investment options:

- Sell your HDB flat and upgrade to a private property or executive condominium (EC).

- Buy a new launch or resale private property.

- Rent out your HDB flat to finance your new private property (more on this below).

An experienced property consultant will be able to advise you on these options and more, which include the following:

- Properties with good capital appreciation potential

- Property rental yields

- Property hotspots and upcoming developments

- Exit strategy to maximise your investment returns

For an in-depth analysis of property investment in Singapore, please check out the 7 key factors in Singapore property investment

Finance New Property with HDB Rental Income

If you have completed your 5-year MOP and intend to invest in a private property, you need to work out your finances carefully.

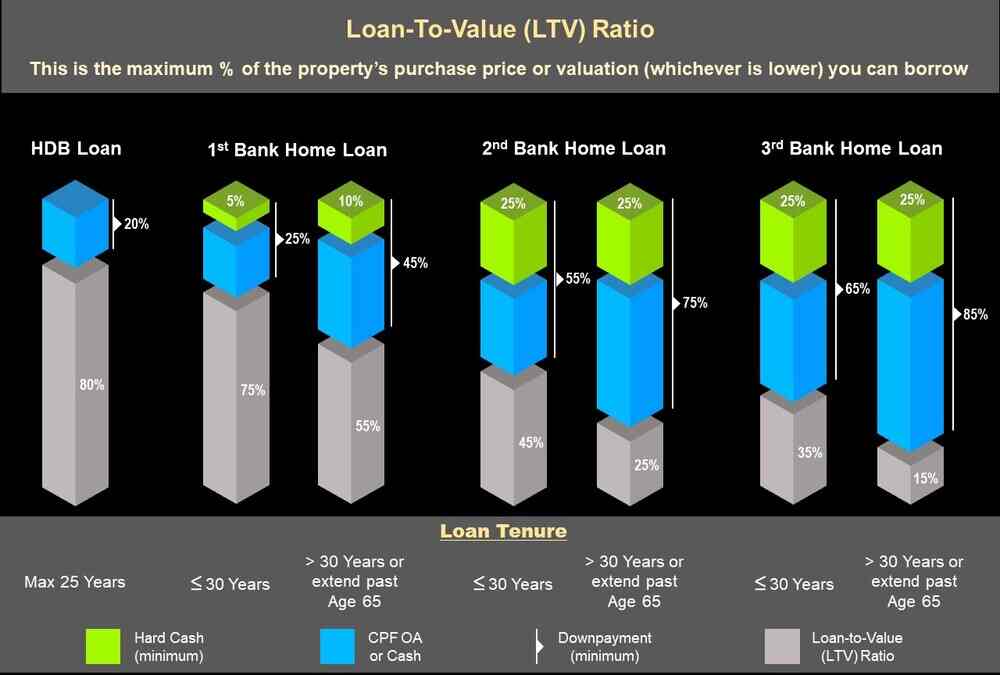

If you buy a private property while still servicing your HDB loan, you can only get a Loan-To-Value (LTV) of 45% instead of 75% for a loan tenure up to 30 years or age 65, whichever comes first (see illustration below).

In other words, banks will only grant you 45% of the purchase price or value of your property, whichever is lower. For the remaining 55%, 25% must be in cash downpayment and 30% in a combination of cash and CPF Ordinary Account (OA) monies.

Since you are still servicing your HDB flat, the purchase of the private property will be considered your second property. Hence, Additional Buyer’s Stamp Duties (ABSD) applies. For most, this will greatly impact their affordability. Hence, you should strive to pay off your existing HDB loan in the shortest time possible so that you can secure a higher loan amount to finance your private property. A shorter loan tenure will also help to reduce your interest expense.

If you are able to pay off your first housing loan, then you can get up to 75% bank financing instead of 45%. This will help you to avoid the huge capital/cash outlay for your second property.

The following example shows what your capital/cash outlay is if you buy a private property for $1 million dollars (second property) BEFORE paying off your first housing loan:

- Property Price: $1 million dollars

- BSD: $24,600

- ABSD: $200,000 (see calculation below)

- Total Cost: $1,224,600

- Bank Loan: $450,00 (LTV of 45% x 1 million dollars)

- Total Cash + CPF OA Monies required: $774,600 (include Minimum Cash Downpayment of 25% of 1 million dollars = $250,000)

The following example shows what your capital/cash outlay is if you buy a private property for $1 million dollars (second property) AFTER paying off your first housing loan:

BSD: $24,600

- ABSD: $200,000 (see calculation below)

- Total Cost: $1,224,600

- Bank Loan: $750,00 (LTV of 75% x 1 million dollars)

- Total Cash + CPF OA Monies required: $474,600 (include Minimum Cash Downpayment of 5% of 1 million dollars = $50,000)

As can be seen, the overall upfront cost for investing in a second property costing 1 million dollars while still servicing your first housing loan is $694,600. This compares to the upfront cost of $394,600 if your first loan has been fully paid - a difference of $300,000.

Moreover, you will be servicing two housing loans at the same time, which could stress your financial position.

Additional Buyer’s Stamp Duty (ABSD) & Buyer’s Stamp Duty (BSD)

If you are investing in a second property, Additional Buyer’s Stamp Duties (ABSD) of 20% will be imposed. This works out to be $200,000. On top of this, there is also the Buyer’s Stamp Duty (BSD). For a 1 million dollar property, the BSD works out to be $24,600. Hence, the ABSD plus BSD amounts to $224,600 ($200,000 + $24,600). The ABSD and BSD are calculated based on the rates indicated in the tables below:

| Additional Buyer's Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

| Buyer's Stamp Duty (BSD) | ||

| Higher of Purchase Price or Market Value of the Property | Rates on or before 14 February 2023 | Rates on or after 15 February 2023 |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6% | |

These stamp duties must be paid within 14 days of the Option to Purchase (OTP) or Sale and Purchase Agreement being signed. They must be paid in full and not in instalments. You can also pay using your CPF, but you must fork out the cash first and then seek reimbursement from CPF later.

After taking into your account the BSD and ABSD, this will push up your total property investment cost to $1,224,600, out of which your bank loan only covers you for $450,000 if you are taking a second mortgage. The balance of $774,600 must be in cash and CPF OA monies.

For more information about stamp duties, please refer to "How To Calculate Singapore Property Stamp Duties BSD, ABSD And SSD?".

How HDB Applicants Can Avoid Paying ABSD

If you wish to avoid paying ABSD when investing in a private property while retaining your HDB flat, one way is to have one of the applicants registered as an "Essential Occupier".

However, the financing can only be borne by the purchaser or registered owner. This means that he/she must have sufficient means to purchase and finance the HDB flat alone.

The essential occupier's CPF funds cannot be used to fund the purchase of the HDB flat and this includes paying the initial downpayment and monthly mortgages (if any).

Doing so will free up the essential occupier's name. When their HDB flat has cleared its 5-year MOP, the essential occupier can purchase a private property without incurring ABSD. However, they must ensure they have sufficient means to finance both properties.

To explore your property investment options, please WhatsApp me.

Restriction on the Use of CPF Funds

On 9 May 2019, the Ministry of National Development (MND) and the Ministry of Manpower (MOM) jointly announced a change in rules on CPF usage and housing loan.

Under the new rules, how much CPF monies can be used for a property purchase will depend on the extent its remaining lease can cover the youngest buyer to the age of 95. It was also announced that CPF savings and HDB loans will not be granted to fund the purchase of HDB flats, Executive Condominiums (EC) and private residential properties with remaining leases of 20 years or less.

If the remaining lease of property at the point of purchase is at least 20 years and can cover the youngest buyer until at least the age of 95, CPF usage will be allowed to pay for the property up to the Valuation Limit (VL). If not, they will be pro-rated. You can find out more about this in "Change In CPF Usage And Housing Loan Rules".

In addition, for investment in a second property, there are further restrictions on the use of your CPF funds. You are required to set aside the minimum Basic Retirement Sum (BRS) before you can use any excess monies in your CPF Ordinary Account (OA). The amount to be set aside for the BRS is shown below:

Total Debt Servicing Ratio (TDSR)

Another restriction you may face is the Total Debt Servicing Ratio (TDSR). It has been put in place by the Monetary Authority of Singapore (MAS) to prevent over-leveraging of your finances. All financial institutions (FIs) such as banks will need to apply TDSR when disbursing housing loans. TDSR sets the limit of your income that can go into servicing all outstanding loans, which currently stands at 55%.

How Does TDSR Work?

TDSR takes into account all your loan obligations (eg. housing loans, study loans, credit card debts, car loans, personal loans, etc). What this means is that your total loan repayments cannot exceed 55% of your income, limiting the amount of debt you can take on. The policy is to ensure financial prudence.

To illustrate, if your monthly income is $1,000, your TDSR (55%) will be $550. This means your total loan repayments (housing, car, credit card, etc) cannot exceed $550 per month.

For those whose income is commission based, such as salespersons, insurance agents, etc, the income will be subjected to a 30% haircut. For example, if your monthly income is $1,000, only $700 will be considered for the calculation of TDSR.

With all the restrictions in place, it is not easy to afford a second property, especially for young couples still building up their careers. The amount of cash and CPF required to buy your second property is quite significant, making it pretty unaffordable for most.

So, what are your options if you wish to invest in private residential properties? What are the strategies to grow your property investment? Let us share with you our knowledge and experience, as well as help evaluate your financial position to determine the best course of action. Feel free to contact us for an obligation-free consultation.

Meanwhile, for those who can afford to invest in a second property and use their HDB flats to generate rental income, below are some useful information to take note of.

Investing In HDB Flats - Rental Yields

If you decide to retain your HDB flat, rent it out and use the proceeds to finance your private property, let's examine how this can be best achieved.

The following table provides a sample of median gross rental yields for 3, 4 and 5-room flats at the four corners of Singapore.

As can be seen, the smaller the flat, the higher the gross rental yield. Please take note that your net rental yield will be slightly lower after taking into consideration expenses such as property taxes, maintenance costs, conservancy charges, household repairs, etc.

Nevertheless, they are still attractive compared to private residential properties, which command rental yields of only 2-3%. This is another reason that makes HDB flats a good investment.

Hence, for those who are looking to rent out their HDB flats to finance their second property, but face financial constraints, buying a smaller HDB flat may be the best option. Besides getting a higher rental yield, more funds can also be set aside to invest in your second property.

Moreover, as shown in our example above, paying off your first mortgage will help you get a higher amount of bank financing, which will lower your capital/cash outlay in the process. This will go towards some way to cushion the ABSD being incurred. To help you with property financing or investment matters, please feel free to Contact Us for an obligation-free consultation.

Depreciating Values of Ageing HDB Flats

Recently, there have been concerns about the steep depreciation in the values of ageing HDB flats once their leases cross the 40-year mark. But the issue has somewhat been allayed by Prime Minister Lee Hsien Loong’s 2018 National Rally Speech. PM Lee said when HDB flats reach 70 years old, owners can vote to let the government buy back their flats early. He calls this the Voluntary Early Redevelopment Scheme (VERS). This is quite similar to the Selective En-bloc Redevelopment Scheme (SERS).

PM Lee also said the Housing Board will carry out a second Home Improvement Scheme (HIP), which is heavily subsidized when flats reach 60 to 70 years old. The first HIP takes place around the 30-year mark. These schemes will help to alleviate property decay, rejuvenate the community and uphold property values.

Also, since 9 May 2019, the government has announced changes in the use of CPF funds that could lift demand for older HDB flats. For HDB flats with a remaining lease of at least 20 years and can cover the youngest buyer till age 95, CPF funds can be used to pay for the property up to the Valuation Limit (VL).

Nevertheless, the fear of capital depreciation cannot be totally ignored. This is especially so when the Ministry of National Development (MND) has not released any details on VERS yet. In addition, when HDB flats get older (or leases get shorter), the rate of depreciation will quicken due to wear and tear.

The Bala Curve

Without getting into the technical details, the Bala Curve seeks to compare values across different tenure and land valuations. It also computes the differential premium for change of use or increase in intensity, and land premium for upgrading of lease tenure. In short, it seeks to determine the value of properties according to the length of its (remaining) leases. The Bala Curve is also known as the SLA Leasehold Table, meaning the government uses it to assess land values.

Without getting into the technical details, the Bala Curve seeks to compare values across different tenure and land valuations. It also computes the differential premium for change of use or increase in intensity, and land premium for upgrading of lease tenure. In short, it seeks to determine the value of properties according to the length of its (remaining) leases. The Bala Curve is also known as the SLA Leasehold Table, meaning the government uses it to assess land values.

There are a few key characteristics of the Bala Curve to take note of, which will help us make important decisions about our property investment. Looking at the curve, there are three key intervals: 60-year, 30-year and 15-year mark. These intervals are important because of their different rate of decline in values.

For example, between 99-year and 60-year, the fall in the value of your property is 0.1-0.4 basis point (bp) for each year of the lease. Between 60-year and 30-year, the decline in value is 0.5-1.0 bp; from 30-year to 15, the decline accelerated to 1.0-1.8 bp; and once it hit the 15-year mark, the decline accelerated even further to 1.8-3.8 bp. Simply put, the older the property gets, the more rapid the decline in its value.

Hence, in order to encash your property's capital appreciation, or to limit the depreciation of your property investment, you should do it before the 60-year lease mark. As the Bala Curve is used by the government to assess land value, should we be concerned about lease decay?

Investing In HDB Flats - Still Viable?

However, don't get us wrong. Investing in HDB flats can still be a viable option. But to mitigate such risks, every property investment needs an Exit Strategy to maximise and preserve its value. To illustrate, take a look at the chart below.

As can be seen, property prices for both private properties and HDB flats fell on the back of a slew of property cooling measures in 2013 after rising sharply for about 8 years. These include the tightening of bank loans, limitation on the use of CPF funds and imposition of ABSD, among many others. However, when the property market began to recover in 2017, home prices between private properties and HDB flats diverge.

The big question is WHY?

There are two major reasons. The first is due to concerns over the depreciating values of HDB flats as their leases get shorter, which we have highlighted above. MND Minister Lawrence Wong has also said that most HDB flat leases will be run down and the land will return to the government eventually. In other words, don't put too much hope on VERS.

Secondly, the HDB has been ramping up the supply of BTO flats, especially from 2010 onward (see table below).

| Year | Approximate Number of BTO Flats Offered |

| 2001 - 2005 | 12,500 |

| 2006 | 2,400 |

| 2007 | 5,500 |

| 2008 | 7,800 |

| 2009 | 9,100 |

| 2010 | 16,000 |

| 2011 | 25,300 |

| 2012 | 27,100 |

| 2013 | 25,200 |

| 2014 | 22,500 |

| 2015 | 15,100 |

| 2016 | 17,900 |

| 2017 | 17,000 |

| 2018 | 15,800 |

| 2019 | 15,000 |

So, it is not hard to imagine what will happen when these HDB flats reach their Minimum Occupation Period (MOP). Given the deluge of supply, it will put a cap on the prices of HDB flats. Basically, this is in line with the government's effort "to provide quality and affordable public housing for generations of Singaporeans", adding "we are proud to continue doing so". We are not saying the prices of HDB flats will not rise. But, it is difficult to see them outperforming private properties.

In addition, the Mortgage Servicing Ratio (MSR) at 30% will limit the amount of our household income that can be used to finance the purchase of HDB flats. Whereas for private properties, it is not subjected to MSR, but the Total Debt Servicing Ratio (TDSR) allows a higher percentage of your income (55%) to finance your property loan.

Should you require more information on property investment, please feel free to email, phone or WhatsApp us. If you are looking for investment in private properties, below are some new launches with different attributes and characteristics. For foreigners, please take note of the restrictions highlighted in the article "Singapore Property Rules for Foreigners". Foreigners are also not allowed to buy new ECs.

Other Resources

- The Greater Southern Waterfront – A Property Market Outlook

- Jurong Lake District

- Woodlands Regional Centre

- One North

- Novena Master Plan – Health City Novena to Spur Transformation

- Mega Developments In The East Region

- Development of Tampines North

- Tampines Nature Parks An Appeal to Property Buyers

- Tampines Regional Centre – A Vibrant Shopping Haven

Reviews of New Property Launches

For reviews of new property launches, please click on the links below. More project information can also be found here.