- Definition of a Foreign Person

- Singapore Property Rules - Restricted Properties Foreigners Can't Buy

- Singapore Property Rules - Properties Foreigners Can Buy

- Purchase of HDB Flats by Singapore Permanent Residents (SPR)

- New Built-To-Order (BTO) HDB Flat

- HDB Resale Flat

- Conditions for Foreigners Buying Restricted Properties In Singapore

- Approval Conditions To Own Restricted Properties

- Conditions for Foreigners Buying Properties in Sentosa Cove

- Property Stamp Duties Payable by Foreigners

- Singapore Property Rules - Capital Gain And Inheritance Taxes

- Property Financing

- Other Property Resources

- Reviews of New Property Launches

For foreigners who wish to buy residential properties, either for own stay or investment, there are a number of Singapore property rules to take note of. The purchase of residential properties is governed by the Residential Property Act (RPA) which specify, among other things, what type of properties a foreigner can or cannot buy. But first of all, what is a Foreign Person?

Definition of a Foreign Person

Under the Residential Property Act (RPA), a foreign person means any person who is not any of the following:

- Singapore Citizen

- Singapore Company

- Singapore Limited Liability Partnership

- Singapore Society

Note: Under the RPA, a Singapore Permanent Resident (SPR) is considered a foreign person.

You can refer to these step-by-step guides on buying either a new launch or resale private property in Singapore.

Singapore Property Rules - Restricted Properties Foreigners Can't Buy

Under the Residential Property Act, a foreign person is not allowed to acquire or purchase restricted properties unless he obtains prior approval from the Minister of Law (more of this below). These restricted properties include the following:

- Vacant residential land

- Terrace house

- Semi-detached house

- Bungalow/detached house

- Strata landed house which is not within an approved condominium development under the Planning Act (e.g., townhouse or cluster house)

- Shophouse (for non-commercial use)

In addition to the above, a foreigner cannot buy an HDB flat or a new executive condo. However, Singapore permanent residents can purchase them, subjected to certain eligibility conditions (see below).

Singapore Property Rules - Properties Foreigners Can Buy

Under the Residential Property Act (RPA), some of the properties a foreigner can buy without approval are:

- Condominium unit

- Flat unit

- Strata landed house in an approved condominium development

- A leasehold estate in a landed residential property for a term not exceeding 7 years, including any further term which may be granted by way of an option for renewal

- An executive condominium unit (can only buy resale after it becomes fully privatised after 10 years)

Meanwhile, before embarking on your property search, there are many factors you need to consider, such as your budget, the location and type of property that suits your needs, and what home loan to apply for. For the latter, it is advisable to consider the different options available to maximise your returns, diversifies risk, aligns with goals, and adapts to market changes effectively (refer to the basics of property financing).

You may also wish to find out where the potential growth hotspots are to maximise your investment potential, which includes the Greater Southern Waterfront, Novena, Tampines Regional Centre, Jurong Lake District, One-North, and the East Region.

Purchase of HDB Flats by Singapore Permanent Residents (SPR)

As mentioned earlier, under Singapore property rules, Singapore permanent residents (SPR) are considered foreigners. However, they are slightly luckier than foreigners. Besides the above-mentioned properties they can buy, they are also allowed to purchase HDB flats. However, certain conditions will apply, as highlighted below.

In addition, it is important to take note of the rules concerning the usage of CPF funds for property purchases.

New Built-To-Order (BTO) HDB Flat

If the SPR is married to a Singapore citizen or about to be married to one, he/she can buy a BTO flat together with his/her spouse under the HDB’s Public Scheme, Non-Citizen Spouse Scheme or Fiancé/Fiancée Scheme. However, the SPR must be at least 21 years old. A SPR family (meaning a family unit that does not include a Singapore Citizen) is not eligible to purchase a new BTO flat.

HDB Resale Flat

If a SPR and his/her Singapore Citizen spouse buy a HDB resale flat, they must dispose of their private property, if any, within 6 months of purchasing it. For a SPR family (meaning no Singapore Citizen) to buy a HDB resale flat, they must be permanent residents for at least 3 years before they are eligible under the Public Scheme or Fiancé/Fiancée Scheme. They cannot buy resale flats individually.

For more information about the various eligibility schemes and conditions, please refer to the HDB website. More can also be found in the article "Is Investing In HDB Flats A Good Option?".

Conditions for Foreigners Buying Restricted Properties In Singapore

A foreigner who wants to buy a restricted property has to submit an application to the Controller of Residential Property through the Land Dealings Approval Unit (LDAU).

Each applicant is assessed on a case-by-case basis. The considerations include, but are not limited to, the following factors:

- A permanent resident of Singapore for at least five years

- Make exceptional economic contributions to Singapore. This is assessed by taking into consideration factors such as the applicant’s employment income assessable for tax in Singapore

- Possess professional or other qualifications or experience which are of value or benefit to Singapore

Approval Conditions To Own Restricted Properties

Even after approval has been granted to the foreign person, stringent conditions have to be met with regard to property ownership. These include the following:

- Cannot sell within 5 years - the property cannot be disposed of within 5 years. This is calculated from the date of purchase of the property.

- Land Size - the land area of the property should not exceed 15,000 sq ft or 1393.5 sqm.

- Cannot rent out - the property is solely for own occupation and not for other purposes, such as rental.

- Grant of Written Permission - if a foreign owner wishes to rebuild or reconstruct the property, a Grant of Permission must be obtained within 6 months after the date of the letter conveying the Minister’s decision.

Conditions for Foreigners Buying Properties in Sentosa Cove

Under the Singapore property rules since August 2004, foreigners are allowed to buy land parcels and completed bungalows in Sentosa Cove. Although approval is still needed from the Land Dealings Approval Unit (LDAU), the conditions are less stringent. Applications will be subjected to express approval within 2 days, instead of 6 weeks.

However, there are still ownership conditions for such property acquisitions in Sentosa Cove:

- Own occupation - the landed property must be for own occupation. But there is no Minimum Occupation Period (MOP).

- Restricted to one property - foreigners are not allowed to own more than one residential property in Singapore.

- Selling Property - foreigners can resell their Sentosa Cove properties to other foreigners, who must likewise satisfy the same ownership conditions.

Property Stamp Duties Payable by Foreigners

Foreigners buying residential properties in Singapore must pay Buyer’s Stamp Duties (BSD) and Additional Buyer’s Stamp Duties (ABSD). These stamp duties are imposed to curb excessive property speculation to prevent property prices from running ahead of economic fundamentals.

Stamp Duties are taxes on dutiable documents relating to any immovable properties in Singapore. Buyer’s Stamp Duties (BSD) are computed on the purchase price as stated in the document to be stamped or the market value of the property, whichever is the higher amount.

However, the ABSD rate being charged differ between Singapore Citizens, Singapore Permanent Residents and Foreigners. (Note: Nationals or Permanent Residents from Switzerland, Norway, the United States, Iceland and Liechtenstein are eligible for ABSD remission under the Free Trade Agreements (FTAs) and are accorded the same stamp duty treatment as Singapore Citizens).

ABSD is charged on top of BSD and these stamp duties are computed based on the following rates:

| Additional Buyer's Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates from 27 April 2023 |

| SCs buying first residential property | 0% | 0% |

| SCs buying second residential property | 17% | 20% |

| SCs buying third and subsequent residential property | 25% | 30% |

| SPRs buying first residential property | 5% | 5% |

| SPRs buying second residential property | 25% | 30% |

| SPRs buying third and subsequent residential property | 30% | 35% |

| Foreigners buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers | 35% (remittable, subject to conditions) + 5% (non-remittable) | 35% (remittable, subject to conditions) + 5% (non-remittable) |

| Buyer's Stamp Duty (BSD) | ||

| Higher of Purchase Price or Market Value of the Property | Rates on or before 14 February 2023 | Rates on or after 15 February 2023 |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | |

| Amount exceeding $3,000,000 | 6% | |

In addition to BSD and ABSD, Seller’s Stamp Duty (SSD) is payable when a property is sold within 4 years of its purchase. This is to prevent the quick flipping of properties for speculation. SSD is calculated from the date when the buyer exercised the Option to Purchase or Sales and Purchase Agreement. It is based on the selling price or market value, whichever is higher.

SSD is payable according to the following rates:

| SSD Holding Period | Rates from 11 March 2017 to 3 July 2025 | Rates on and after 4 July 2025 |

| Up to 1 year | 12% | 16% |

| > 1 year and up to 2 years | 8% | 12% |

| > 2 years and up to 3 Years | 4% | 8% |

| > 3 years and up to 4 Years | 0% | 4% |

| > 4 years | 0% | 0% (no change) |

For a more detailed explanation of these stamp duties, please refer to "How To Calculate Singapore Property Stamp Duties?"

Singapore Property Rules - Capital Gain And Inheritance Taxes

As explained above, anyone who sells his property within 3 years of its purchase, regardless of whether you are a Singaporean or foreigner, will have to pay the seller's stamp duty (SSD) of up to 16%. Considering that a property can easily cost over $ 1 million nowadays, it's a substantial amount to pay. Hence, be prepared to hold the property for at least 4 years.

However, the good news is that there are no capital gains or inheritance taxes in Singapore.

If you have any queries about investing in new property launches, please Email or WhatsApp Us for an obligation-free consultation.

Property Financing

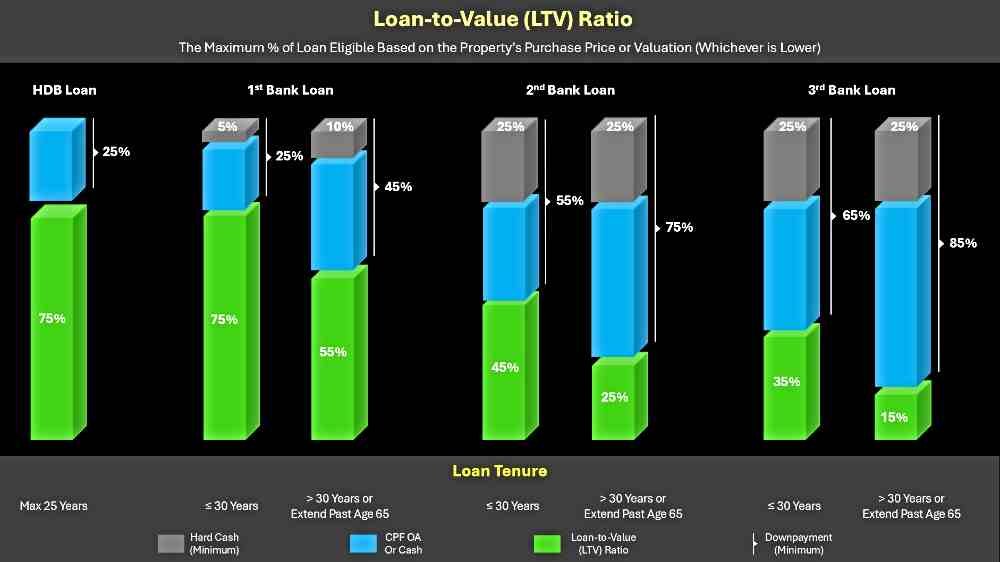

In Singapore, the Loan-to-Value (LTV) ratio for purchasing private property by either Singaporeans or foreigners is set at 75%.

This means they can borrow up to 75% of the property's value from financial institutions, with the remaining 25% downpayment to be paid by cash (minimum 5%) or CPF monies. However, for foreigners who do not have any CPF monies, it has to be paid by cash.

The LTV ratio is a regulatory measure to prevent over-leveraging and ensure financial stability. For loans with a tenure exceeding 30 years, the LTV limit is reduced to 55% (see

infographic below). This framework helps maintain a balanced property market and encourages prudent borrowing practices among property investors.

Other Property Resources

Reviews of New Property Launches

For reviews of new property launches, please click on the links below. More project information can also be found here.

- Property Launches in Core Central Region (CCR)

- Property Launches in Rest of Central Region (RCR)

- Property Launches in Outside Central Region (OCR)