New launch vs resale condo – which is the better investment choice?

Choosing between a new launch and a resale condo involves weighing many key factors. Each option offers distinct advantages and disadvantages that can affect investment returns, financial objectives, and personal needs.

This investment analysis aims to provide a balanced perspective on both choices, examining factors like income generation, capital appreciation potential, risk consideration, and financial assessment.

A Brief Overview: New Launches vs Resale Condos

New launch condos are typically purchased through developer brochures, advertising, and showflat visits prior to completion. While they offer modern designs, extensive facilities, and potential for higher capital appreciation, they also carry inherent risks.

As construction takes about 3-5 years, accurately projecting future investment and rental returns can be tricky.

In contrast, resale condominiums are typically older properties previously occupied, offering investors the opportunity to acquire a tangible, existing asset with a known history. For example, information about their neighbourhoods, existing amenities, past transaction prices and rental rates, are readily available.

For property investors, the choice between a new launch and a resale condo is rarely straightforward. Much will depend on their primary purpose for purchasing the property, individual investment goals, risk tolerance, and financial capacity. Hence, understanding the intricacies of each option is crucial for making an informed decision.

Key Considerations for Property Investors

Some of the key factors that influence a property investor’s choice between new launch and resale include the following:

- Immediate vs Delayed Income: Resale condos offer the advantage of immediate rental income. This is because owners can let out their resale units almost immediately after purchase. In contrast, new launch condos may take several years to complete, delaying any potential rental income. Therefore, for property investors looking for immediate cash flows, the preferred option is resale condos.

- Predictability of Income: With resale condos, predicting rental income is easier as owners can analyse current and past rental data from sources like the URA website to understand trends and estimate potential returns. New launch condos lack this predictability, as future rental rates are based on projections and market conditions may change when they are completed.

- Physical Inspection: When buying a resale property, you can physically inspect the actual unit. This means you can check its condition thoroughly and identify any problems that need repairs before you commit to buying. With new launch condos, you rely on show flats and brochures, which sometimes do not perfectly match the final product.

- Interior Design: For resale condos, you can renovate to your preferred design and tastes. As for new launch condos, most fittings and provisions are fixed and largely standardised for the whole development.

- Unit Size and Layout: Resale condos are often more spacious than new launch units, which will appeal to property investors and tenants. This is important for accommodating larger families or to maximise rental potential. Newer condos tend to be smaller to keep the price quantum more affordable.

- Price Negotiation: Resale condos often provide more room for price negotiation. Investors can sometimes secure a better deal, especially when sellers are motivated to sell quickly. For new launches, prices are by the developers.

- Maintenance and Defects: New launch condos come with a one-year defects-free period, where the developer is responsible for rectifying any issues within this timeframe. Resale condos, however, might require immediate renovations or repairs, which can add to the initial acquisition costs.

- Potential for Appreciation: New launch condos often benefit from the “first-mover advantage”, where prices tend to appreciate more significantly upon completion of the development and surrounding infrastructure. Buyers of new launches may also benefit from developers’ early-bird promotions. Resale condos, while generally appreciating over time, may not experience the same level of price growth.

- Flexibility of Payment: New launch condos typically offer progressive payment schemes, allowing property investors to spread out their payments over the construction period. This can lower the initial capital outlay and ease the financial burden. In addition, less interest payments will be incurred during this period. Resale condos will require a 25% downpayment and immediate servicing of the full loan amount once the purchase is completed in about 8-12 weeks.

- Market Conditions: If the rental market is on an upswing, resale units may take advantage of the current market conditions. Conversely, if the rental market is in a lull, a new launch condo may make more sense by waiting out the construction period and taking delivery later, letting the market improves over time.

Side-by-Side Comparison: New Launches vs Resale Condos

To further clarify the differences, the following table summarizes the pros and cons of new launch versus resale condos:

| Feature | New Launch Condos | Resale Condos |

| Immediate Rental Income | No – delayed until completion | Yes – almost immediate upon purchase |

| Income Predictability | Lower – based on future projections | Higher – based on current available data |

| Physical Inspection | No – can only based on show units during the sales launch | Yes – full inspection of the unit. You see what you get |

| Unit Size | Often smaller, designed for affordability | Usually larger, more spacious |

| Price Negotiation | No – prices set by developers | Yes – can be negotiated |

| Maintenance/Defects | A one-year defects-free period is offered by developers | May require immediate renovations/repairs |

| Capital Appreciation | Higher potential for significant appreciation due to first-mover advantage and attractive early-bird discount given by developers | Usually more moderate appreciation due to ageing and lease decay |

| Payment Flexibility | More flexible payment schemes, such as progressive payments, which can lower initial capital outlay and resulting in lower interest payments | Requires larger down payment upfront and almost immediate full monthly instalment payments |

| Unit Choice | Wider range of choices at launch, such as facing, floor level, or unit number | Limited to what is available on the market |

| Facilities | Newer, more modern and comprehensive | Older and may be dated, usually less comprehensive |

| Location Options | Limited to areas where new developments are being launched | A wider choice of locations |

| Renovation Requirement | Minimal, as new units come with new fittings | Usually required, as older units suffer from wear and tear |

| Financial Flexibility | Banks will match the valuation of the new launch property | Banks may value the property lower than the purchase price, requiring cash-over-valuation (COV) |

| Maintenance Fees | Usually lower as development is new | Usually higher due to age |

| Risk | More risk due to potential construction delay and uncertain future investment projections | Less risk due to predictable rental rates and transaction history of existing properties near it |

Case Studies: Profitability of New Launch Condos

One of the most compelling reasons investors are drawn to newly launched condos is their potential for faster capital appreciation and higher profitability. This profitability is not solely due to the newness of the property but is also influenced by market dynamics and payment structures:

- First-Mover Advantage: As noted earlier, buyers of new launches often benefit from being the “first movers”, like receiving early-bird discounts and the opportunity to select the best units. They may also benefit from a developing area. As amenities around a property gets built up, its value will likely increase, enabling it to be sold at a profit.

- Progressive Payment Scheme: New launches typically come with a progressive payment scheme, meaning the buyer pays at different stages of the construction. This approach requires a lower initial capital outlay compared to resale units. For example, a buyer may only need to pay a 5% deposit and 15% on exercising the deal. The remainder of the payments are structured based on construction milestones. This payment flexibility reduces the immediate financial burden, allowing investors to use their funds for other opportunities.

- Reduced Interest Payments: The progressive payment scheme for new launches requires a lower initial capital outlay as payments are stretched over the entire construction period. Full loan servicing is also required upon completion of the development. As a result, property investors pay less interest on their mortgage loans during this period. However, those purchasing a resale property would have to service the full mortgage payments almost immediately after the purchase, leading to higher interest payments.

- Initial Entry Point: Developers of new projects often offer special launch prices such as early-bird discounts or promotions, which can result in considerable savings and enhance profitability. Also, buyers do not have to pay agents’ commissions when purchasing new launch properties, helping to reduce initial costs.

- Price Preservation & Support: Owners who purchase new launches are more likely to make a profit because developers control the prices. Usually, after selling a certain percentage of a development, prices will be raised. Hence, resale buyers will face higher prices when owners decide to sell them once they have cleared the three-year selling stamp duty period, or after the completion of the development.

- Tenant Preference: New condos with more comprehensive and better facilities are often preferred by tenants, leading to higher rental yields.

- Larger Potential Returns: Data shows that new launch condos have historically outperformed resale units in terms of capital appreciation. This is even though new launches cost more than similar resale units in the same vicinity at the point of entry.

To demonstrate this, we undertake three case studies focusing on developments located in the Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR). By analysing properties in these distinct market segments, these case studies offer a comprehensive overview of Singapore’s property investment landscape and its dynamics.

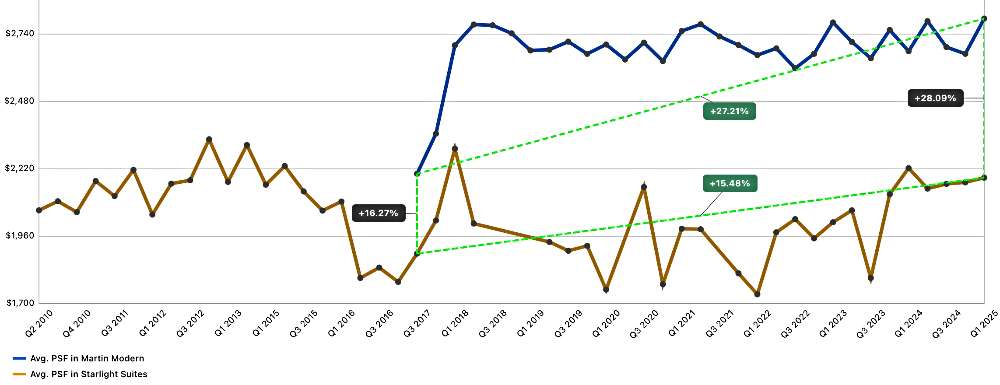

Capital Appreciation Comparison: Martin Modern versus Starlight Suites (CCR)

- Martin Modern Launch Date: July 2017

- Starlight Suites Launch Date: April 2010

During the launch of Martin Modern in July 2017, it was sold at an average price premium (psf) of 16.27% over the prevailing average resale transacted price of Starlight Suite. Both developments are located about 120m apart at River Valley Close in prime District 9.

Since then till Q1 2025, Martin Modern and Starlight Suites appreciated by 27.21% and 15.48% respectively. This widens the price premium from 16.27% to 28.09% (See Chart 1).

Interestingly, Martin Modern is a 99-year leasehold development while Starlight Suites is a freehold. This illustrates that freehold developments may not necessarily offer better investment returns.

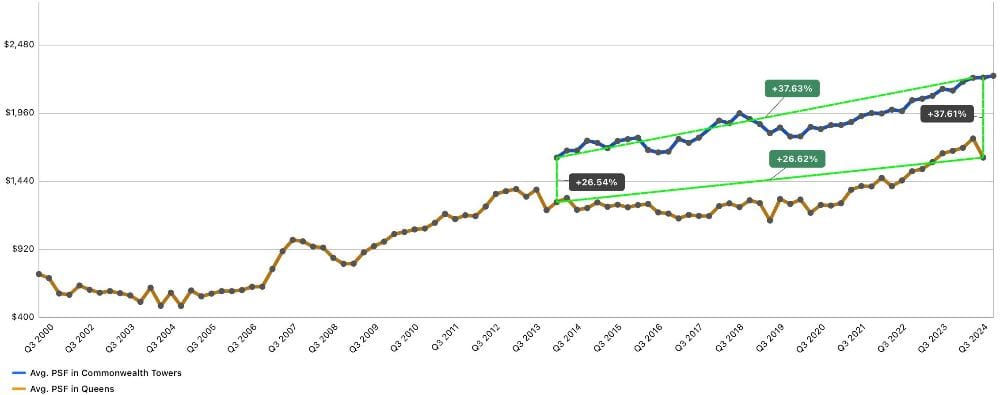

Capital Appreciation Comparison: Commonwealth Towers versus Queens (RCR)

- Commonwealth Tower Launch Date: May 2014

- Queens Launch Date: July 2000

During the launch of Commonwealth Towers in May 2014, it was sold at an average price premium (psf) of 26.54% over the prevailing average resale transacted price of Queens. Both 99-year leasehold developments are located opposite each other and very near the Queenstown MRT station.

Since then till Q3 2024, Commonwealth Towers and Queens have appreciated by 37.63% and 26.62% respectively. This widens the price premium from 26,54% to 37.61% (See Chart 2).

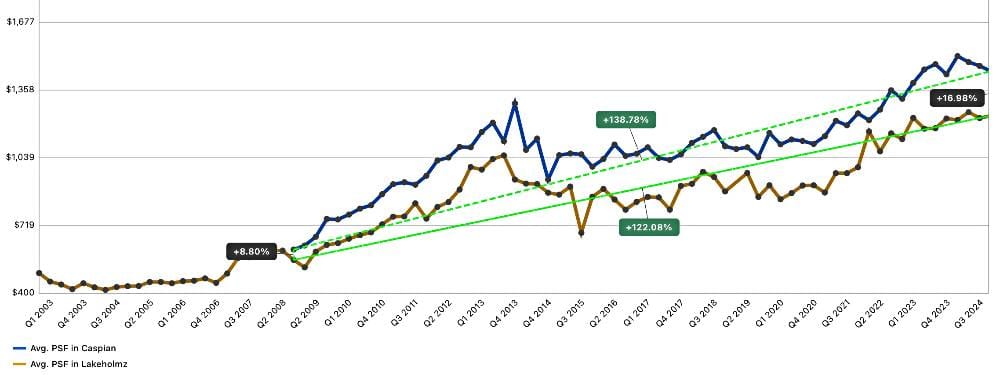

Capital Appreciation Comparison: Caspian versus Lakeholmz (OCR)

- Caspian Launch Date: February 2009

- Lakeholmz Launch Date: March 2003

During the launch of Caspian in February 2009, it was sold at an average price premium (psf) of 8.80% over the prevailing average resale transacted price of Lakeholmz. Both development are located near each other in Jurong West and within walking distance of the Boon Lay MRT station.

Since then till Q3 2024, Caspian and Lakeholmz have appreciated by 138.78% and 122.08% respectively. This widens the price premium from 8.80% to 16.98% (See Chart 3).

Case Study Insights

The analysis of the three case studies demonstrates that newly launched condominiums, despite commanding a premium over resale properties in the vicinity, have the potential to deliver superior investment returns and profitability.

However, this is not always guaranteed. Investors must carefully assess other key factors such as entry price, prevailing market conditions, upcoming infrastructure developments, and revisions to the URA Master Plan, among others, to make a well-informed investment decision.

Therefore, a comprehensive analysis of all the elements is essential to identifying opportunities that align with long-term financial goals.

Conclusion

The choice between a new launch and a resale condo is a complex one that depends on an individual’s key objective. While resale condos offer the advantage of immediate rental income and reduced risk, new launches may present a higher potential for long-term profitability and capital appreciation, albeit with slightly more risks.

Ultimately, making an informed decision requires carefully weighing the pros and cons of each option, considering current market conditions, and aligning with personal investment goals and risk appetite with personal needs.

Consulting with a knowledgeable property consultant can help you navigate these complexities and explore options that align with your investment needs.

New & Upcoming New Property Launches

If you are interested in the latest new property launches, please check out the following:

- Lentor Central Residences – a condo development next to Hillock Park

- Parktown Residences – the largest integrated development in Tampines North

- Union Square Residences – a mixed development near Clarke Quay

- One Sophia – a mixed development near Dhoby Ghaut MRT station

- Bloomsbury Residences – a mixed development at One-North

- Aurea – a redevelopment of the iconic Golden Mile Complex at Beach Road

- Arina East Residences – a freehold development at Tanjong Rhu

- Newport Residences – a mixed development at Anson Road

- W Residences Marina View – a mixed development at Marina Bay