- Fix an Appointment with the Official Property Agency

- Visit New Launch Private Property Showflats

- View the Different Unit Types

- Check Out the Actual Location

- Submit Letter of Authorisation (LOA)

- Property Booking Day

- What Does the Property Details Information (PDI) Contain?

- Post-Launch Properties

- Secure a Bank Loan and Hire a Conveyancing Lawyer

- Total Debt Servicing Ratio (TDSR)

- Signing The Sales and Purchase Agreement (S&P)

- Payment Property Stamp Duties

- New Launch Private Property - Property Progressive Payments

- Collect the Keys and Move In

- An Investment Perspective - New Launch Versus Resale Condo

- Are All New Property Launches Under Construction Good Investments?

- A Quick Checklist for Purchasing a New Launch

- Frequently Asked Questions (FAQs)

- Reviews of New Property Launches

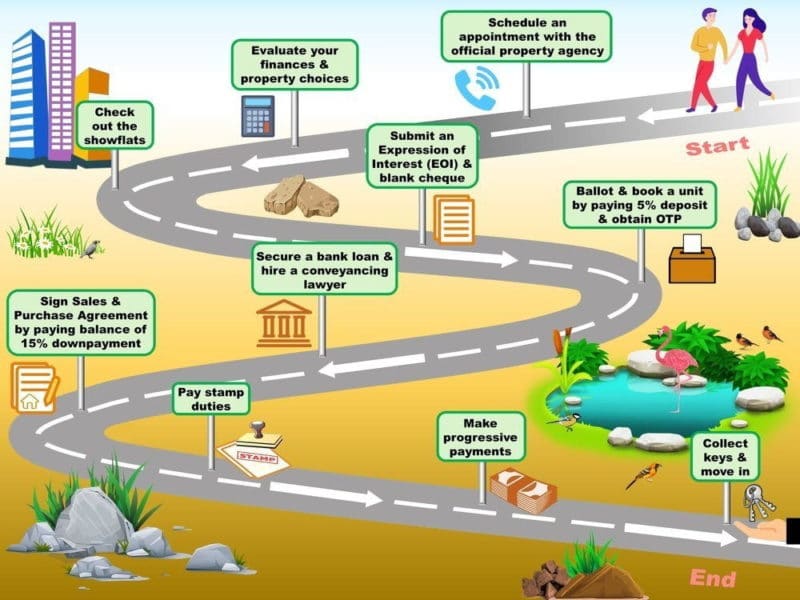

To buy a new launch private property (also as known as BUC – Building Under Construction) from a real estate developer in Singapore, it involves navigating a structured process that include researching new launches, shortlisting suitable projects, arranging show flat viewings, and securing financing and legal completion.

When shortlisting your preferred project, it is also important assess the reputation of its developer. Next, visit show flats to view unit layouts and understand the development’s features. Upon deciding to purchase a unit, a 5% booking deposit is required, followed by signing the Sales and Purchase Agreement (S&PA) within 2 weeks of obtaining the Option-to-Purchase (OTP).

Engaging a conveyancing lawyer and securing a mortgage loan are crucial steps to address the legal and financial aspects of the purchase, including managing progressive payments tied to construction milestones. Once the development is completed, buyers can take possession of their new property.

Understanding each stage, from due diligence to legal procedures, is essential for a smooth transaction.

Meanwhile, understanding Singapore’s property market is critical in finding a property with good investment potential. Some important factors to consider include the following:

- Location and future development plans.

- Lifestyle needs.

- Budget.

- Investment Potential.

One of the most efficient ways to find suitable new property launches is to seek advice from a property agency appointed by developers. As it has all the latest necessary information, this will save you lots of time researching different properties yourself. (Note: For new property launches, you don’t have to pay any commission. So, why not take advantage of the free service!).

Fix an Appointment with the Official Property Agency

Fix an appointment with the appointed property agency and provide him with some basic information about your property preferences and budget. The representative of the property agency will then prepare the necessary materials for your consideration.

Besides drawing up a list of recommended properties that matches your requirements, he can also help to evaluate your finances and affordability, including the use of CPF savings for your property purchase. This is one of the most important steps in property investment to prevent over-stretching your finances.

In addition, the property representative can guide you through the entire buying process, including advising you on bank loans and recommending conveyancing lawyers.

If you are a foreigner, your property agent can also advise on the types of property you are eligible to purchase.

Visit New Launch Private Property Showflats

Next, set aside time to visit the showflats of new property that you have shortlisted together with your real estate representative. Typically, showflats will open for preview about 2 weeks before the official launch day. At this point, the developers will only provide “indicative prices” for the different unit types. These prices are usually not far off the mark and sometimes developers may provide early-bird discounts. Check with your property representative for the latest updates, including how well the development is being received.

View the Different Unit Types

View the different unit types and evaluate their sizes and layouts. There may be units of the same size but with different layouts. Some of the things to look out for are the relative size of the living room, dining room, bedroom, kitchen and balcony, as well as any odd configuration. For those who often cook at home, then a bigger and enclosed kitchen may be preferable. Also check out the quality of the fittings and household appliances that come with the property, such as cooking stove, fridge, washing machine, dryer, sanitary ware, etc.

Check Out the Actual Location

Very often, the showflats are not located at the actual site of the property. It’s important to check out the actual location to survey the surroundings. Some of the things to take particular note of include:

- Surrounding – Is the property located in a tranquil area with lots of greenery or is it near a busy road like an expressway?

- Facing – Is it facing the morning/afternoon sun or unsightly buildings? Is it windy and airy?

- View – Do you have a clear view in front of your property, or will there be potential new developments that may obstruct your view in the future.

- Essential amenities – Are there eateries, supermarkets, shopping centres and schools around the area?

- Transportation and accessibility – Is the area well-served by public transportation like MRT, or will there be any improvements in the future?

Besides the above, you may also wish to check out what are the future developments in the surrounding areas, such as shopping centres, parks, hospitals, new employment hubs, etc. These are important factors to determine the investment potential of the property.

Submit Letter of Authorisation (LOA)

Once you have decided on your property and is keen to proceed with the purchase, you can submit a Letter of Authorisation (LOA). This will be handed together with a blank cheque issued to the developer’s project account (Important Note: Never issue the blank cheque in anyone’s name, except the name of the developer’s project account).

The purpose of the LOA is to allow interested buyers to participate in the balloting for a unit in the development.

However, at this point, only an “indicative price” range of the different unit sizes is given. Your property representative will be able to advise you on the entire booking process. Before the day of balloting, there will be one or two days set aside for the developers to check through all the applications from all the joint marketing agencies (JMA) to ensure everything is in order. Dates will then be set aside for priority booking, which may include employees of the developer and those on bulk purchase.

This will be followed by balloting for the public to determine their queue number to select their units. The earlier your queue number, the better chance of snaring your choice unit.

Before the booking day, your property agent should have briefed you on the entire booking procedure. Your property agent will also be present on the booking day to guide you through the entire process. It is advisable to shortlist a few units in the event your choices are taken by those ahead of you in the queue. If you are unable to get your choice unit and decide to pull out of the purchase, the cheque will be returned to you in full without penalty.

Property Booking Day

On the property booking day, balloting will take place. Once you have received your ballot number, you will proceed to the sales reception area to select your unit. There will be an elevation chart displaying the available units. At this point, you should have pre-identified some of your choice units.

If they are still available, you can ask the sales coordinator or representative for their prices. If you are undecided, you will be moved to the “thinking box” nearby while you contemplate your selection. Meanwhile, those behind you in the queue will move up and proceed with their selection.

If you have come to a decision, you will rejoin the queue to book your unit (provided it has not been booked). However, if the remaining units are not to your liking, you can withdraw from the selection process. The cheque and all the forms submitted earlier will be returned to you and you will not incur any penalty.

If your selection is confirmed and marked sold, the developer will proceed to prepare a set of PDI forms, which comprise documents related to the project and the unit you purchase. Review them and ask questions if you have any. If all is in order, put your initials and signature on all pages and return them to the developer.

After which, the developer will generate the Option to Purchase (OTP) and issue it to you. After this point, if you decide to abort the purchase, 25% of the booking fee will be forfeited. The booking fee itself is usually 5% of the total purchase price of the condo unit. Therefore, the forfeiture amount would be 1.25% of the total purchase price.

What Does the Property Details Information (PDI) Contain?

Once you have booked your unit, you will have to pay 5% of the purchase price with the cheque you have earlier submitted with the LOA, after which the developer will provide you with a set of Property Details Information (PDI) documents.

Some of the information in the PDI will include your unit number, floor plans, rules and regulations, equipment provided and other terms relating to your property purchase. You will be asked to read and agree to the terms and details in the PDI documents by signing on all the pages.

The Option to Purchase (OTP) will be given to you at this point, which confirms your official booking of the property. Should you back out of the purchase, the developer will forfeit 25% of your booking fee.

Post-Launch Properties

If you have missed or cannot secure your choice unit in the newly launched private property, don’t despair. You can either wait for the developer to release new batches for sale (if any) or look at other post-launch properties that are already on the market.

Very often, especially for large projects, developers will release their units in phases. If you find a property to your liking, you need to put down a cash deposit (5% of the purchase price) to secure the OTP. Do take note that once signed, you won’t be getting your money back. You will have 3 weeks to exercise your OTP.

Secure a Bank Loan and Hire a Conveyancing Lawyer

With your copy of the Option-to-Purchase (OTP), shop for a suitable bank loan to finance your property.

The bank will do a credit assessment before granting you a Letter of Offer (LO), which specifies the terms and conditions of the loan. [Note: It is advisable to secure an Approval-In-Principle (AIP) for a bank loan before committing to your property purchase]. An AIP sets the quantum of the loan the bank is willing to lend you. It also sets out your monthly mortgage instalments, among other terms and conditions. This will give you an indication of the property you can afford.

The last thing you want is not being able to get the relevant financing for your property, jeopardising your purchase.

Total Debt Servicing Ratio (TDSR)

Do take note that when taking a bank loan, you will be assessed on your total debt servicing ratio (TDSR). The TDSR is imposed by the Monetary Authority of Singapore (MAS) to prevent borrowers from over-extending their financial burden. It is currently set at 55%, which means your total debt commitments (e.g. home and renovation loans, car loans, study loans, credit card debts, etc) will be capped at 55% of your total gross income.

This will in effect limit the amount of loan you can borrow. More information on this can be found in “Change In CPF Usage and Housing Loan Rules”.

Signing The Sales and Purchase Agreement (S&P)

By now, you should have engaged a conveyancing lawyer becasue within 2 weeks of obtaining your Option-to-Purchase (OTP), the developer will deliver the Sales and Purchase Agreement (S&P) to your lawyer.

After you have exercised the option at your lawyer’s office, you will have a further 5 weeks to endorse the S&P by paying 20% of the purchase price of the property (which will include the initial 5% booking fee). Your lawyer will help you deliver the signed S&P Agreement back to the developer and handle all your subsequent progressive payments for the property.

Payment Property Stamp Duties

Within 14 days of signing the Sales and Purchase (S&P) Agreement, you will also need to pay the relevant property stamp duties. They are the Buyer’s Stamp Duty (BSD) and the Additional Buyer’s Stamp Duties (ABSD), if applicable. These stamp duties are charged regardless of whether you are buying a new launch private property or a resale.

The BSD and ABSD rates are computed as follows:

| Additional Buyer’s Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

| Buyer’s Stamp Duty (BSD) | ||

| Higher Purchase Price or Market Value of the Property | Rates on or before 14 February 2023 | Rates on or after 15 February 2023 |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6 | |

To find out more information about property stamp duties, please refer to “How To Calculate Singapore Property Stamp Duties?”. Alternatively, you can easily determine the amount of stamp duties payable using an online stamp duty calculator.

New Launch Private Property – Property Progressive Payments

For the remaining 80% of the price of the new launch property, you will have to make progressive payments according to a set of construction stages as stipulated below:

- 10%: Notice on completion of foundation work.

- 10%: Notice on completion of concrete framework.

- 5%: Notice on completion of brick walls of each unit.

- 5%: Notice on completion of the ceiling of each unit.

- 5%: Notice on completion of doors, windows, electrical wiring, plumbing and internal plastering.

- 5%: Notice on completion of carparks, roads and drains.

- 25%: Notice of vacant possession or obtaining the Temporary Occupation Permit (TOP).

- 15%: On obtaining the Certificate of Statutory Completion (CSC), which is the completion date.

These progressive payments can be made via CPF, cash or a bank loan.

If the developer fails to deliver vacant possession of your property by the stipulated date, it is liable to pay liquidated damages amounting to 10% p.a. on the total instalments already paid.

Collect the Keys and Move In

The estimated TOP date should be indicated when you purchase your property. After you have moved in, there is a 12-month Defects Liability Period where the developer must make good any defects found. The developer must rectify the defects within 1-month of your notice.

However, should the developer fail to rectify the defects, you can take the following actions:

- Notify the developer of your intention to initiate rectification works to be done and provide the estimated cost of carrying out such work.

- Allow the developer to carry out the proposed rectification works within 14 days after the date of the notice, failing which, you may proceed to rectify the defects yourself and claim compensation.

In addition, should you find the area of your property smaller than what is stipulated in the Sales and Purchase (S&P) Agreement, you can demand a reduction in the sale price. However, developers are given a buffer of 3%. In other words, you can only claim compensation for the difference of the area above the 3% buffer, calculated at the rate of what you have paid per square metre.

An advantage of buying a new launch private property compared to a resale is that home buyers can stretch their payments over a longer period. This means taking up a smaller bank loan while building up the necessary funds to finance the property.

In contrast to resale properties, full payment is required on completion of the property transaction in about 12 weeks. After exhausting your cash and CPF monies, the balance will have to be financed by a bank loan straightaway.

An Investment Perspective – New Launch Versus Resale Condo

When it comes to real estate investment, there is a choice between a newly launched private property and an older resale property.

Although a new property will always cost more, it usually offers a higher rate of capital returns compared to an older resale property of the same attributes (e.g. location, size, facilities, and tenure). Naturally, many investors simply focus on the prices without realising other important aspects of property investment which will be elaborated below.

Leveraging Your Capital

Like in any investment, real estate is cyclical, and prices can go up or down. However, a newly launched private property, which is also known as BUC (Building Under Construction), allows you to leverage on your capital.

A BUC property lets you pay progressively. In other words, you only pay a certain percentage of the selling price based on the completed stages of the development. You do not need to pay in full, unlike buying a resale private property. This allows you to get a return on the total value of your purchase despite paying only a fraction upfront.

At the same time, your unutilised capital can be invested elsewhere until you need it.

Asset Appreciation

The value of properties usually appreciates over time. Of course, there are periods of downturn due to a financial crisis or an economic downturn, but the real estate market usually recovers to register new peaks.

In addition, the capital appreciation of new private properties under construction tends to increase at a faster rate. By the time the development is completed, there is a good chance your investment will be profitable. Therefore, one of the key tactics to maximise your returns is to use equity to finance your investment.

Other Advantages of Buying a New Launch Private Property

Besides the above, buying a new launch private property also enjoys the following advantages:

- Early Bird Special or Discount – To kickstart the sale, housing developers usually offer some discounts. This will also help to generate publicity as part of their marketing effort.

- Step-Up Pricing – After the developers have moved a certain number of units, they will start increasing their prices over time, or when their inventory of unsold units dwindled. Hence, early buyers will benefit from the step-up prices and stand to gain once the development is completed.

- Decaying Lease – Both a new and resale leasehold property will suffer from lease decay, but the former will get a fresh lease. With a shorter lease, a resale property will suffer more significantly from lease decay, negatively affecting its value to a greater extent.

- No Maintenance Fees – No maintenance fees are payable for a new private property until it is completed, saving investors a tidy sum and lowering the overall cost of investment. However, a resale property does not enjoy such a benefit.

- No Agent Commission – In a new agreement inked by most property agencies, buyers/sellers of resale properties will pay commissions to their respective property agents. However, for the purchase of new launches, no commission is payable. The property agent will get his/her commission from the developer.

Are All New Property Launches Under Construction Good Investments?

No, not all new property launches under construction are good investments. But they do offer you some advantages highlighted above that will help you increase your chances of making money.

There are many factors to evaluate when investing in a property. These include the following:

- Entry price

- Location

- Demand/Supply situation

- Rental price and rentability

- Transformational potential

If you need assistance in finding the right property for you, please feel free to WhatsApp or Email us.

For the latest new property launches, please click on the links at the end of the article.

A Quick Checklist for Purchasing a New Launch

- Affordability: Assess your financial position by finding out how much you can borrow. Secure in-principle loan approval, and take into account upfront costs such as stamp duties and legal fees.

- Mortgage & Recurring Expenses: Plan for long-term mortgage repayment and monthly maintenance expenses.

- Property Type & Location: Choose locations with good transport links, amenities, and growth potential, or those close to your workplace. These factors can impact investment potential and your quality of life.

- Tenure (Freehold or Leasehold): Freehold and 999-year properties usually hold value better, but cost more. However, 99-year homes in well-located areas can also perform well. Balance tenure with budget and locational attributes.

- Condition & View: Carefully assess the property’s view when shortlisting during the sales launch. Units facing disamenities like garbage a collection centre or am expressway can affect future resale value. Also, check zoning plans to avoid view obstructions from future developments.

- Government Cooling Measures & Regulations: Be aware of regulations like Additional Buyer’s Stamp Duty (ABSD) and Total Debt Servicing Ratio (TDSR) as they can impact affordability, financing, and eventual return on investment.

- Economic Outlook: The health of the economy can significantly affect interest rates, employment, income growth, property demand, and pricing trends.

- Capital Growth & Rental Yield: If investing, assess the rental yield and long-term market trend. Proximity to major infrastructure developments such as building new MRT stations and business hubs can often boost returns.

- Developer Reputation: Research the developer’s track record for build quality, timely delivery, and after-sales service. A reliable developer builds confidence among buyers and supports resale value.

Frequently Asked Questions (FAQs)

How do I book a new launch property in Singapore?

To book a new launch property in Singapore, you first need to fix an appointment with the official property agency appointed by the developer. This will give you access to the latest information on the property.

Next, you’ll need to visit the showflat, view the different unit types, and check out the actual location. Once you have decided on the type of unit, you will need to submit a Letter of Authorisation and attend the property booking day. After that, you will receive the Property Details Information (PDI) documents, secure a bank loan, hire a conveyancing lawyer, and sign the Sales and Purchase Agreement.

What is the down payment for a new launch condo in Singapore?

When buying a new launch condo in Singapore, you’ll need to pay a 20% down payment upon signing the Sales & Purchase Agreement (S&PA). This 20% down payment includes a 15% Exercise Fee and an initial 5% booking fee. The remaining 80% of the property price can then be paid through progressive payments as construction certain milestones are reached.

Can permanent residents (PRs) buy new launch condos in Singapore?

Yes, permanent residents (PRs) in Singapore can buy new launch condos. However, they will incur additional buyer’s stamp duty (ABSD) – 5% for the first property, 30% for the second property and 35% for the thrid and subsequent property.

However, if a PR is looking to buy a new Executive Condo (EC), they can only do so if their spouse is a Singapore citizen.

What the PDI documents contain for purchasing a new launch?

PDI stands for Property Details Information. Once you have booked a unit in a new launch, the developer will provide you with a set of PDI documents. This includes all the floor plans, rules and regulations, offered items, and other details related to your unit. You will need to read and agree to the terms in the PDI by initialling all the pages.

Can you negotiate prices for new launch condos in Singapore?

Prices are generally fixed for new launches. Developers may offer limited discounts or early-bird deals during previews, but unit prices are not typically negotiable like resale units.

Reviews of New Property Launches

For reviews of new property launches, please click on the links below. More project information can also be found here.