River Modern Preview: 20 February – 1 March, 2026 This is an in-depth River Modern condo review, a 99-year leasehold mixed development with commercial shops on the ground floor by GuocoLand, one of Singapore’s real estate developers known for transforming neighbourhoods. Located at River Valley […]

Continue readingCategory Archives: Core Central Region New Launches – Singapore’s Prime Property Market Insights

- Why Invest in River Modern Condo?

- River Modern Fact Sheet

- River Modern Unit Mix & Distribution

- What are the Prices for River Modern Condo?

- About GuocoLand, River Modern's Developer

- River Modern Design Concept & Features

- River Modern Condo Location

- Transport Connectivity

- Shopping Malls Near River Modern Condo

- Leisure and Entertainment Options

- Medical Centres and Healthcare Services

- Schools and Educational Institutions Near River Modern Condo

- River Modern’s Investment Potential

- Comparative Market Analysis

- Conclusion

- New Property Launches

In our Core Central Region property market insights, we examine one of Singapore’s most prestigious residential segments. Singapore’s private properties are generally classified into three key geographical zones:

- Core Central Region (CCR).

- Rest of Central Region (RCR).

- Outside Central Region (OCR).

This market insight will explore the Core Central Region’s (CCR) distinct market characteristics, its prevailing buyer profiles, and the latest developments that continue to shape demand and investment trends in this high-end property segment.

The CCR encompasses the most coveted and luxurious residential areas of the city-state. It covers prime locations such as Orchard Road, Marina Bay, Sentosa, Downtown Core, Holland Road and Bukit Timah.

Besides being home to luxurious condominiums, exclusive landed estates, and some of the city’s most sought-after addresses, it also offers a dynamic mix of world-class shopping destinations, fine dining restaurants, and vibrant entertainment options that cater to diverse lifestyles.

The district also boasts rich cultural and heritage landmarks, blending modern sophistication with timeless charm. This cosmopolitan atmosphere, together with its thriving community, has propelled Singapore into one of the most desirable and multifaceted countries to live, explore, and invest in.

When compared to the Rest of Central Region (RCR) and Outside Central Region (OCR), the CCR offers a unique and premier urban living experience.

For a quick overview of the characteristics of Singapore’s three main regions, please refer to CCR, RCR, and OCR Market Insights.

Unique Characteristics of Singapore’s Core Central Region

The CCR is highly valued for its central location and is at the very core of Singapore’s urban landscape, which includes the Central Business District (CBD) and Marina Bay.

Its access to high-end shopping and dining, as well as abundant entertainment options, and major transportation nodes clearly differentiate it from the RCR (city fringe) and OCR (suburbs).

Beyond commercial vibrance, the CCR also offers a distinctive cultural vibe that enriches its residential appeal.

The Civic District enhances this allure with heritage landmarks like the National Gallery Singapore, Asian Civilisations Museum, Fort Canning Park, and Victoria Concert Hall, blending colonial architecture, cultural exhibitions, and green spaces for an enriching, walkable lifestyle.

Meanwhile, the Arts District around Waterloo Street and Bras Basah offers a vibrant creative ecosystem with museums, galleries, performance venues, and cultural spaces that further enhance CCR’s urban lifestyle.

Not forgetting, the annual Formula One’s inaugural night race held at Singapore’s Marina Bay Street Circuit attracts a global audience of 70 to 80 million.

The high prices in the Core Central Region (CCR) can be attributed to its limited land supply and sustained demand from affluent locals, expatriates, and foreign investors.

This demand is further reinforced by the region’s cosmopolitan lifestyle, where luxury living is seamlessly integrated with vibrant cultural diversity and premium urban conveniences.

On the other hand, the RCR offers a mix of convenience and affordability, while the OCR offers a more peaceful, suburban living at a lower price point.

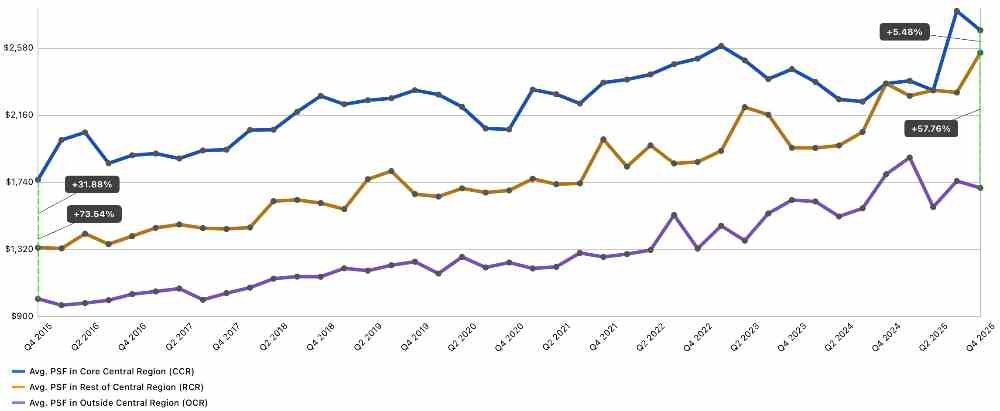

Chart 1 below shows the 20-year average price per square foot (psf) appreciation of residential properties across the CCR, RCR, and OCR.

The Core Central Regions (CCR) Investment Potential

Despite the high land prices and entry costs, the property investment potential of the CCR is still strong.

Long-term data have consistently displayed capital growth, driven mainly by land scarcity and steady demand for luxury residences.

In the rental market, CCR properties are attractive to expatriates and high-income professionals who value exclusivity and convenience. They include those working in Singapore’s Downtown Core, covering areas such as the Central Business District and Singapore’s financial centres in Raffles Place and Marina Bay.

Although rental yields may be lower than the RCR and OCR due to their higher property prices, CCR properties are valued for their long-term capital gains, ideal for those seeking wealth accumulation and asset preservation over time.

Reflecting the area’s prestige, new property launches in the CCR offer premium fittings, fixtures, equipment, and finishes, as well as extensive facilities, which attract well-heeled and discerning home buyers and investors.

However, in recent years, they have also attracted young professionals and rich empty-nesters seeking a vibrant and dynamic lifestyle.

Sales of New Property Launches in Core Central Region

Recent new launches in the CCR include Union Square Residences, One Sophia, The Robertson Opus, One Marina Gardens, Upperhouse At Orchard Boulevard and Skye At Holland.

Of these projects, Skye at Holland performed the best, selling 658 (98.8%) of its 666 units at an average price of $2,953 psf during its sales launch. The strong demand can be attributed to its attractive price point, vibrant locale near Holland Village and a short stroll to the Holland MRT station.

Although most buyers in Singapore’s residential market are Singapore Citizens and Permanent Residents – largely due to the 60% Additional Buyer’s Stamp Duty (ABSD) imposed on foreign purchasers – there are still notable exceptions.

In a recent case, a Cambodian national acquired a unit at One Marina Gardens despite being subject to the full 60% tax on the property’s purchase price.

Also, the strong growth of family offices in Singapore has further underpinned demand for prime residential assets. Many of these ultra-high-net-worth individuals have sought stability and wealth preservation by taking advantage of Singapore’s political stability, robust governance, favourable tax framework, and strong financial ecosystem.

To avoid the hefty 60% ABSD, many of them have acquired Singapore citizenship or permanent resident status, which eliminates or reduces the ABSD payment substantially.

The above developments underscore the enduring appeal of Singapore’s real estate. Even in the face of stringent policies, it is highly regarded as a safe-haven asset amid the ongoing global economic and geopolitical uncertainties.

Units at Ultra-Luxury Market Transacted Above $6,000 psf

In 2025, Singapore’s ultra-luxury property market witnessed a significant surge, with five transactions surpassing the $6,000 psf threshold – nearly matching the total of six such deals recorded between 2011 and 2024.

These transactions were driven by high-net-worth individuals, including Singaporeans and Permanent Residents, seeking rare, move-in-ready assets in the Core Central Region.

A Park Nova penthouse led the way, achieving the second-highest psf price in Singapore’s history.

These high-value deals reflect a narrowing price gap between prime and city-fringe properties, further boosting the appeal of top-tier luxury developments.

Properties breaching $6,000 psf in 2025

- Park Nova: A 5,899 sq ft penthouse sold for $38.89 million ($6,593 psf).

- Skywaters Residences: An Aman-branded residence sold for $11.69 million ($6,501 psf).

- The Marq on Paterson Hill: A resale unit sold for $19.18 million ($6,274 psf).

- Sculptura Ardmore: Two units were sold for $20 million – one at $6,193 psf and the other at $6,013 psf.

Navigating Singapore’s Residential Real Estate Market

Nevertheless, investing in Singapore’s residential real estate requires the necessary knowledge to navigate the complex regulatory environment and market dynamics. These include government policies, economic factors, and market trends that can significantly impact property values and investment returns.

Some of the key government regulations – including strict foreign ownership rules, property cooling measures such as Additional Buyer’s Stamp Duty (ABSD), and stringent loan-to-value (LTV) limits – are crucial instruments in shaping Singapore’s residential property market.

These policies directly influence eligibility, affordability, and overall investment viability. As such, understanding them is fundamental to mitigating regulatory risk, structuring purchases effectively, and ultimately optimising returns within Singapore’s highly controlled and tightly regulated property landscape.

In addition, keeping tabs on macroeconomic developments such as supply-demand balance, GDP growth, employment rates, and interest rate movements are crucial, as these factors will influence the market’s performance.

For a more detailed understanding of Singapore’s residential, please refer to our property resources and guides.

URA Master Plans – Shaping Singapore’s Core Central Region

Understanding Singapore’s Urban Redevelopment Authority (URA) master plans is crucial in making informed investment decisions.

These include the Master Plan and Concept Plan, formulated to meet the long-term needs of land-scarce Singapore.

The Master Plan covers a 10 to 15-year period into the future and is reviewed every five years. It works in tandem with the broad long-term strategies outlined in the Concept Plan, which provides land use plans covering a 40 to 50-year period.

In this regard, the URA Master Plan plays a crucial role in guiding the phased development of the CCR, which includes new homes, offices, hotels, and lifestyle precincts, alongside transport upgrades and green networks.

The aim is to create round-the-clock “live-work-play” districts, moving beyond the traditional work-centric model. The plan also emphasises enhanced pedestrian connectivity and preservation of heritage sites to boost liveability and vibrancy within the city core.

This will help to maintain its position as Singapore’s premier business and residential hub.

Undertaking such a forward-looking approach will ensure that the CCR remains attractive and investment-worthy, with a well-calibrated pipeline of future projects supporting both liveability and long-term investment value.

Government Land Sales (GLS)

The Core Central Region (CCR) has seen some of the most competitive bidding in 2025, particularly for sites located in the prime District 10 (Holland) and District 11 (Newton/Bukit Timah) areas.

Recent government land tenders have attracted strong developer appetite for Core Central Region (CCR) sites, signalling confidence in Singapore’s prime residential market.

For example, the Bukit Timah Road (Newton) site attracted eight bids, with HH Investment securing it at $1,820 per square foot per plot ratio in November 2025.

Similarly, the Dunearn Road (Turf City) parcel generated nine competing bids, awarded to a consortium comprising Frasers, Sekisui House, and CSC Land at $1,410 psf ppr in July 2025.

As for the Holland Link site, it drew five bids and was awarded to Sim Lian at $1,432 psf ppr in July 2025.

Based on these land prices, new projects in these areas may be launched at prices up to $3.400 psf to $3,600 psf.

These competitive bids reflect several converging factors.

- Pent-up demand from high-net-worth individuals and expatriates seeking premium residences has strengthened amid Singapore’s favourable economic outlook.

- The scarcity of well-located CCR land creates supply constraints that support prices and future capital appreciation potential.

- Developers recognise that CCR properties’ unique attributes – including proximity to the CBD, cultural precincts, prestigious schools, and lifestyle amenities – justify their premium positioning.

The narrowing price gap between CCR and city-fringe/suburban properties further enhances the former’s investment appeal. Chart 2 below shows the 10-year average price per square foot (psf) trends for CCR, RCR, and OCR.

- CCR vs RCR: from +31.88% to +5.48%.

- CCR vs OCR: from +73.54% to +57.76%.

Developers are also capitalising on improved market sentiment following policy stabilisation and economic resilience, viewing CCR acquisitions as strategic long-term investments that align with Singapore’s continued urbanisation and wealth accumulation trends.

| GLS Site | Winning Developer / Consortium | No. of Bids | Land Cost (psf ppr) | Award Date |

| Bukit Timah Road (Newton) | HH Investment (Huang Hsiang) | 8 | $1,820 | Nov 2025 |

| Dunearn Road (Turf City) | Frasers, Sekisui House & CSC Land | 9 | $1,410 | Jul 2025 |

| Holland Link | Sim Lian Land & Sim Lian Development | 5 | $1,432 | Aug 2025 |

Conclusion

In conclusion, Singapore’s Core Central Region (CCR) stands as the island’s unrivalled prime residential enclave, defined by its exclusivity, comprehensive urban integration, and exceptional lifestyle offerings.

CCR properties offer far more than just a shelter over your head; they represent a strategic asset, providing investors with solid capital preservation, good long-term appreciation prospects, and consistent rental demand from a high-calibre tenant pool.

For discerning homeowners, the CCR represents the epitome of luxury urban living – a singular address that encapsulates status, convenience, and unparalleled access to the very best the city has to offer.

The premium attached to CCR ownership is ultimately the premium paid for world-class assets, enduring value, and unrivalled prestige.

Core Central Region Property Reviews

The following are some of the latest property launches in the Core Central Region (RCR):

- Newport Residences at Anson Road.

- W Residences at Marina View.

- Upperhouse At Orchard Boulevard.

- Robertson Opus at Robertson Quay.

- Union Square Residences at Clarke Quay.

- The Collective @ One Sophia at Sophia Road.

For a more information on Singapore’s residential, please refer to our property resources and guides. These include:

- Property Investment Guides

- Property Regulations

- Private Property Guides

- Executive Condo Guides

- HDB Guides

- Property Finance & Costs

- Property Marketing

- Property Hotspots

WhatsApp me if you have any questions about Singapore’s residential real estate market.

Core Central Region District Numbers and Planning Areas

| District Number | Planning Area |

| 1 (Part) | Boat Quay, Raffles Place, Marina Downtown, Suntec City. |

| 2 (Part) | Shenton Way, Tanjong Pagar. |

| 4 (Part) | Sentosa. |

| 6 (Part) | City Hall. |

| 7 (Part) | Bugis. |

| 9 | Orchard, Somerset, River Valley. |

| 10 | Tanglin, Bukit Timah, Holland. |

| 11 | Newton, Novena, Dunearn, Watten. |

Newport Residences Condo Review: Location, Price, Investment Analysis

This is a review of Newport Residences, an upcoming freehold mixed-use development located at 80 Anson Road in Singapore’s prime District 2 next to the Greater Southern Waterfront. Within walking distance of the Price Edward (Circle Line) and Tanjong Pagar (East-West Line) MRT stations, there […]

Continue readingW Residences – Marina View: Condo Review & Investment Analysis

This is an in-depth property review of W Residences – Marina View, a luxurious 51-storey mixed-use development integrated with a hotel within the Central Business District (CBD) in Singapore’s District 1. Located at Marina View just off Shenton Way in the Marina Bay area, it […]

Continue readingAurea Condo Review: Reimagining of Iconic Golden Mile Complex

This is a property review of Aurea, a 99-year mixed-use development on Beach Road just a 5-minute walk from the Nicoll Highway MRT station in Singapore’s District 7. Redeveloped from the conserved Golden Mile Complex, it will comprise a commercial development with 156 Grade A […]

Continue readingOne Sophia Review: Prime Mixed-Use Development in District 9

This is a property review of The Collective at One Sophia (former Peace Centre), a 99-year leasehold mixed-use development at Sophia Road in Singapore’s prime District 9. To be jointly developed by renowned developers CEL Development and SingHaiyi Group following their successful en bloc acquisition […]

Continue readingUnion Square Residences Review: Exclusive Mixed-Use Development by CDL

This is a property review of Union Square Residences, a mixed-use development by City Developments Ltd (CDL) located at the corner of Havelock Road and Keng Cheow Street, near the vibrant Clarke Quay. It is within walking distance of Clarke Quay, Singapore River, Chinatown, Boat […]

Continue readingUpperhouse @ Orchard Boulevard Review – Integrated Development in Prime District 10

This is an in-depth property review of Upperhouse @ Orchard Boulevard, a prestigious 99-year leasehold integrated development located at the junction of Orchard Boulevard and Grange Road in Singapore’s prime District 10. Its address is 22 Orchard Boulevard 249628. Beside it is the exclusive Chatsworth […]

Continue readingOne Marina Gardens Review: An Investment Risk or Opportunity?

This is an in-depth property review of One Marina Gardens is a luxurious 99-year leasehold integrated development connected to the Marina South MRT station and next to Gardens by the Bay in Singapore’s District 1. To be developed by Kingsford Development Pte Ltd, it aims […]

Continue readingSkye At Holland Review: Prime District 10 Condo Near Holland Village

This is a property review of Skye At Holland, a 99-year leasehold condo development with two 40-storey blocks offering 666 residential units ranging from 2- to 5-bedroom. Located at Holland Drive, it is a stone’s throw from the vibrant Holland Village in Singapore’s Prime District […]

Continue readingRiver Green Condo Review: Direct Link to Great World City & MRT

This is a in-depth property review of River Green Condo, a 99-year leasehold development located next to the Great World MRT station on the Thomson-East Coast Line and directly linked to Great World City Shopping Mall, a 3-minute walk away. It will be developed by […]

Continue readingThe Robertson Opus Review: 999-Year Mixed Development at Robertson Quay

This is an in-depth property review of The Robertson Opus, a luxury mixed development located at Unity Street in vibrant Robertson Quay, Singapore’s prime District 9. Situated just a 5-minute walk from Fort Canning MRT station, it will be the first new launch in the […]

Continue readingWatten House Condo Review: Location, Price, Investment Analysis

This is a review of Watten House, a luxurious freehold condominium at Bukit Timah in Singapore’s prime District 11. It is just 7 minutes walk from the Tan Kah Kee MRT station on the Downtown Line. The site was formerly occupied by the Watten Estate […]

Continue readingTMW Maxwell Condo Review: Mixed-Use Development Near Maxwell MRT

This review of TMW Maxwell, a forthcoming mixed-use development that will offer 324 residential units, 8 restaurants, and 3 retail outlets. It will be constructed on the site of the former Maxwell House, a commercial building located in Singapore’s coveted District 2. Maxwell House was […]

Continue readingHill House Review – District 9 Condo Near Fort Canning MRT

This is a review of Hill House, an exclusive and luxurious 999-year leasehold condo development located at Institution Hill, just off River Valley Road, in Singapore’s prime District 9. Located at 10A, 10B, and 11 Institution Hill and offering 72 residential units of 1- to […]

Continue reading10 Evelyn Review – A Boutique Freehold Condo In District 11 Near MRT

This is a review of 10 Evelyn, a freehold condo development located at 10 Evelyn Road in Singapore’s prime District 11, just off Newton Road. Consisting of four 5-storey blocks comprising a total of 56 units of 1- to 3-bedrooms, it is within walking distance […]

Continue readingJervois Mansion Review – Freehold Condo In Exclusive District 10

This is a review of Jervois Mansion, a freehold low-rise condo development by Kimen Realty Pte Ltd and Roxy-Pacific Holdings Ltd. Consisting of six 5-story blocks totalling 130 exclusive units, it is located in the prime residential District 10 near the Malaysia High Commission and […]

Continue readingPerfect Ten Condo Review & Investment Analysis

This is a review of Perfect Ten, a luxurious freehold condo development in Bukit Timah. Nested within Singapore’s prime District 10, it will occupy the site of the former City Towers that was sold en-bloc in August 2019 to Japura Development, a company linked to […]

Continue readingIrwell Hill Residences Review – District 9 Condo By CDL

This is a review of Irwell Hill Residences, an exclusive condo development in Singapore’s prime District 9 by City Developments (CDL). Irwell Hill Residences will comprise two 36-storey blocks offering a total of 540-units (537 units of 1- to 4-bedrooms plus 3 Sky penthouses). It […]

Continue readingThe Atelier Review – Freehold, D9 Condo @ Newton

This is a review of The Atelier, an upcoming freehold condo at Makeway Avenue in Singapore’s prime District 9. Located in the coveted Newton/Novena enclave and at the fringe of Orchard Road, it is expected to be well-received by both locals and foreign investors. In […]

Continue readingOne Bernam @ Tanjong Pagar – Condo Review

This is a review of One Bernam condo, a mixed-use development in Tanjong Pagar in Singapore’s District 2. It will consist of a 35-storey development comprising of a 2-storey commercial podium, 1-storey service apartments (13 units) and 32-storey residential tower (351 units) that comes with […]

Continue readingMidtown Modern By GuocoLand – Condo Review

This is a review of Midtown Modern, an exclusive integrated development to be built atop the Bugis MRT interchange station and along Tan Quee Lan Street which features a row of conserved shophouses. Situated just across Bugis Junction, it enjoys a plethora of retail, dining, […]

Continue readingKopar At Newton – An Investment Overview

The Kopar At Newton condominium is an exclusive development in Singapore’s prime District 9 near the Newton Circus. It is just opposite the famous Newton Food Centre and about 5 minutes walk to the Newton MRT station. Surrounding it are mostly high-end residential properties, hotels […]

Continue reading