While some individuals may choose to handle transactions independently to avoid paying property agent commission, doing so can lead to potential pitfalls, such as overlooking critical legal or financial details, misjudging market conditions, or encountering delays due to administrative mishandling. Singapore’s real estate market is […]

Continue readingCategory Archives: Understanding Property Finance and Costs in Singapore: A Complete Guide

Buying a property is one of the most significant financial commitments most people will ever make. Whether you are a first-time buyer or an experienced investor, having a solid grasp of property finance and costs – and understanding the full cost of property ownership well beyond the asking price – is essential to making a sound and sustainable decision.

This guide breaks down the key financial considerations involved in purchasing a property in Singapore, with a focus on affordability, prudence, and long-term financial stability.

Why Affordability Should Come First

Before you fall in love with a property, you need to be honest about what you can genuinely afford. Affordability is not just about whether you can secure a loan – it is about whether you can comfortably manage all the costs that come with ownership over the long term without putting your financial health at risk.

A prudent approach to property investment starts with asking:

- What is my current monthly income and how stable is it?

- How much do I have in savings and liquid assets?

- Do I have an emergency fund that covers at least six months of expenses?

- What are my existing financial obligations, such as car loans or credit card debt?

- Am I buying within my means, or stretching my finances to the limit?

Being stretched thin on a property purchase can lead to financial stress and, in the worst cases, forced sales at a loss, if you are hit by a financial strain. The goal is to invest wisely, not just invest.

Beyond the Asking Price: Upfront Costs You Must Budget For

Many buyers focus solely on the property’s listed price and may be caught off guard by the significant upfront expenses required before they even receive the keys. Here is a clear breakdown of what to expect:

Down Payment

- For a bank loan, you are required to pay at least 25% of the purchase price as a down payment.

- Of this 25%, a minimum of 5% must be paid in cash – the remainder can come from your CPF Ordinary Account.

- This means for a S$1 million property, you need at least S$50,000 in cash and S$200,000 in total for the down payment.

Stamp Duties

- Buyer’s Stamp Duty (BSD) applies to all property purchases and is calculated on a tiered scale based on the purchase price.

- Additional Buyer’s Stamp Duty (ABSD) applies if you are buying a second or subsequent property, or if you are a foreign buyer. These rates can be substantial and significantly affect your total outlay.

- It is critical to calculate stamp duties accurately before committing to a purchase.

Legal and Conveyancing Fees

- You are required to engage a lawyer to handle the legal documentation and fund transfers.

- Legal fees typically range from a few thousand dollars depending on the property type and complexity of the transaction.

Other Upfront Costs to Consider

- Valuation fees (required by some banks before approving a loan)

- Property agent commission, if applicable

- Renovation costs, especially for resale properties

- Fire insurance and mortgage-reducing insurance premiums

Failing to account for these costs upfront can put you in a tight financial position right from the start.

Ongoing Costs of Property Ownership

Owning a property involves recurring financial commitments that extend well beyond the initial purchase. These must be factored into your long-term budget.

Monthly Mortgage Repayments

- Your monthly loan instalment will likely be your largest recurring cost.

- The amount depends on your loan quantum, interest rate, and loan tenure.

- Interest rates fluctuate, particularly for bank loans pegged to market benchmarks. You should stress-test your budget against potential interest rate increases.

Property Tax

- Property tax is payable annually to the Inland Revenue Authority of Singapore (IRAS).

- It is calculated based on the Annual Value (AV) of your property – an estimate of the annual rental income the property could generate.

- Owner-occupied residential properties enjoy lower tax rates, but investors renting out their units pay higher rates.

Maintenance and Service Fees

- HDB flat owners pay monthly Service and Conservancy Charges (S&CC).

- Private condominium owners pay monthly maintenance fees, which can range from a few hundred to over a thousand dollars per month depending on the development and its facilities.

- These fees cover the upkeep of common areas and building infrastructure.

Sinking Fund Contributions

- Condo owners also contribute to a sinking fund for major repairs and long-term maintenance of the development.

Utilities and Insurance

- Monthly utility bills and home insurance are additional recurring costs that should be factored into your budget.

Having a realistic picture of all recurring costs helps you avoid overcommitting financially.

Understanding Loan Limits and Borrowing Prudently

Singapore has clear regulations that govern how much you can borrow, and these exist for good reason – to protect buyers from taking on more debt than they can handle.

Total Debt Servicing Ratio (TDSR)

- The TDSR framework limits your total monthly debt repayments (including the new mortgage) to no more than 55% of your gross monthly income.

- This applies to all property loans from financial institutions.

- If your TDSR exceeds this threshold, your loan application will not be approved.

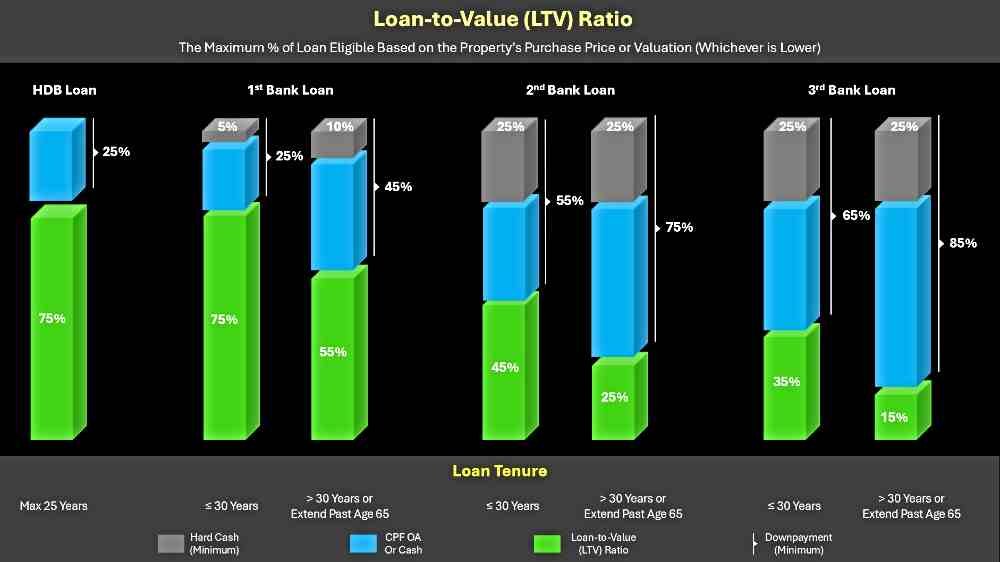

Loan-to-Value (LTV) Ratio

- For a first home loan from a bank, you can borrow up to 75% of the property’s purchase price or value, whichever is lower. This applies to both HDB and bank loans.

- If you have an existing property loan, the LTV limit drops, meaning you need a larger cash outlay for subsequent purchases.

HDB Loan vs Bank Loan

- If you are purchasing an HDB flat, you may be eligible for an HDB concessionary loan, which currently offers a fixed interest rate of 2.6% pa, which is currently higher than a bank loan.

- Bank loans offer more flexibility in some areas but carry variable interest rate risk for those taking a floating-rate loan.

- Comparing both options carefully is important before making a decision.

Key Borrowing Principles to Follow

- Borrow only what you need, not the maximum you are entitled to, providing you a buffer against instances of income loss, interest rate hikes, or unexpected expenses.

- Opt for a loan tenure that balances manageable monthly repayments with minimising total interest paid.

- Avoid using 100% of your CPF for property, if possible. Retaining savings in your CPF account could help to protect your retirement adequacy.

Smart Financing Decisions That Protect Your Financial Health

Making the right financing choices at the outset can save you tens of thousands of dollars over the life of your loan and significantly reduce financial stress.

Shopping for the Best Home Loan

- Interest rates vary across banks, so it pays to compare packages carefully.

- Look beyond the headline rate – check for lock-in periods, penalty clauses, and repricing options.

- Consider engaging a mortgage broker to access a wider range of loan options.

Fixed vs Floating Interest Rates

- Fixed rate packages offer payment certainty for an initial period, which is useful for budgeting.

- Floating rate packages may start lower but can rise with market conditions.

- Your choice should reflect your risk tolerance and financial buffer.

Building and Maintaining a Cash Reserve

- Do not deploy all your savings into a property purchase.

- A healthy cash reserve of at least six months of household expenses provides a safety net against job loss, medical emergencies, or unexpected property expenses.

- Financial stability is built over time – it should not be sacrificed in the pursuit of property ownership.

Key Principles for Prudent Property Investment

Whether you are buying for owner-occupation or investment, the following principles should guide your decision-making:

- Buy within your means: Stretching your finances for a more expensive property rarely pays off if it compromises your financial security.

- Think long-term: Property is a long-term asset. Short-term market fluctuations are normal – plan your finances for at least a 5 to 10-year horizon, especially in Singapore due to the imposition of the seller’s stamp duty.

- Diversify your financial portfolio. Avoid putting all your wealth into a single property. Maintaining other savings and investments provides balance.

- Understand the full cost of ownership before committing – not just the purchase price.

- Keep your TDSR healthy. Even if you qualify for the maximum loan, aim to keep your debt repayments well within comfortable limits.

- Do not time the market. Property investment decisions should be based on your financial readiness and personal circumstances, not speculation.

- Seek professional advice. Consult a qualified property agent and a financial advisor to ensure your purchase aligns with your overall financial plan and choosing a property with with promising growth potential using data-driven analytics.

Final Thoughts: Financial Stability Is the Foundation of Good Property Investment

Property investment in Singapore can be a rewarding way to build wealth over time, but it requires careful planning, realistic expectations, and disciplined financial management.

The excitement of finding the right property should never overshadow the fundamental need to invest prudently and within your financial capacity.

Understanding every cost involved – from stamp duties and legal fees to monthly loan repayments and maintenance charges – gives you a clear and honest picture of what you are committing to. That clarity is the foundation of a sound investment decision.

Take the time to educate yourself, undertake research, seek advice where needed, and always prioritise financial stability over the rush to get onto the property ladder.

Other Property Resources

Besides property finance and costs, you may also be interested in the following property guides:

- Property Investment Guides.

- Property Regulations.

- Private Property Guides.

- Executive Condo Guides.

- HDB Guides.

- Property Marketing.

- Property Hotspots.

For review of the latest property launches, please visit Sg Home Investment.

How to Choose a Home Loan in Singapore. Factors to Consider [Guide]

For most, buying a property in Singapore will entail getting a home loan. Unless of course, if you are wealthy or cash-rich. Foreigners who are interested in acquiring a property in Singapore can also apply for a housing loan in Singapore, subject to meeting certain […]

Continue readingThe Basics of Property Financing and Investment in Singapore

Property financing and investment in Singapore can be a complex process as it requires a wide spectrum of knowledge. These include the following: Property financing options and terms. Financial assessment and evaluation. Government grants, schemes, and taxes. Legal and regulatory frameworks. Market trend and risk […]

Continue readingUnderstanding Singapore Property Policies and Financing Options

Navigating Singapore’s private residential property market can present significant challenges. Equip yourself with essential information on Singapore property policies, financing alternatives, and in-depth market research to make informed decisions during your property investment journey. Singapore’s property market stands out as one of the most robust […]

Continue reading