- 1. Clarify Your Objective: Home vs Investment

- 2. Understand Property Types and Eligibility

- 3. Know the True Costs of Home Ownership

- 4. Location & Future-Growth Potential

- 5. Macro and Micro Market Factors

- 6. Financing and Loan Considerations

- 7. Stamp Duties, Taxes, Legal Costs & Agent Commission

- 8. Use of CPF Funds & Retirement Considerations

- 9. Buying Process & Working with Professionals

- 10. Long-Term View & Exit Strategy

- Closing Thoughts

- A Review of New Property Launches

Buying a property in Singapore is a landmark decision. Whether you're looking for a home to settle in or an investment for asset progression, understanding the essentials from the outset can save you time, money and stress.

In this article, we’ll explore the key considerations when buying a property in Singapore. You can also use it as a checklist before undertaking such a major financial commitment.

1. Clarify Your Objective: Home vs Investment

The first step in the journey of buying a property in Singapore is to clarify what you want. Are you buying primarily for your own stay, or are you aiming for investment returns? Your objective will influence many other decisions.

Here are some questions to ask yourself:

- Own stay or rental: Will this property be your long-term residence, or will you rent it out?

- Holding period: How long do you intend to hold on to it?

- Investment objective: Do you focus more on monthly cash flow (rental yield) or capital appreciation over time?

- Future housing plan: Will you be relocating, upgrading or downsizing in a few years?

Getting clarity here helps steer your choices in property type, location, tenure and financing.

2. Understand Property Types and Eligibility

Not all properties in Singapore are created equal. Whether you’re looking at HDB flats, executive condos, or private properties, each comes with different price tags, ownership rules, and resale restrictions that can impact your financial goals and lifestyle choices.

Here’s a quick breakdown:

- HDB Flats: Public housing built by the Housing & Development Board; heavily regulated (like new flat classifications); mainly for Singapore citizens. Some eligibility criteria for Singapore Permanent Residents (SPRs). Foreigners generally cannot buy.

- Executive Condominiums (ECs): Hybrid public-private housing type; some restrictions apply (e.g., minimum occupancy period before you can sell). SPRs and foreigners face additional rules.

- Private Condominiums: Non-landed strata developments; foreign buyers can generally buy. Offers more flexibility.

- Landed Properties: Bungalows, semi-detached houses, terraces, etc. Typically, the most expensive and foreign buyers require approval (via the Land Dealings Approval Unit) or satisfy certain conditions.

Before making any purchase, ensure you understand which property types you are eligible to buy while aligning with your financial and lifestyle objectives.

Each property category comes with its own restrictions, eligibility criteria, and resale conditions.

3. Know the True Costs of Home Ownership

Budget wisely. The “entry price” can differ significantly for different parts of Singapore. Singapore is commonly divided into three main regions – Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR).

Home ownership cost goes far beyond the headline purchase price.

Some of the key cost components to account for include:

- Purchase price (obvious).

- Stamp duties: Buyer’s Stamp Duty (BSD). Additional Buyer’s Stamp Duty (ABSD) applies if you are a Singapore citizen buying more than one residential property, or a PR/foreigner purchasing any residential property.

- Legal/conveyancing fees.

- Renovation/furnishing costs.

- Recurring costs: Maintenance fees, property tax, utility expensess.

- Mortgage instalments: May be higher if interest rates rise in the future.

Practical budgeting tips

- Set a realistic maximum budget and stick to it.

- Check “entry price” bands for different regions: Core Central Region (CCR), Rest of Central Region (RCR), Outside Central Region (OCR) in Singapore. Typically, CCR is most expensive.

- Ensure you’re comfortable with loan repayments, especially if interest rates rise.

- Don’t ignore hidden costs - stamp duties (BSD and ABSD) can add up substantially to the property acquisition cost.

4. Location & Future-Growth Potential

Location is always key. But in Singapore, it’s not just about “now” but also about what the area will become. A good location today is helpful, but strong future development potential adds major value.

Things to check:

- Proximity to public transport (MRT stations, bus interchanges): This improves convenience, boosting resale/rental appeal.

- Access to amenities: Schools, shopping malls, parks, clinics, etc.

- Future infrastructure development: Master-plan growth zones; upcoming MRT lines and business hubs. Think 5–10 years ahead.

- Micro factors: Is the development large or small? What are neighbouring land parcels used for? If used for future housing, will they compete with existing developments?

- Lease tenure/property age: For older leasehold properties, the shorter remaining lease and lease decay can reduce value over time.

Why this matters:

- A property near transport and amenities tends to attract tenants and buyers more easily.

- Strong growth areas may deliver better capital appreciation.

- Conversely, poor location or weak future growth may reduce resale flexibility and appeal.

5. Macro and Micro Market Factors

Other than focusing on your individual purchase, it’s also important to understand macro trends and micro details. A strong purchase plan considers both.

Macro-level factors

- Regulation: Government policy and property cooling measures (eg, ABSD, LTV limits).

- Financing cost: Interest rate movements.

- Land scarcity: Singapore is small and has a limited land supply, which supports long-term value.

- Economic fundamentals: Employment, foreign investment, household incomes.

Micro-level factors

- Development size: Bigger projects may be more appealing due to full facilities. However, smaller projects provide more exclusivity.

- Competing developments: If many new units in your vicinity come online soon, supply might rise.

- Building upkeep: Assess whether the property is properly maintained by its management council, especially for older properties. Check whether the maintenance fees collected are adequate to cover regular repairs, cleaning, landscaping, and the upkeep of shared facilities.

- Potential obsolescence: Functional, physical or economic (for example, a building design that becomes outdated).

Taking a broad macro and micro perspective allows you to identify both potential risks and emerging opportunities when purchasing a property in Singapore.

6. Financing and Loan Considerations

Let’s talk numbers. Most buyers will need a loan. Therefore, understanding what you can borrow, what you’ll pay and how you’ll manage repayments is critical.

Key loan concepts:

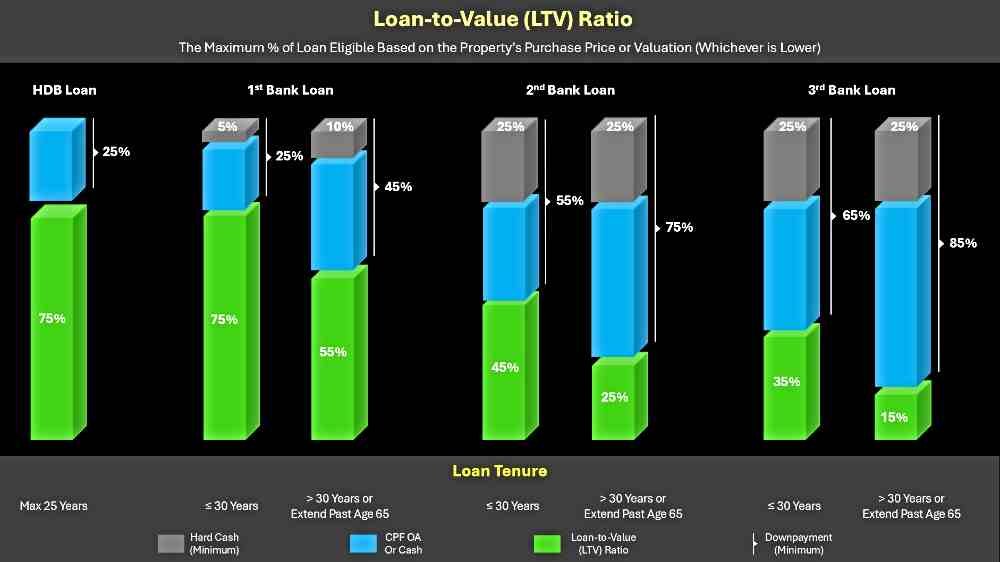

- Loan-to-Value (LTV) ratio: How much you can borrow relative to the property value. For first properties, often up to 75%. If you are financing more than one property, the limit will be lower.

- Mortgage Servicing Ratio (MSR) / Total Debt Servicing Ratio (TDSR): Measures how much of your income is used for debts, ensuring affordability and ability to finance your property purchase.

- Compare loan types: Evaluate fixed vs floating interest rates, lock-in periods, early repayment penalties, etc. Refer to “How to Choose a Home Loan”.

- Loan tenure: The longer the tenure, the lower the monthly repayments - but the higher the total interest paid.

- Future rate risk: Have a buffer for interest rate increases, which affect mortgage repayments.

Tips to stay safe

- Use a conservative income estimate when evaluating how much you can afford.

- Factor in down payment, CPF contribution/usage (if applicable) and other debts.

- Make sure you are comfortable with monthly mortgage repayments, even in less favourable conditions.

- Provide an emergency buffer - unexpected situations may arise in property ownership, like job losses.

7. Stamp Duties, Taxes, Legal Costs & Agent Commission

An often underestimated aspect of buying a property in Singapore is the taxes (refer to tables below) and legal fees that add substantially to the overall cost.

Key items to account for:

- Buyer’s Stamp Duty (BSD): Applies to all property purchases.

- Additional Buyer’s Stamp Duty (ABSD): Applies to Singapore Citizens buying a second property or more, and Singapore Permanent Residents/foreigners buying any residential properties. Rates can be significant.

- Seller’s Stamp Duty (SSD): If you resell within four years of your property purchase.

- Conveyancing and legal fees: Can cost you from $500 for an HDB flat to a couple of thousand dollars for a private property.

- Agent commissions: For engaging a realtor to purchase a resale property

- Renovation/furnishing costs: Amount varies depending on your scope of work/renovation needs, property type and size, and material/design choices.

- Recurring home ownership expenses: These include property taxes, maintenance fees and utility expenses.

It’s prudent to include all these in your budgeting from the outset and ensure the purchase is still affordable even after these extra costs.

| Buyer's Stamp Duty (BSD) | ||

| Higher of Purchase Price or Market Value of the Property | Rates on or before 14 February 2023 | Rates on or after 15 February 2023 |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6% | |

| Additional Buyer's Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

| SSD Holding Period | Rates from 11 March 2017 to 3 July 2025 | Rates on and after 4 July 2025 |

| Up to 1 year | 12% | 16% |

| > 1 year and up to 2 years | 8% | 12% |

| > 2 years and up to 3 Years | 4% | 8% |

| > 3 years and up to 4 Years | 0% | 4% |

| > 4 years | 0% | 0% (no change) |

8. Use of CPF Funds & Retirement Considerations

If you are a Singapore citizen or SPR using your Central Provident Fund (CPF) funds for property investment, there are additional rules to consider.

Important points:

- The remaining lease of the property must cover you up to age 95 if you plan to use CPF funds to finance your purchase. If not, the CPF usage will be pro-rated.

- If the remaining lease is too short (e.g., 20 years or less), CPF funds cannot be used.

- If you own a property bought with CPF funds that can cover you up to age 95, you can choose to set aside the Basic Retirement Sum (BRS) when you reach age 55 - half of the Full Retirement Sum (FRS). If the property cannot cover you up to age 95, you need to set aside the FRS.

Why this matters for you:

- Using CPF funds can help reduce your initial cash outlay. However, you must also consider your long-term retirement adequacy needs.

- If you ignore these rules, you may potentially face unexpected cash flow issues later, such as having a large portion of your personal savings or CPF funds locked up in your property. Therefore, it’s important to balance your housing and retirement needs.

9. Buying Process & Working with Professionals

Even when you’ve done your homework, the process of buying a property in Singapore involves a structured process. Engaging a real estate professional is advisable.

Key steps:

- Find a Conveyancing Lawyer: Preferably, engage a qualified lawyer (conveyancing) early to ensure your property purchase proceeds smoothly, with all legal documents reviewed and your interests fully protected.

- Sign “Option to Purchase” (OTP): Have your conveyancing lawyer help you vet it and advise accordingly.

- Review the contract carefully: Find out if there are any restrictive clauses (eg, land use and subdivision, or alteration of façade), timeline for completion, and inventory.

- Due diligence: Inspect property condition (especially for a resale property), check legal ownership, remaining lease, management, and maintenance history.

- Secure financing: It is advisable to get loan approval in principle in advance. It helps you determine your affordability.

- Handover and occupancy: Check condition, defects, transfer of utility account, terms of tenancy agreement (if any), etc.

Working with agents & checking developers' reputation

- Agents can offer you guidance, whether it is a resale or new property, but always check credentials and fully understand your contractual obligations.

- For new launches, check the background of the developer, track record, and sales conditions.

10. Long-Term View & Exit Strategy

Buying property in Singapore requires a long-term strategy, not a quick flip.

Regulations like the 4-year Seller’s Stamp Duty (SSD) and other "property cooling measures" are in place specifically to moderate price increases and ensure they align with economic fundamentals. Therefore, having a clear exit strategy is essential.

Things to consider:

- Holding period: How long do you plan to hold the property? Five years? Ten years, or more?

- Resale market performance: How is the resale market in the area? Will there be demand and competition from other housing developments?

- Rental: If you are renting it out, what rental yield can you expect? What are the vacancy risks?

- Early liquidation: What happens if you need to sell early? Seller’s Stamp Duty (SSD) or market downturns may hurt.

- Macro & micro factors: What is the global economic and interest rates outlook? Is there any major urban transformation taking place nearby?

Closing Thoughts

When buying a property in Singapore, many factors must be carefully considered. These include aligning your goals, understanding the full cost of acquisition, choosing the right property type, securing the ideal location, and staying informed about financing and regulations.

Although this analytical approach may not eliminate all risks, it gives you far greater clarity and control over your investment decisions.

Remember:

- Define your goal (home vs investment).

- Make sure you understand what housing types you’re eligible for.

- Budget realistically.

- Research the location deeply, including future growth prospects.

- Consider macro and micro market forces.

- Secure a manageable loan structure.

- Incorporate all taxes and hidden costs.

- Devise a long-term strategy and exit plan.

By adopting this mindset, you give yourself the best chance of making a well-informed decision - one you’ll feel less stressed down the line. Buying property in Singapore is a significant financial undertaking. But, when done analytically and prudently, it can be an exciting step towards asset progression.

A Review of New Property Launches

For reviews of new property launches, please click on the links below. Alternatively, refer to our project information.

Below are some of the latest and upcoming new launches:

W Residences Marina View