- Step 1: Understanding Executive Condominiums

- Step 2: Eligibility Checks to Buy an Executive Condo

- Step 3: Evaluate Finances and Set Aside Funds for Down Payment

- Step 4: Research and Selection of ECs

- Step 5: Submit an Application to Book an EC Unit

- Step 6: Shortlist EC Units

- Step 7: Booking Day of Executive Condo

- Step 8: Post-EC Booking Requirements

- Step 9: Financing Your Executive Condo

- Step 10: Collect the keys and Move Into Your EC

- Conclusion

- Frequently Asked Questions (FAQs)

Buying an executive condominium (EC) in Singapore is a significant financial decision that involves a structured process. This guide provides detailed information on navigating each step, whether you're a first-time buyer or an HDB homeowner looking to upgrade. It's crucial to understand the eligibility criteria, financial planning, and application procedures to ensure a smooth purchase

Step 1: Understanding Executive Condominiums

Executive condominiums (ECs) are a unique housing type in Singapore that blends public and private housing elements. They are developed and sold by private developers but are initially subject to Housing Development Board (HDB) regulations for the first ten years. After this period, ECs will become fully privatised, similar to private condominiums.

This hybrid nature makes them an attractive housing option for many eligible Singaporeans because the government allocates EC land at a discount through its Government Land Sales (GLS) programme, making them more affordable than new private condos. Moreover, applicants can receive up to $16,000 in housing grants, depending on their gross monthly household income.

Ownership restrictions for ECs are also less stringent than HDB BTO flats sold under the new Standard, Plus, and Prime classifications.

Step 2: Eligibility Checks to Buy an Executive Condo

Before applying for an executive condo (EC), it's vital to check your eligibility. Here are the key criteria:

- Citizenship: At least one applicant must be a Singapore Citizen, and the other must be a Singapore Citizen or Permanent Resident. All singles must be Singapore Citizens if applying under the Joint Singles Scheme.

- Age: Applicants must be at least 21 years old. Those applying under the Joint Singles Scheme must be at least 35 year-old.

- Family Nucleus: Applicants must form a family nucleus under schemes such as the Public Scheme, Fiancé/Fiancée Scheme, Orphans Scheme, or Joint Singles Scheme.

- Income Ceiling: The gross monthly household income must not exceed $16,000.

- Property Ownership: You must not own any private property locally or overseas, or have disposed of any within the last 30 months. Additionally, you must not have bought an HDB resale flat with CPF Housing Grant or a new HDB/ DBSS flat or EC more than once.

Step 3: Evaluate Finances and Set Aside Funds for Down Payment

After your EC eligibility checks, financial preparation is crucial for your purchase. Here’s what you need to consider:

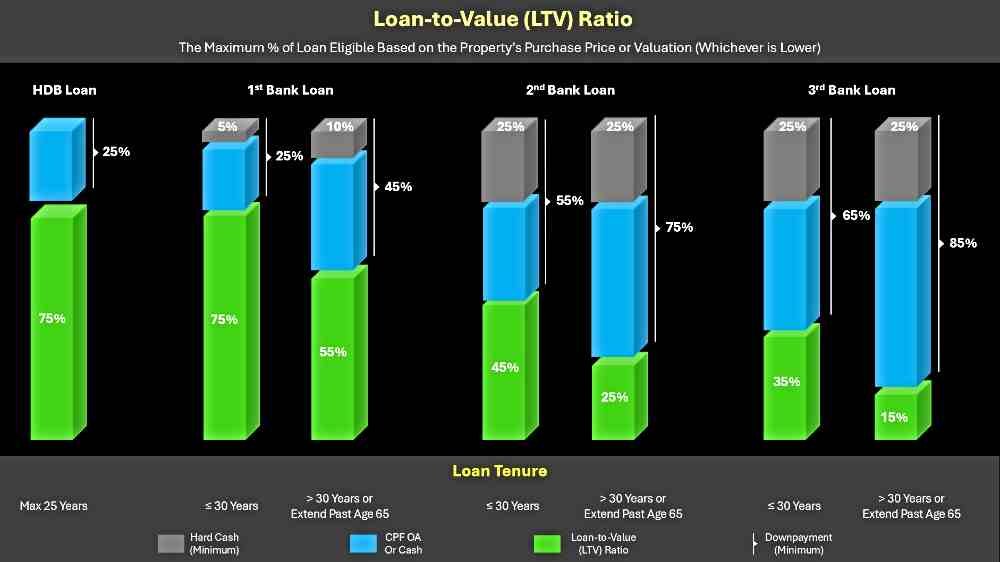

Assessing Financial Health: Ensure you have sufficient savings for the down payment, which is 20% of the purchase price (5% in cash and 15% in cash/CPF). In addition, due to the loan-to-value (LTV) limit where financial institutions can only loan up to 75% of the property value, you must be able to cover any funding gaps.

Loan Amount: It is important to note that the actual loan amount you are granted to buy an EC may be lower than expected due to financing regulations like the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR).

EC Housing Grant: Check your eligibility for housing grants, which can be up to $30,000 if your gross monthly household income is $10,000 or lower. The amount decreases as income increases, as indicated in the table below:

| Average Monthly Gross Income of Applicants/Occupants | FAMILY GRANT | Half Housing Grant First-Timer (FT) SC & Second-Timer (ST) Who Has Previously Taken 1 Housing Subsidy | |

| SC Household | SC/SPR Household | ||

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $16,000 | Nil | Nil | Nil |

| *SC - Singapore Citizen *SPR - Singapore Permanent Resident | |||

Applying for a Mortgage: Buyers must take bank loans, as HDB loans are not applicable for EC purchases. It's advisable to get an In-Principle-Approval (IPA) from a bank to assess your borrowing limit, taking into account your income, age, loan tenure and outstanding debts. It is advisable to assess your loan options and select one that suits your financing needs.

Budgeting for Additional Costs: Set aside funds for legal fees (about $2,500-$3,000), stamp duty (approximately 3%-4% of the purchase price), and administrative fees.

Resale Levy: If you have previously purchased a subsidised flat, an EC from a developer, or received a CPF Housing Grant, a resale levy of up to $55,000 will be imposed, depending on the type of housing you previously owned (refer to table below).

| First Subsidised Housing Type | Resale Levy Amount | |

| First Subsidised Housing Type | Recipient of CPF Housing Grant (Singles) | |

| 2-room/ 2-room Flexi flat | $15,000 | $7,500 |

| 3-room flat | $30,000 | $15,000 |

| 4-room flat | $40,000 | $20,000 |

| 5-room flat | $45,000 | $22,500 |

| Executive flat | $50,000 | $25,000 |

| Executive Condominium | $55,000 | Not applicable |

Step 4: Research and Selection of ECs

Research EC Projects: Conduct extensive research on available and upcoming EC projects. Consider location, developer reputation, project facilities, proximity to MRT stations or your workplace, and future developments for their investment potential. Online resources, property portals, and property agents can provide valuable insights

Visiting Show Flats: Visit show flats to have a better understanding of the project. Contact the marketing agent for launch previews and detailed information, including floor and site plans. In addition, you will receive guidance on the entire process of buying the new executive condo.

Reviewing Floor Plans: Analyze available floor plans and unit layouts. Select a unit that suits your needs and budget. Units with practical layouts not only enhance functionality and an overall better living experience, they will also be easier to sell in the future.

Step 5: Submit an Application to Book an EC Unit

After shortlisting your preferred EC, the next step is to submit your E-application to book a unit.

E-Application: Submit an electronic application during the developer’s launch period. The application process typically lasts 2-3 weeks, with results released within a week or two after closing. There is no penalty for withdrawing after applying or backing out from balloting after HDB approval.

Your property agent can help with the necessary documentation and submission.

Information Required for E-Application:

- Name.

- Citizenship.

- NRIC Number.

- Gender.

- Marital Status.

- Mobile Number.

- Email.

- Employment Status.

- Occupation.

- Gross Monthly Income.

Documents to be Submitted:

- Proof of Identity / Citizenship (NRIC).

- Proof of Relationship / Marital Status (Marriage Certificate).

- Proof of Income (three months payslips for employed, or two years of Notice of Assessment for self-employed).

- CPF Housing Grant Application Form - to be submitted to the developer within one week of booking or risk not being able to utilise it for your down payment.

Balloting and Price List Release: After the application period closes, a ballot will be conducted. Successful applicants will receive a ballot number and the price list before the booking date

Step 6: Shortlist EC Units

Pricing Analysis: Study the pricing for different unit types, levels, facings, and locations within the development. Premium pricing is typically applied to units with good layouts and desirable facings.

Unit Selection: Tap into your property agent's marketing experience to shortlist the best units. Prioritise units with efficient layouts, like enclosed kitchens, utility rooms, and functional balconies. Avoid units facing disamenities like main roads, bin centres, or walkways that compromise privacy.

Backup Options: Create a comprehensive shortlist with backup options in case your preferred units are taken before your turn.

Step 7: Booking Day of Executive Condo

Booking Process: The booking is typically done at the show flat. You will be given a designated time, based on your ballot number. Arrive early and have your property agent with you for support throughout the booking process.

Unit Selection: You will be ushered to an area to select your unit. A live update of the units taken and those still available will be provided. If your shortlisted units are taken, you'll be directed to a "Thinking Box" or decision room to consider other options without holding up the queue.

Proxy Booking: If you are overseas, you can assign a proxy to book a unit on your behalf by completing an authorisation form.

Securing Your EC Unit

To secure your unit, you'll need to pay a booking fee of 5% of the purchase price. This fee is part of your 20% down payment and secures your right to purchase the unit for a set period (typically 21 days). Payment can be made by Cashier's Order, check or telegraphic transfer

Signing of Property Detail Information (PDI) Form

In exchange for the 5% booking fee, you’ll receive the PDI form, which contains detailed information about your property purchase, including the developer, floor plans, site plans, fixtures, appliances, and regulations. Signing the PDI form means you agree to the Terms & Conditions of the EC purchase

Receiving the Option-to-Purchase (OTP)

OTP Issuance: Successful applicants will receive an OTP, a legal agreement that grants the right to purchase the property.

Exercising the Option: You have 21 days to exercise the option by signing the Sales & Purchase Agreement and returning it to the developer. You will then need to pay the remaining down payment of 15%, plus Buyer's Stamp Duty using HDB Housing Grants, CPF monies, or cash.

Withdrawal: If you withdraw from the purchase at this stage, the developer will forfeit 25% of the 5% booking fee.

Step 8: Post-EC Booking Requirements

After booking your executive condo unit, two important matters must be settled.

Secure Financing: Obtain a letter of offer from a bank to finance the remaining 80% of your EC purchase price. Your property agent can recommend loan packages.

Engage a Conveyancing Lawyer: A conveyancing lawyer handles the legal aspects of property transfers. Their expertise is vital for ensuring a smooth and legally sound transaction. If you do not have any conveyancing lawyer in mind, your property agent can also provide recommendations.

Step 9: Financing Your Executive Condo

Decide on your payment scheme: There are two ways to finance your EC purchase.

Normal Progressive Payment Scheme (NPS): Your home loan will be disbursed according to the construction stages of your executive condo. This means that your home loan repayments will commence much earlier.

Deferred Payment Scheme (DPS): After the down payment of 20% to book your executive condo (5% in cash and the remaining 15% using either cash or CPF), the balance of 80% financed through a bank loan will only take effect when your executive condo receives its TOP. However, the purchase price under DPS is typically 2-3% higher to account for the delayed payment to the developer. DPS can benefit buyers with existing housing loans as they need not service two housing loans concurrently.

The schedule of payments for both schemes is shown below:

| Stages of Payments | Timeline | Normal Progressive Payment Scheme (NPS) | Deferred Payment Scheme (DPS) |

| Booking: Upon the grant of the Option to Purchase | Option Date | 5% (Cash) | 5% (Cash) |

| S&P: Upon the signing of the Sales & Purchase Agreement | 9 Weeks from Option Date | 15% (CPF or Cash) | 15% (CPF or Cash) |

| Foundation: Completion of Foundation Work | 6-9 Months | 10% (5% CPF or Cash and 5% Bank Loan) | - |

| Framework: Completion of Reinforced Concrete Framework | 6-9 Months | 10% (Bank Loan) | - |

| Wall: Completion of Brik Walls | 3-6 Months | 5% (Bank Loan) | - |

| Ceiling: Completion of Roofing/Ceiling | 3-6 Months | 5% (Bank Loan) | - |

| Windows: Completion of Electrical Wiring, Internal Plastering, Plumbing and Window Frames | 3-6 Months | 5% (Bank Loan) | - |

| Car Park: Completion of Car Park, Roads and Drains serving the housing development | 3-6 Months | 5% (Bank Loan) | - |

| TOP: Temporary Occupation Period | TOP | 25% (Bank Loan) | 65% (Bank Loan) |

| CSC: Certificate of Legal Completion | CSC | 15% (Bank Loan) | 15% (Bank Loan) |

Step 10: Collect the keys and Move Into Your EC

Key Collection: Collect your keys once the Temporary Occupation Permit (TOP) is issued.

Defects Check: Conduct a thorough inspection for any defects. Report any issues to the developer within the 12-month defect liability period for free rectification. Avoid starting renovations or moving in until all defects are rectified.

Renovation: Plan and execute any renovation work needed while ensuring compliance with developer and management guidelines, such as standardized zip blinds for balconies. This maintains a uniform external appearance to preserve property value.

Conclusion

The process of buying a new executive condo does not have to be daunting, especially with the help of a property agent. Engaging a property agent offers many benefits:

- No Commission: You don't pay a commission when buying a new EC, as the developer pays the agent.

- Market Expertise: Agents provide knowledge of market trends, pricing, and property regulations.

- Network Access: Agents have connections to legal professionals and financial institutions.

- Administrative Assistance: Agents handle paperwork, reducing errors and delays.

- Financial Planning: Agents help assess your financial readiness, including eligibility, CPF usage, grants, and loan options.

- Personalised Service: Agents tailor their search to your specific needs and provide advice on new launches, saving you time and effort.

If you are looking to buy a new executive condo, check out Lumina Grand and Altura. at Bukit Batok, Novo Place, at Tengah, and Aurelle of Tampines at Tampines North.

Whatsapp me for the latest information on executive condo launches or if you need any help.

Frequently Asked Questions (FAQs)

Navigating the purchase and ownership of an Executive Condominium (EC) can be complex. This FAQ addresses some important questions to help you make an informed decision.

What are some common mistakes to avoid when buying an EC?

When purchasing an executive condo, it's easy to overlook some important details. Make sure you research the developer's reputation thoroughly - this can save you a lot of headaches later. Also, don’t forget to account for ongoing expenses like maintenance fees and property taxes. It’s crucial not to stretch your budget too thin, and always read the contract terms you are comfortable with them.

How does selling my EC work?

If you’re considering selling your EC, there are a few important regulations to satisfy. Firstly, you must live in the unit for at least five years, if you bought it new from the developer. However, you can only sell to Singapore citizens and permanent residents. You can only sell to foreigners after owning it for 10 years. When you meet these eligibility criteria to sell, you can work with a real estate agent to market your property, who will also guide you with the necessary paperwork, such as preparing the Option to Purchase (OTP).

How can I assess the future resale value of my EC?

Like any property investment, consider its location, access to public transport, nearby amenities, and upcoming developments in the vicinity. Evaluate the demand for properties in the neighbourhood and compare historical price trends of ECs after privatisation. Analyse similar private condos nearby to gauge market potential and long-term appreciation prospects.

What amenities should I look for in an EC development?

When choosing an EC, consider the size of the development. A smaller development will offer fewer facilities and potentially higher monthly maintenance fees as fewer residents will share the load of the estate upkeep. Some common features are swimming pools, clubhouses, gyms, playgrounds, and BBQ areas. Also, consider how close the development is to public transport, schools, shopping centres, and parks. These factors can significantly improve your daily life but affect the future value of your property.

Are there rules about renting out my EC?

Yes, there are some rules regarding renting out your EC. You must live in it for at least five years before you can rent it out fully. Before your 5-year MOP, you can only rent out rooms. But make sure you meet specific conditions set by HDB.

What’s the process for getting a mortgage for my EC?

Getting a mortgage for your EC starts with understanding your finances and figuring out your budget. It’s a good idea to approach several banks for mortgage options and get an In-Principle Approval (IPA) so you know how much you can borrow. Gather all necessary documents like income statements and ID before applying. Finally, compare interest rates and terms from different lenders to find the best fit for you.