Key Takeaways

- Major Transformation: The Greater Southern Waterfront (GSW) spans 2,000-ha, transforming Singapore’s southern coastline into a dynamic urban hub.

- Site Redevelopment: Key areas like Keppel Club and Pasir Panjang Power District will be redeveloped into new neighbourhoods with a mix of housing and lifestyle amenities.

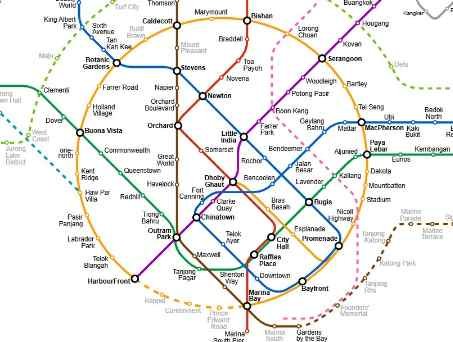

- Improved Connectivity: A 30km waterfront promenade and green corridors, as well as new MRT stations will enhance accessibility and community engagement.

- Sustainable Development: GSW incorporates climate resilience and coastal protection, setting a model for sustainable urban planning.

- Investment Opportunity: With residential and commercial developments, GSW property values are expected to rise, attracting investors.

- Phased Timeline: Development will span 2 to 3 decades, with the eventual relocation of Pasir Panjang Port Terminal relocated to Tuas by 2040.

- Why Is Singapore's Greater Southern Waterfront a Premier Property Hotspot?

-

What Housing Developments will be Built at the Former Keppel Club?

- Government Land Sale (GLS) & Private Housing Developments

- URA Master Plan for Marina South

- First Private Housing development at Former Keppel Club Site

- New Private Housing from En Bloc Redevelopment

- Launch of BTO Flats (Berlayer Residences) at Former Keppel Club Site

- High Demand for Telok Blangah Beacon BTO flats in May 2021

- What is the Timeline for the Relocation of Port Terminals?

- What are the Plans to Preserve Historical Sites in GSW?

- What are the Four New Parks and Green Corridors in the Greater Southern Waterfront?

- How will Sentosa and Pulau Brani be transformed into a “Game-Changing” Leisure & Tourism Destination?

- What are the Transportation Developments to Enhance Connectivity?

- The Greater Southern Waterfront Investment Opportunities and Market Outlook

-

Frequently Asked Questions (FAQs)

- What is the Greater Southern Waterfront (GSW)?

- How big is the Greater Southern Waterfront?

- How will the GSW become a property hotspot?

- What new housing developments are planned for the GSW?

- What is the Sentosa-Brani Master Plan?

- How will transportation connectivity be improved?

- What is the timeline for the port relocation?

- How is the GSW being developed sustainably?

- Review of New Property Launches

Looking for property investment opportunities in the Greater Southern Waterfront (GSW)? Below are the key details and latest developments to help you assess its viability and long-term potential.

The Singapore Greater Southern Waterfront is a major government undertaking to transform Singapore’s southern coast into a new major gateway and a coveted place to live, work, and play.

It will comprise 30km of coastline and 2,000 ha of land (six times the size of Marina Bay and twice the size of Punggol housing estate), stretching from the Gardens by the Bay East to Pasir Panjang and West Coast Park, stringing together the following areas:

- Gardens by the Bay East

- Cruise Hub & Coastal Park at Marina South/Straits View

- Keppel & Tanjong Pagar Terminals

- Mount Faber

- Harbourfront

- Pulau Brani

- Sentosa

- Keppel

- Labrador Park

- Pasir Panjang Power District

- Pasir Panjang Terminal

- West Coast Park

When the Greater Southern Waterfront (GSW) was first announced in 2013, it has generated great excitement and interest amongst real estate developers, property investors and homebuyers.

This is because the sale of land for new private residential and commercial developments in the Greater Southern Waterfront would impact the property prices of existing developments in the area in two ways:

- Refresh the area and make it a more attractive place to live, work, study and play, significantly raising its investment prospect.

- The sequential launch of projects for sale in the area would be at stepped-up prices, and this would help to lift prices of existing properties.

Why Is Singapore's Greater Southern Waterfront a Premier Property Hotspot?

The Greater Southern Waterfront represents more than just urban renewal; it is a visionary project to transform Singapore's southern coastline into a world-class residential, commercial, and lifestyle hub. This massive redevelopment is poised to become a premier property hotspot.

Here’s why:

Mega Waterfront Redevelopment: Singapore's Greater Southern Waterfront is a monumental 2,000-ha project, six times the size of Marina Bay. The plan will liberate 1,000-ha of prime land by relocating the city's port, creating an unprecedented opportunity for urban redevelopment and creating a vibrant waterfront live-work-play destination.

A Green and Sustainable Development: The Greater Southern Waterfront is a multi-decade project to transform Singapore's southern coastline into a sustainable, integrated urban ecosystem. The plan is to create a vibrant residential, commercial, and recreational hub that seamlessly integrates lush green spaces with urban amenities. The entire development will be well-connected by an efficient public transportation network, ensuring both convenience and environmental sustainability.

Creating a Dynamic Urban Core: The GSW’s "decentralised re-centralisation" vision aims to bring life back to Singapore's central region after work hours by integrating public and private homes. This will create a more vibrant and socially inclusive community, while ensuring it will not become a “ghost town” after office hours.

An Economic Driver: The development of the Greater Southern Waterfront will potentially extent Singapore’s Central Business District. This strategic project aims to create jobs, drive economic growth, and attract talent by offering a dynamic live-work-play environment.

A World-Class Lifestyle Destination: The rejuvenation of Sentosa and the transformation of Pulau Brani into a new lifestyle hub will collectively elevate the Greater Southern Waterfront into a world-class leisure and entertainment destination.

What Housing Developments will be Built at the Former Keppel Club?

When the vacated 44-ha Keppel Club site is fully redeveloped, it will offer about 10,000 private and public housing units, comprising 7,000 HDB BTO flats and 3,000 private residences.

These housing developments will feature waterfront promenades, open spaces, abundant greenery, and nature-inspired designs.

Residents can also expect to have views of the Southern Ridges and the coast.

Government Land Sale (GLS) & Private Housing Developments

In April and July 2025, two private housing developments in the Greater Southern Waterfront were launched – One Marina Gardens and W Residences Marina View. They are expected to kickstart more housing developments in the Marina South and Marina Bay areas.

The next new launch is likely to be Newport Residences at Anson Road, a redevelopment of the former Fuji-Xerox Building.

Besides these developments, there are more than 16 land plots in Marina South that could yield around 10,000 new homes in the coming years and decades.

URA Master Plan for Marina South

To enhance urban living, Marina South is being developed as a 45-ha mixed-use "10-minute neighbourhood."

This concept ensures residents will have convenient access to amenities and MRT stations. The plan will also integrate lush green spaces and sustainable design, promoting a healthy, environmentally conscious lifestyle.

These exciting plans will further enhance the appeal of the Greater Southern Waterfront for both home buyers and property investors.

First Private Housing development at Former Keppel Club Site

The URA has also launched a land tender for a site at Telok Blangah Road (part of the former Keppel Club) on 24 June 2025. The tender for the site will close on 4 November 2025.

The 4.7-ha land plot is projected to offer about 740 private residential units. It will be part of the plan to build 3.000 private homes in the precinct.

Located a 6-minute walk from Telok Blangah MRT station on the Circle Line and two bus stops from Vivo City, the project is expected to garner strong interest from both property investors and home buyers due to its excellent location, lush greenery, and beautiful views overlooking Keppel Bay.

New Private Housing from En Bloc Redevelopment

Besides government land sales, en bloc sales are another source of private housing supply. However, there were only a few successful transactions along the Greater Southern Waterfront.

In the past decade, the only developments that succeeded in en bloc sales are:

- The Hillshore (former Gloria Mansion, January 2022)

- Terra Hill (former Flynn Park, September 2021)

- Harbour View Gardens (retained the same name, February 2018)

- Kent Ridge Hill Residences (former Vista Park, December 2017)

- The Verandah (former Redwood West, July 2017)

Essential Conditions for a Successful En Bloc Sale

Housing developers will only consider en bloc sales to replenish their land banks if they meet certain factors that include the following:

- Realistic pricing that matches market conditions

- Redevelopment potential, such as higher plot ratios or intensification opportunities

- Prime location near MRT stations, transport links, and key amenities

- Attractive site attributes, including size, layout, and redevelopment feasibility

- Favourable market sentiment, like strong housing demand and supportive policies

Given the extremely arduous process to secure an en bloc sale, the majority of housing development sites are most likely to come from government land tenders.

Launch of BTO Flats (Berlayer Residences) at Former Keppel Club Site

The HDB will offer its first batch of BTO flats (Berlayer Residences) at the former Keppel Club site at the October 2025 launch. It will comprise 870 flats (2- to 4-room) plus 200 public rental flats in a single block. This is part of the plan to offer up to 7,000 HDB flats in the precinct.

Located just a stone’s throw from Telok Blangah MRT station and next to Berlayer Creek, the project will offer 2-room Flexi to 4-room flats, as well as public rental flats.

These Prime HDB flats will be between 19 and 46 storeys high, specifically designed with step-down heights towards the green spaces to maximise views.

These HDB blocks will be built at least 5.2 metres above mean sea level for protection against rising sea levels. Also, about 20% of the site area (≈10-ha) will be set aside for green spaces.

High Demand for Telok Blangah Beacon BTO flats in May 2021

Like the Telok Blangah Beacon BTO flats launched in May 2021 nearby, the Keppel BTO project is expected to attract a huge demand, if not more, due to its superior location.

When the Telok Blangah Beacon BTO flats were launched, despite it being one of the most expensive in HDB's sales exercise at that time, it attracted one of the highest application rates.

Only one in more than 28 first-time applicants managed to secure a unit. For second-time applicants, the ratio is even more dire, with more than 412 applications received for each available unit.

This robust demand signals a powerful underlying market sentiment that will drive future property values in the Greater Southern Waterfront.

What is the Timeline for the Relocation of Port Terminals?

The transformation of the Greater Southern Waterfront includes the relocation of the Tanjong Pagar, Keppel, and Pasir Panjang port terminals to the Tuas mega port, while Pulau Brani will be redeveloped into a tourist and lifestyle hub known as Downtown South.

Together, these ports will free up approximately 1,000-ha of land for redevelopment. They will transform Singapore's urban landscape, creating a vibrant live-work-play destination that will redefine the city for future generations.

The relocation of the port terminals will be carried out in phases, with the City Terminals (Tanjong Pagar, Keppel, and Brani) to be vacated by 2027 and the Pasir Panjang Terminal by 2040.

What are the Plans to Preserve Historical Sites in GSW?

The development of the Greater Southern Waterfront will include the preservation of some historical industrial sites, with the vision of creating a vibrant, cohesive, and sustainable new waterfront that will also commemorate Singapore’s heritage.

This may include incorporating the wharves, repurposing the Prima Flour Mill, and transforming the Pasir Panjang Power District into an entertainment and lifestyle destination.

Port Heritage Conservation

As part of the Greater Southern Waterfront development, the URA is evaluating the preservation of some port structures. The aim is to enhance the area's character by retaining structures with architectural, historical, and social significance.

These include the Prima Flour Mills, Singapore’s first flour mill, and some of the wharves, drawing inspiration from successful international examples such as Cape Town's Victoria and Alfred Waterfront.

Pasir Panjang Power District

The iconic red-brick Pasir Panjang Power Station, completed in 1952-1953, will be transformed into a lifestyle destination. These may include hotels, exhibition venues, and nature-focused developments featuring parks and water features.

However, the actual plans are still under evaluation.

Additionally, Singapore's largest underground electrical substation has been constructed at the former power district. Sitting atop it is Labrador Tower, a 34-storey commercial building completed by 2025.

What are the Four New Parks and Green Corridors in the Greater Southern Waterfront?

Four new parks will be created under the Labrador Nature Park Network, covering more than 200-ha to improve wildlife connectivity between Labrador Nature Reserve and surrounding green spaces. These include:

- Alexandra Nature Park: A 2-ha park featuring a 500m trail within a natural forest valley

- Berlayer Creek Nature Park: A 6.5-ha park that includes the existing Berlayer Creek and a 30m wide extension to act as a buffer for the creek's mangrove habitats

- Park at Keppel Club: A 7-ha park integrated with upcoming housing developments and will consist of four green corridors running around the perimeter and between future housing blocks

- Park at King's Dock: A 0.4-ha recreational area featuring a unique waterfront setting with a focus on biodiversity and community access

These four parks will form part of an extensive parks network in the southern region comprising:

- Alexandra Nature Park

- Berlayer Creek Nature Park

- Clementi Woods Park

- HortPark

- Kent Ridge Park

- Labrador Nature Park

- Mount Faber Park

- Park at Keppel Club

- Park at King’s Dock

- Pasir Panjang Linear Park

- Telok Blangah Hill Park

- West Coast Park

The Pasir Panjang Linear Park, slated for completion by 2028, will showcase maritime heritage through repurposed shipping containers, preserved port artefacts, and heritage galleries featuring community-contributed historical photographs.

The Rail Corridor & Nature Integration

The 24km Rail Corridor, a green lung, will link the future Woodlands North Coast and Greater Southern Waterfront. Besides providing safe, scenic routes for nature spotting, walking and cycling, which help to enhance health and well-being, it will also spur the development of the surrounding lands.

The former Tanjong Pagar Railway station, at the end point of the Greater Southern Waterfront, will be conserved. The plan is to redevelop it into a multi-functional community space, including Station Green park, which will be integrated with the Cantonment MRT station.

How will Sentosa and Pulau Brani be transformed into a “Game-Changing” Leisure & Tourism Destination?

The new Sentosa-Brani master plan will integrate the two islands to create a world-class leisure and tourist resort. The development will be spread over the next 20 to 30 years.

As part of this plan, Pulau Brani will be renamed Downtown South, transforming it into an entertainment and lifestyle destination with new attractions akin to Universal Studios.

The development will also focus on environmental sustainability, with plans to preserve natural habitats, restore wetland areas, and enhance marine life by conserving coastal coral reefs. Additionally, the island's waterfront will retain its port architecture to honour Singapore's maritime heritage.

Five Distinct Leisure & Lifestyle Zones

The redeveloped islands of Sentosa and Pulau Brani will feature five distinct zones:

- Vibrant Cluster: A festive and attraction zone, it will feature large attractions and an outdoor performance space

- Island Heart: At the centre of the entire development, it will have both indoor and outdoor attractions, with views of Mount Serapong

- Waterfront: The city-facing Waterfront, which will be located closest to the main Singapore island, will retain its port architecture to commemorate its port heritage

- Ridgeline: For nature lovers, it will offer nature and heritage attractions connecting Mount Faber, Pulau Brani, Mount Serapong and Mount Imbiah to Fort Siloso

- Beachfront: It will offer water-themed attractions for families

Proposal for People-Mover System Between Pulau Brani and Mainland Singapore

The Sentosa Development Corporation (SDC) is undertaking a high-level feasibility study to develop a new people-mover system that will connect Pulau Brani to mainland Singapore via the proposed Keppel Link bridge.

The study is part of the Greater Sentosa Master Plan (formerly known as Sentosa-Brani Master Plan) to transform Sentosa and Pulau Brani into a major tourist destination once the Brani Port Terminal relocates to Tuas megaport by 2027.

This is to complement existing infrastructure by enhancing accessibility and visitor experience through innovative transport solutions, providing tourists with a "wow" factor.

What are the Transportation Developments to Enhance Connectivity?

When the final stage of the Circle Line - the Circle Line Stage 6 (CCL6) - opens in the first half of 2026, it will complete the loop between the HarbourFront and Marina South Pier stations.

The completed line will enhance connectivity across Singapore, providing a more direct and efficient commute between key business and lifestyle hubs, including the upcoming mega Changi Airport Terminal 5.

The three new stations - Keppel, Cantonment, and Prince Edward Road - will also unlock new development opportunities in previously underserved areas, especially in the new Marina South precinct, which saw the launch of One Marina Gardens and W Residences Marina View in April and July 2025, respectively.

MRT Linkage Between Circle Line & Jurong Regional Line

MRT connectivity for the Greater Southern Waterfront will be further enhanced, with the Land Transport Authority (LTA) announcing plans for the West Coast Extension, which will extend the Jurong Region Line to connect to the Cross Island Line and the Circle Line in the late 2030s and 2040s respectively.

This multi-billion-dollar infrastructure investment will ensure residents enjoy seamless connectivity to Singapore's business districts and other key employment hubs such as Jurong Lake District and Greater One-North.

The Greater Southern Waterfront Investment Opportunities and Market Outlook

The redevelopment of the Greater Southern Waterfront (GSW) will create a significant investment opportunity, driven by key economic and urban planning initiatives.

The expansion of business infrastructure, driven by established hubs like Mapletree Business Centre, Alexandra Technopark, and the new Labrador Tower, will attract more multinational corporations to the area.

This diversification will extend Singapore’s economic base beyond the traditional Central Business District, stimulate job creation, and further underpin demand for residential properties in the surrounding regions.

Furthermore, the Sentosa-Brani Master Plan is designed to enhance tourism, lifestyle, and entertainment offerings, which would lend support to the hospitality and retail sectors. The resulting increase in economic activity could bolster residential property demand.

The phased nature of the GSW's development, combined with substantial infrastructure investment and its strategic coastal location, suggests a favourable environment for long-term property value appreciation. This offers a compelling case for investors seeking assets with potential for sustained long-term growth.

Frequently Asked Questions (FAQs)

What is the Greater Southern Waterfront (GSW)?

The GSW is a major government project to transform Singapore's southern coast into a new gateway for living, working, and recreation. It will encompass 30km of coastline and 2,000-ha of land, stretching from Gardens by the Bay East to Pasir Panjang and West Coast Park.

How big is the Greater Southern Waterfront?

The GSW is a 2,000-ha project, which is six times the size of Marina Bay. It is also twice the size of the Punggol housing estate.

How will the GSW become a property hotspot?

The GSW is a monumental redevelopment that will free up 1,000-ha of prime land by relocating the city's port. It is envisioned as a premier property hotspot due to its massive scale, sustainable development plans, and its aim to create a dynamic urban core and a world-class lifestyle destination.

What new housing developments are planned for the GSW?

The 44-ha former Keppel Club site will be redeveloped to offer about 9,000 new housing units, consisting of 6,000 HDB flats and 3,000 private residences. Additionally, more than 16 land plots in Marina South could yield around 10,000 new homes.

What is the Sentosa-Brani Master Plan?

The Sentosa-Brani Master Plan aims to integrate the two islands, Sentosa and Pulau Brani, into a single world-class leisure and tourist resort. Pulau Brani will be transformed into an entertainment and lifestyle hub with new attractions.

How will transportation connectivity be improved?

The final stage of the Circle Line (CCL6) to complete the loop will be completed in the first half of 2026, enhancing connectivity between key business and lifestyle hubs. There are also plans to connect the West Coast station on the Jurong Regional Line with the Cross Island Line and Circle Line by the late 2030s and 2040s, respectively.

What is the timeline for the port relocation?

The City Terminals (Tanjong Pagar, Keppel, and Brani) will be vacated by 2027, and the Pasir Panjang Terminal will be vacated by 2040. This relocation will free up approximately 1,000-ha of land for redevelopment.

How is the GSW being developed sustainably?

The GSW is a multi-decade project to create a sustainable, integrated urban ecosystem. The plan includes integrating lush green spaces, creating a well-connected public transportation network, and preserving natural habitats. It will also feature four new parks under the Labrador Nature Park Network.

Besides the Greater Southern Waterfront, the other property hotspots in Singapore include the following:

- Jurong Lake District

- One-North

- Woodlands Regional Centre

- Novena

- Tampines Regional Centre

- Tampines North

- East Region

- Bayshore & Long Island

Review of New Property Launches

For review of new property launches, please click on the links below. More project information can also be found here.

- Property Launches in Core Central Region (CCR)

- Property Launches in Rest of Central Region (RCR)

- Property Launches in Outside Central Region (OCR)