The 2024 government land sales (GLS) will add a supply of 5,050 private homes (including 560 EC units) and 14,300 sqm GFA of commercial space in the second half of this year.

This will add to the 5,450 units in the first half of 2024.

The Confirmed List comprises nine private residential sites (including one EC site) and one commercial & residential site.

This will bring a total supply of 11,110 private residential units for the 2024 government land sales (including 610 units from the activated Reserve List site tendered out in May 2024). This is the highest supply being introduced in a single year since 2013.

Under the Reserve List are five private residential sites (including two EC sites), one commercial site, two White sites and one hotel site. These sites can potentially yield an addition of 3,090 private residential units (including 730 EC units), 99,350 sqm GFA of commercial space and 530 hotel rooms.

| RESIDENTIAL SITES | |||||||

| S/N | Location | Site Area (ha) | Proposed GPR | Est. No. of Residential Units | Est. Commercial Space (sqm) | Est. Launch Date | Sales Agent |

| 1 | Tampines Street 95 (EC) | 2.25 | 2.5 | 560 | 0 | Aug 2024 | HDB |

| 2 | Faber Walk | 2.58 | 1.4 | 400 | 0 | Sep 2024 | URA |

| 3 | Lentor Gardens | 2.06 | 2.1 | 500 | 0 | Oct 2024 | URA |

| 4 | River Valley Green (Parcel B) | 1.17 | 3.5 | 580 | 500 | Oct 2024 | URA |

| 5 | Bayshore Road | 1.05 | 4.2 | 515 | 0 | Nov 2024 | URA |

| 6 | Media Circle (Parcel A) | 0.81 | 3.7 | 345 | 400 | Nov 2024 | URA |

| 7 | Media Circle (Parcel B) | 0.97 | 4.3 | 485 | 400 | Nov 2024 | URA |

| 8 | Chuan Grove | 1.58 | 3.0 | 550 | 0 | Dec 2024 | URA |

| 9 | Holland Link | 1.72 | 1.4 | 240 | 0 | Dec 2024 | URA |

| COMMERCIAL & RESIDENTIAL SITES | |||||||

| 10 | Chencharu Close | 2.94 | 3.2 | 875 | 13,000 | Sep 2024 | HDB |

According to the Ministry of National Development, the residential property market has stabilised, with price momentum easing after more units were launched over the last two years as the government land sales programme is being accelerated.

This can be seen in the first quarter of 2024 where private home prices in Singapore rose by 1.4%, a slowdown from the 2.8% increase in the previous quarter. This marks the slowest quarterly gain since the third quarter of 2021.

Singapore Market Outlook for 2024

The private residential market in Singapore is poised to maintain its moderate uptrend in 2024, with some analysts predicting a potential price increase of up to 5%.

The market anticipates the launch of approximately 30 to 40 new projects, introducing between 7,000 to 8,000 units. Despite the potential increase in supply of new private homes from the 2024 government land sales, persistently high interest rates and an uncertain economic outlook, significant price corrections are unlikely.

The firmness in property prices can be attributed to inflationary pressures coupled with elevated land acquisition and construction costs.

An illustrative case is the Urban Redevelopment Authority’s (URA) rejection of a $770.46 million bid in January 2024 by a consortium comprising GuocoLand, Hong Leong Holdings, and TID for a government land sale (GLS) site at Marina Gardens Crescent. This consortium was the sole bidder for the 1.73-hectare white site, translating to a land cost of $984 per square foot per plot ratio (psf ppr).

The reason for the URA’s rejection is that the land bid is deemed “too low”.

Proactive Government Measures

The Singapore government’s strategic and proactive land use planning is critical to ensure a balanced supply-demand dynamic, preventing sudden market imbalances and unexpected price fluctuations.

Hence, the increase in private housing supply can be seen as a attempt to further moderate housing prices, which have surged by a hefty 49.6% since their low in Q2 2017. This has fuelled much disquiet amongst Singaporeans which may become a hot political issue ahead of the next general election that needs to be called by 23 November 2025.

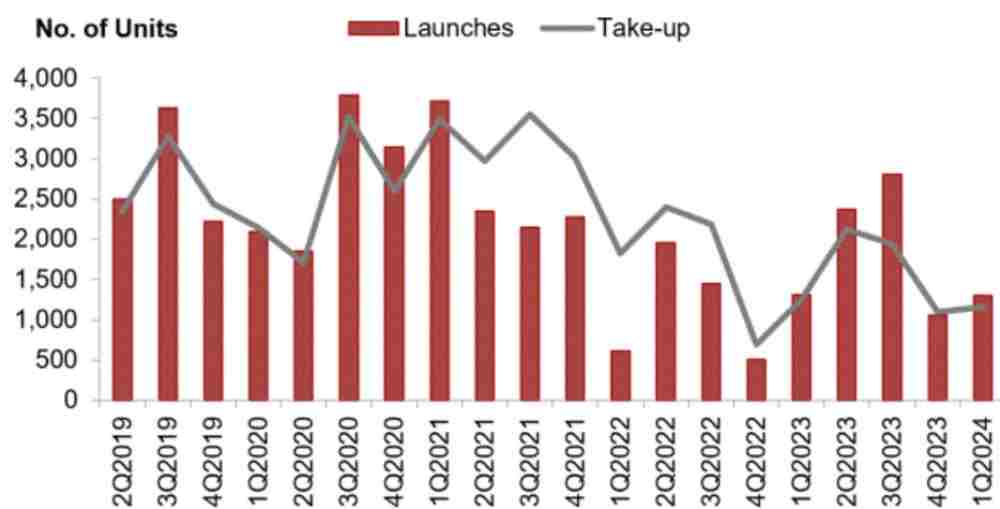

Meanwhile, the supply of new private housing has been relatively limited in the last three years, as illustrated in the chart below.

At the same time, the government has implemented various “property cooling measures,” such as the Additional Buyer’s Stamp Duty (ABSD) and Seller’s Stamp Duty (SSD), to curb speculative activities and maintain long-term market stability.

As a result, despite the cautious sentiment among developers and buyers, the Singapore property market in 2024 is expected to experience further moderate price growth, reflecting the government’s effective interventions and the market’s inherent resilience where many still aspire to upgrade from public housing to private properties.

Upcoming Private Property and EC Launches

- Sora, a 440-unit condo overlooking the scenic Jurong Lake Gardens.

- Kassia, a 276 unit freehold ccondo at Flora Drive in District 17.

- Meyer Blue, a rare freehold luxurious condo overlooking East Coast Park.

- The Chuan Park, a 916-unit condo next to Lorong Chuan MRT station.

- Novo Place, an executive condo a short walk from Tengah Park MRT station.

Property Resources

- How to Buy a New Launch Private Property.

- How to Buy a Resale Private Property.

- Are Executive Condos Good a Good Investment Property?

- Executive Condo FAQs.

- Executive Condo Eligibility.

- How to Choose a Housing Loan.

- Property Agent Commission Guide.

- New HDB Resale Flat Portal.