- Understanding Your Financial Position

- Types of Loans for Property Financing

- Risks and Considerations

- Loan Tenure In Property Financing

- Loan-to-Value (LTV) Ratio

- Mortgage Affordability

- The Importance of Credit Scores in Property Financing

- Government Schemes and Grants

- Property Financing Options for Foreigners

- Conclusion

Property financing and investment in Singapore can be a complex process as it requires a wide spectrum of knowledge. These include the following:

- Property financing options and terms.

- Financial assessment and evaluation.

- Government grants, schemes, and taxes.

- Legal and regulatory frameworks.

- Market trend and risk analysis.

- Investment strategies.

Although property investment is a popular way to grow wealth, it is a major financial undertaking due to the high property prices in Singapore. Hence, most investors will require financing to help them with their purchases.

But first of all, it is crucial to do a self-evaluation of one’s own financial position.

Understanding Your Financial Position

Before looking for property financing, it is important to evaluate your financial situation first. By doing so, it will help to determine your affordability and the type of properties to buy. Hence, it is important to assess the following:

- Your Income: What is your monthly income? Do your company pay you any bonuses?

- Your Savings: How much savings do you have, and is it sufficient to cover your downpayment for the property?

- Your Debts: Are there any outstanding debts you are servicing? These may include a car loan, a study loan or credit card debt.

- Other Property-Related Costs: These may include legal fees, renovation expenses, and property agent commissions. Although the latter is negotiable, depending on the type of marketing services rendered, it nevertheless adds to the overall cost of property acquisition.

After completing your assessment, you will have a better understanding of your borrowing capacity and affordability. This information will guide you in the decision-making process, such as the type of property to purchase, setting realistic investment goals, and choosing the appropriate financing option.

Of course, you will still need to know how much a bank or financial institution can lend you. Hence, it is prudent to secure an In-Principle Approval (IPA) from them. An IPA is essentially a commitment by a lender to extend you a home loan up to a specific amount and tenure.

Types of Loans for Property Financing

The most common property financing approach is to secure a housing loan. Therefore, it is important to look around and compare the various financing options available.

Property loans are offered by banks and financial institutions, each with its pros and cons. Hence, it is important to know their terms and conditions while taking into consideration factors such as your investment horizon, the state of the economy and interest rate outlook, as well as penalties and restrictions should you wish to refinance or prepay your loan in the future.

The most common property loans are:

Fixed Rate Mortgage: A fixed-rate housing loan has an interest rate that stays the same throughout the loan term. This means that your monthly instalments will be fixed for each month, unaffected by any fluctuation in market interest rates. This offers certainty about your monthly mortgage payments for the entire loan period.

Floating Rate Mortgage: A floating-rate housing loan is tied to the prevailing market interest rate and is typically based on a certain benchmark rate. In Singapore, the benchmark rate is the Singapore Overnight Rate Average (SORA). This means that your monthly payments could fluctuate, subject to market conditions.

Besides the above, there are several other property financing options, but they are less common, and include the following:

Board Rate Mortgage: A board rate mortgage is a type of home loan where the interest rate is set by the bank, taking into consideration changes in market conditions or its own lending policies. It is not tied to any specific reference rates like SIBOR or SORA. It’s important to note that board-rate mortgages may not be as common or widely offered by banks compared to fixed-rate or floating-rate mortgages.

Home Equity Loan: If you already own a property, you may be able to leverage it to finance your next property investment. A home equity loan is a type of secured loan where the lender will take a lien on your home if you default on it. Home equity loans typically have more favourable interest rates than unsecured loans, such as credit cards.

Personal Loans: A personal loan is a type of unsecured loan where the lender does not require any collateral. However, due to the higher risks that the bank or financial institution is assuming in extending such a loan, it typically has a higher interest rate than secured loans like property loans or home equity loans. Nevertheless, personal loans can still be an option if the investor lacks other financing means.

How much housing loan you can get from a bank will depend on various criteria such as income, credit score, and the type of property you are buying.

Risks and Considerations

Interest Rate Risks – Floating rate mortgages expose borrowers to potential interest rate fluctuations, impacting monthly repayments.

For more certainty on monthly mortgage instalments, borrowers may consider fixed-rate loans instead.

Nevertheless, it is advisable to engage a property consultant who can offer advice on future interest rate expectations to enable you to make an informed decision on the types of loan to opt for. For example, if interest rates are expected to peak soon and subsequently decline, it is advisable to avoid committing to a fixed-rate housing loan, even if it offers a lower interest rate at that point of time.

Whatever type of property financing you decide to take, it is prudent to have a financial contingency plan. This is to ensure you can meet mortgage repayments during unforeseen circumstances, such as job loss or economic downturns.

Loan Tenure In Property Financing

The maximum housing loan tenure in Singapore is capped at:

- 30 years for HDB flats.

- 35 years for non-HDB properties.

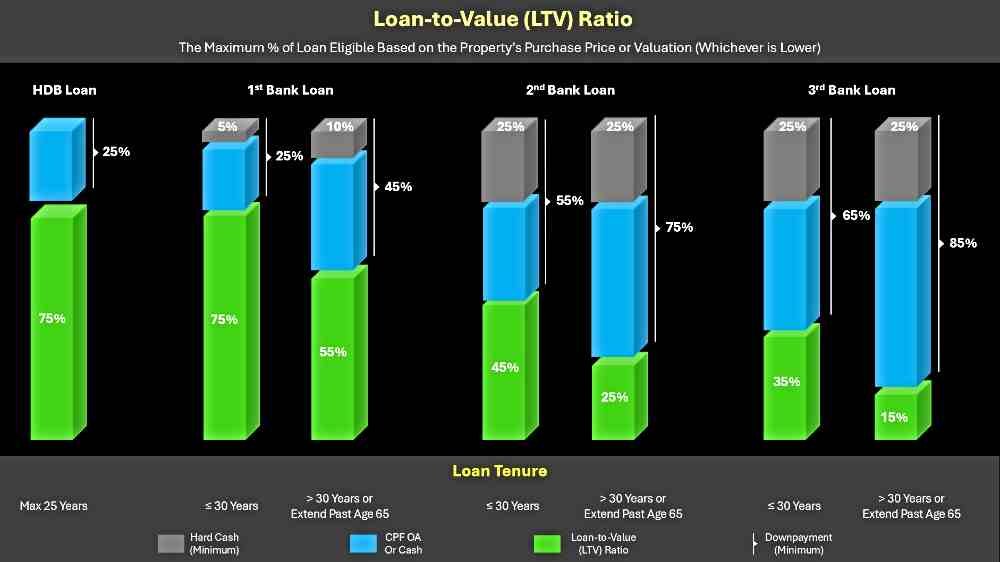

Loan-to-Value (LTV) Ratio

The LTV determines the maximum loan amount a bank or financial institution in Singapore, or the HDB, can provide as a percentage of the property’s value.

LTV ratios vary depending on factors such as the property type, loan tenure, and borrower’s profile.

Bank Loan: The current LTV limit that banks and financial institutions offer for private residential property purchases in Singapore is 75%, with a required minimum cash downpayment of 5%.

HDB Loan: For HDB loans, the LTV is set at 75%. The 25% downpayment can be paid in cash, CPF Ordinary Account (OA) monies, or a combination of both. To help flat buyers with the downpayment, HDB has introduced the Staggered Downpayment Scheme.

Essentially, this allows HDB flat buyers to pay in two instalments. The first to be paid on signing the Agreement for Lease, which is usually six months after flat booking. The second will be due at the time of key collection for the new flat, which typically takes about two and a half to four years to complete.

However, the LTV limit for a loan tenure of more than 30 years for private property and more than 25 years for an HDB flat is 55%. The same applies if the loan tenure extends beyond the borrower’s 65th birthday. The minimum cash downpayment required will be 10% of the house value (Refer to infographic below).

Mortgage Affordability

The amount of a loan disbursed by banks and financial institutions is regulated under two property financing frameworks imposed by the Monetary Authority of Singapore. They are:

Total Debt Servicing Ratio (TDSR): TDSR limits the borrower’s total monthly debt liabilities, which include mortgage repayment, to a maximum of 55% of their monthly income. Effectively, this restrains the borrowing capacity, which in turn, affects the affordability to purchase private properties. It is applied to only non-HDB housing loans.

In other words, if the borrower has other loan commitments such as a hire purchase agreement, car loan, credit card debt, etc, all of them plus the monthly mortgage instalment cannot exceed the 55% threshold.

Mortgage Servicing Ratio (MSR): Similar to the Total Debt Servicing Ratio (TDSR), it pegs a property buyer’s maximum monthly mortgage instalment to their monthly income level.

However, MSR is more stringent, capping borrowing at 30%. But unlike TDSR, it does not consider other existing debt obligations and is only applied to the purchase of HDB flats and executive condos. This is a deliberate government policy aimed at controlling public housing prices to ensure affordability for the general population.

The Importance of Credit Scores in Property Financing

The credit score is a numerical representation of your creditworthiness, and it plays a crucial role in securing property financing in Singapore.

A credit score is a three-digit number that ranges from 1000 to 2000. The higher your score, the better your credit history and the lower your risk of defaulting on loans. Lenders use this score to assess your ability to repay a loan, and it can significantly impact your chances of loan approval, loan rate, loan amounts, and loan terms.

Therefore, maintaining a good credit score is important and requires diligent financial management. These include consistently paying bills on time, keeping credit card utilisation low, and promptly settling any outstanding debts.

Prudent financial management and a strong credit score are essential for securing favourable mortgage terms, ultimately facilitating your property purchase while minimising interest expenses.

Government Schemes and Grants

Singapore citizens and permanent residents can use their Central Provident Fund (CPF) savings for property financing. However, certain limitations and rules apply, such as the CPF usage cap and the Minimum Sum requirement.

The government also provides concessionary housing loans to eligible Singapore citizens for the purchase of HDB flats. The loan terms and interest rates are typically more favourable compared to commercial banks.

To help first-time homebuyers of HDB flats and executive condos, the government provides several housing grants that help to lower the cost of their property acquisitions. However, they come with certain ownership criteria. These criteria will vary for different class of BTO flats launched from October 2024 where they will be classified as Standard, Plus, and Prime.

These include the CPF Housing Grant ($80,000), Enhanced Housing Grant (up to $120,000), and Proximity Housing Grant (up to $30,000). The actual amount they receive will be based on their household income and the type of public housing they are buying – a BTO, HDB resale flat, or an executive condo.

Applying for a new executive condo is different from a BTO. If unsure, you may consider contacting a property agent to assist you with the entire buying process.

Property Financing Options for Foreigners

Foreigners are generally eligible to purchase private properties in Singapore, subject to certain restrictions. However, they are barred from buying HDB flats (public housing) and most landed properties.

To purchase a landed property, foreigners must seek approval from the Land Dealings Approval Unit (LDAU). There are also certain ownership criteria.

The Singapore government imposes additional stamp duty (taxes) on foreign buyers, which has undergone several revisions. The latest on 27 April 2023 saw a hefty increase in Additional Buyer’s Stamp Duty to 60% from 30%.

Foreigners can obtain property financing from local or international banks operating in Singapore when they purchase a property. Typically, the LTV ratio for a first home loan is 75%, and the remaining 25% must be paid in cash.

However, the loan terms and eligibility criteria may vary for foreigners, and it’s advisable to consult a professional property consultant familiar with financing for non-residents.

Conclusion

Successful financing of your property investment in Singapore demands a comprehensive grasp of the available options, eligibility criteria, and associated risks, as well as being conversant with the local property landscape.

Through a meticulous assessment of your financial situation, exploration of mortgage loans, consideration of government housing grants and schemes, and awareness of potential pitfalls, you can make astute decisions to secure the most fitting property financing solution.

Embarking on property investment represents a significant endeavour that can wield a profound impact on one’s financial future. Therefore, it is advisable to seek the expertise of a property consultant who possesses an intimate understanding of the local property market, and who is also conversant with the financial and legal framework governing property transactions.

In addition, he can offer a well-suited investment strategy tailored to your specific needs and aspirations.

The Benefits of Working with a Property Consultant

Expert Advice: A proficient property consultant can offer a wealth of industry knowledge spanning every facet of property financing and investment. These include a deep understanding of the property market, housing loan options, legal requirements, and even financial assessment.

Peace of Mind: Working with a professional consultant allows you to proceed with your property investment with greater confidence and peace of mind, knowing you will be getting expert advice from someone who is qualified and experienced.

Increased Chances of Success: A good consultant can potentially amplify your chances of achieving success by furnishing you with precise market information and invaluable counsel.

Should you have any queries about property financing or wish to find out more about the property market, please feel free to WhatsApp Me.

If you are looking for new property launches, please check out our reviews below:

Core Central Region

- Aurea, a redevelopment of the iconic Golden Mile Complex.

- Union Square Residences, a mixed development near Singapore River and Clarke Quay.

- One Sophia, a mixed development along Selegie Road.

- W Residences – Marina View, a mixed-use development at the heart of CBD.

- Newport Residences, a mixed-use development by CDL at the corner of Keppel Road and Anson Road.

- TMW Maxwell, a mixed-use development opposite The URA Centre.

- Watten House, a premium freehold condo 7 minutes walk from Tan Kah Kee MRT station.

Rest of Central Region

- Bloomsbury Residences, a mixed development at Media Circle in One-North.

- Nava Grove, an exclusive condo at Pine Grove.

- Emerald of Katong, a uniqued condo with Peranakan-inspired designs.

- Meyer Blue, a freehold luxury condo at Meyer Road

- The Arcady, a freehold condo near Boon Keng MRT in District 12

- The Hill @ One-North, a mixed development by Kingsford Property Investment.

- The Continuum, a luxurious freehold condominium by CDL at Thiam Siew Avenue.

- Grand Dunman, a mega condo development by Sing-Haiyi Jade beside Dakota MRT.

- Pinetree Hill, a condo development near the idyllic Sungei Ulu Pandan in District 21.

Outside Central Region

- Lentor Central Residences, the tallest development in the new Lentor Precinct.

- Novo Place, an executive 4 minutes walk from Tengah Park MRT station.

- Bagnall Haus, a freehold condo opposite Sungei Bedok MRT station.

- Kassia, a freehold condo in a private residential enclave at Flora Drive

- Lentor Hills Residences, a condo development overlooking Hillock Park.

- The Myst, a condominium near Cashew MRT and Bukit Panjang integrated transport hub.