When it comes to property investment in Singapore, one of the biggest questions buyers face is this: Should I invest in a new launch or a resale condo?

It’s a common dilemma for both investors and homebuyers alike. Each option offers pros and cons, taking into considerations such as financing, risk appetite, investment outlook, and personal objective.

Below, we’ll take a closer look at both new launch and resale condos from an investor’s perspective – exploring their advantages, drawbacks, and real-world examples (case studies) – to help you make an informed decision.

Meanwhile, learn about the different characteristics and development of Singapore’s property landscape in CCR, RCR, and OCR.

Understanding the Basics: What’s the Difference?

New Launch: It refers to a development that’s still under construction and sold directly by the developer. Buyers usually purchase based on floor plans, brochures, and visiting showflats before the project is completed.

Resale Condo: It is an existing, completed property that has already been lived in or rented out. You can physically inspect it, evaluate its condition, and move in almost immediately after completion of the sale.

Both have their appeal – and understanding what drives their value helps investors make smarter decisions.

Key Differences Between New Launch and Resale Condos

Choosing between a new launch and a resale condo depends on various factors, such as your goals, investment horizon, and risk appetite.

Resale units offer immediate rental income and certainty, while new launches provide modern designs and potentially better future growth potential. Understanding these differences helps investors make smarter property decisions.

Below are some of the pros and cons of choosing between a new launch and resale condo.

1. Immediate vs Delayed Rental Income

If your goal is to generate immediate rental returns, resale condos have a clear advantage. You can start renting out the unit right after the completion of your purchase, providing steady cash flow almost immediately.

New launch condos, however, typically take three to five years to complete. During the construction period, your capital remains tied up (through progressive payments) with no rental income generated. For immediate return on investment in the short-term yield, resale properties will be the preferred option.

That said, some investors view the construction period of a new launch as a “gestation phase” — a time when the property quietly gains value before it’s ready for occupation.

2. Predictability of Returns

With resale condos, price appreciation and rental income can be estimated using real, historical data. You can get updated private property resale prices or rental rates through the URA website for free. This will allow you to project the returns on your investment.

On the other hand, new launches rely on future projections. Factors such as the state of the economy, interest rates, and future supply can affect your eventual returns. For investors who prefer certainty and measurable performance, resale condos offer more clarity.

3. Physical Inspection and Transparency

One of the biggest advantages of buying resale condo is that you see what you get. You can inspect the actual unit, check its condition, lighting, and noise levels, and even speak with existing residents to understand the living environment.

For new launches, you’re relying on brochures and showflats. While most developers deliver as promised, there can be differences in finishing, views, or unit orientation that only become apparent after completion.

4. Space and Design

Older resale condos are typically more spacious, reflecting the design preferences of earlier years. This can be a selling point for families or tenants who prioritise roominess and larger living spaces.

New launches nowadays tend to have smaller unit sizes but compensate with modern layouts, sleek interiors, and extensive communal facilities such as co-working lounges or smart home systems – features designed to suit modern lifestyles.

5. Price Negotiation and Flexibility

In the resale market, prices are open to negotiation. Motivated sellers may accept lower offers, especially if they’re upgrading or relocating. This gives buyers room to secure a better deal.

New launches, in contrast, have developer-controlled pricing. Discounts are rare except during early-bird phases or slow sales periods. However, developers often structure attractive payment schemes that can help manage cash flow, which we’ll explore next.

6. Payment Structure and Financing

A major benefit of buying a new launch is the progressive payment scheme. Instead of paying the full loan upfront, payments are made gradually based on construction milestones.

This spreads out the financial burden and reduces immediate interest payments since the loan amount grows over time. It’s especially useful for investors who want to manage liquidity or diversify their investments.

Resale buyers, on the other hand, must pay 25% upfront and start servicing the full loan within weeks of completion. This requires stronger cash flow management but offers faster access to rental income.

7. Maintenance, Repairs, and Defects

New launch condos come with a one-year defects liability period, meaning the developer will fix any construction issues at no extra cost. Resale units, being older, might require renovation or repair work – something to factor into the total acquisition cost.

For resale condos, it is important to ensure the developments are wll-managed, have sufficient maintenance fees and sinking funds, and whether there are major upgrades that may require out-of-pocket payments, which will add to the cost of ownership.

8. Capital Appreciation and Growth Potential

New launch condos often provide a “first-mover advantage.” Buyers who purchase early in the development phase may enjoy substantial price appreciation as the project nears completion and surrounding infrastructure improves.

For instance, new MRT stations, schools, or shopping malls nearby can significantly raise property values. Additionally, developers often raise prices in phases as their stocks deplete, allowing earlier buyers to lock in lower prices and benefit from the later price hikes.

Resale condos, while less likely to experience sharp gains, can still appreciate steadily – particularly in mature estates with limited new supply. The key lies in choosing developments with strong fundamentals: good location, healthy resale demand, and well-maintained facilities.

9. Risk and Uncertainty

Every investment comes with risk.

New launches carry uncertainties such as construction delays, changes in market sentiment, or slower-than-expected appreciation. Since rental and resale prices are based on projections, investors must take a longer-term view.

Resale condos on the other hand, offer predictable performance backed by real transaction data and immediate occupation. You’re buying something tangible with an existing market valuation.

Side-by-Side Summary: New Launch vs Resale Condo

| Feature | New Launch Condo | Resale Condo |

| Lease | Tend to have longer leases for new 99-year leasehold condos. | Usually have shorter leases for resale 99-year leasehold condos. |

| Move-in Timeline | Requires construction to be completed before moving in. | Can move in immediately upon purchase. |

| Immediate Rental Income | No – delayed until completion. | Yes – almost immediate upon purchase. |

| Income Predictability | Lower – based on future projections. | Higher – based on current available data. |

| Physical Inspection | No – can only based on show units during the sales launch. | Yes – full inspection of the unit. You see what you get. |

| Unit Size | Often smaller, designed for affordability. | Usually larger, more spacious. |

| Price Negotiation | No – prices set by developers. | Yes – can be negotiated. |

| Maintenance/Defects | A one-year defects-free period is offered by developers. | May require immediate renovations and repairs. |

| Capital Appreciation | Higher potential for significant appreciation due to first-mover advantage and attractive early-bird discount given by developers. | Usually more moderate appreciation due to ageing and lease decay. |

| Payment Flexibility | More flexible payment schemes, such as progressive payments, which can lower initial capital outlay and resulting in lower interest payments. | Requires larger down payment upfront and almost immediate full monthly instalment payments. |

| Unit Choice | Wider range of choices at launch, such as facing, floor level, or unit number. | Limited to what is available on the resale market. |

| Facilities | Newer, more modern and comprehensive facilities. | Older and may be dated, usually less comprehensive facilities. |

| Fittings & Fixtures | Equipped with latest technology, fittings and fixtures. | Usually more dated technology, fittings and fixtures. |

| Location Options | Limited to areas where new developments are being launched. | A wider choice of locations. |

| Renovation Requirement | Minimal, as new units come with new fittings. | Usually required, as older units suffer from wear and tear. |

| Financial Flexibility | Banks will match the valuation of the new launch property. | Banks may value the property lower than the purchase price, requiring cash-over-valuation (COV). |

| Maintenance Fees | Usually lower as development is new. | Usually higher due to age. |

| Risk | More risk due to potential construction delay and uncertain future investment projections. | Less risk due to predictable rental rates and transaction history of existing properties near it. |

Case Studies: Profitability of New Launch versus Resale Condo

The following case studies have shown that new launch condos have outperformed their resale counterparts in capital appreciation across various regions in Singapore. Let’s look at a few examples.

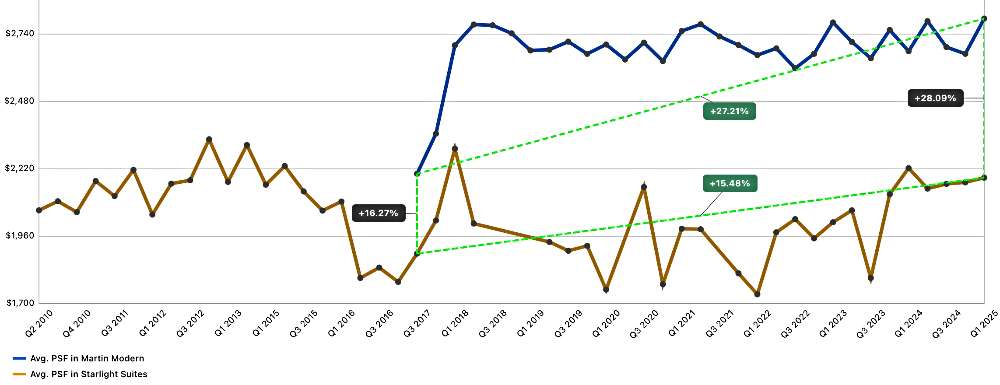

1. Core Central Region (CCR): Martin Modern vs Starlight Suites

- Martin Modern Launch Date: July 2017

- Starlight Suites Launch Date: April 2010

During the launch of Martin Modern in July 2017, it was sold at an average price premium (psf) of 16.27% over the prevailing average resale transacted price of Starlight Suite. Both developments are located about 120m apart at River Valley Close in prime District 9.

Since then till Q1 2025, Martin Modern and Starlight Suites appreciated by 27.21% and 15.48% respectively. This widens the price premium from 16.27% to 28.09% (See Chart 1).

Interestingly, Martin Modern is a 99-year leasehold development while Starlight Suites is a freehold. This illustrates that freehold developments may not necessarily offer better investment returns.

2. Rest of Central Region (RCR): Alex Residences vs Ascentia Sky

- Alex Residences Launch Date: November 2013.

- Ascentia Sky Launch Date: July 2009.

During the launch of Alex Residences in November 2013, it was sold at an average price premium (psf) of 10.32% over the prevailing average resale transacted price of Ascentia Sky. Both 99-year leasehold developments are located next to each other and near the Redhilll MRT station.

Since then till Q1 2025, Alex Residences and Ascentia Sky have appreciated by 32.08% and 25.06%, respectively. This widens the price premium from 10.32% to 16.51% (See Chart 2).

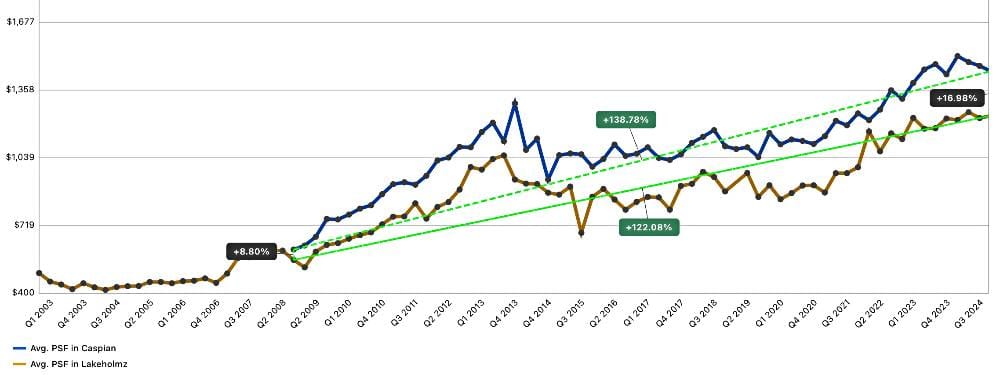

3. Outside Central Region (OCR): Caspian vs Lakeholmz

- Caspian Launch Date: February 2009

- Lakeholmz Launch Date: March 2003

During the launch of Caspian in February 2009, it was sold at an average price premium (psf) of 8.80% over the prevailing average resale transacted price of Lakeholmz. Both development are located near each other in Jurong West and within walking distance of the Boon Lay MRT station.

Since then till Q3 2024, Caspian and Lakeholmz have appreciated by 138.78% and 122.08% respectively. This widens the price premium from 8.80% to 16.98% (See Chart 3).

Insights from These Case Studies

These examples highlight a key trend: while new launches may initially appear more expensive, they often deliver better capital gains over time.

Why? Several factors play a role:

- Developer Discount: Buyers of new launches often benefit from being the “first movers”, like receiving early-bird discounts and the opportunity to select the best units. They also need not pay any property agent commission, resulting in further cost savings.

- Developer Controlled Pricing: New launch buyers benefit from developers’ controlled pricing, where they usually raise prices once certain percentages of the developments are sold. This ensure a gradual upward trijectory of prices.

- Progressive Payment Scheme: It offers a lower initial outlay while reducing interest payments, allowing buyers to hold the property more comfortably until it is fully completed.

- Market Perception: Tenants and buyers generally prefer newer properties with modern facilities and smart layouts.

- Competition in Resale Market: Prices of resale condos may be capped by new launch sellers once the 4-year Seller’s Stamp Duty period is crossed.

However, investors should not assume all new launches will outperform resale condos. Timing, location, and entry price still matter. A resale unit in a high-demand area with limited competition and near transport hubs can outperform a new launch in a less desirable location.

Choosing the Right Option: Matching Strategy to Objectives

Ultimately, the “better” investment depends on your investment profile and priorities.

Here’s some of the considerations:

- Investment Alignment: The “better” option depends on your investment profile, time horizon, and priorities.

- Steady Income Focus: If you prioritise consistent rental income and lower risk, resale condos are suitable, as you can assess existing data, rent out or move in quickly, and enjoy stable cash flow.

- Growth Potential Focus: If your objective is long-term capital appreciation, new launches can provide stronger upside, especially when bought early in growth locations with planned URA developments.

For many seasoned investors, the right strategy often involves either of the following or a combination of both – buying resale units for stable returns or holding new launches for appreciation potential.

Final Thoughts

Deciding between a new launch and a resale condo may not be about which one is “better” overall – it’s about which one fits your investment goals, budget, and timeline.

Resale condos provide immediate returns and predictability, while new launches may offer faster capital appreciation potential, modern amenities, and progressive financing. Both could offer promising investment opportunities by undertaking in-depth research and due diligence.

Study market trends, evaluate the surrounding infrastructure, and assess your financial readiness. When in doubt, consult a trusted property advisor who can provide personalised guidance based on your objectives.

In Singapore’s dynamic real estate market, both new launch and resale condos can deliver attractive returns – when chosen wisely with a clear, long-term exit strategy.

Pro-Tip: Given the rising cost of land and construction in Singapore, seek out balanced units of newly launched or recently completed developments. These developments may offer better value relative to future launches. Yet, they offer similar modern designs and specifications, but at more attractive entry prices.