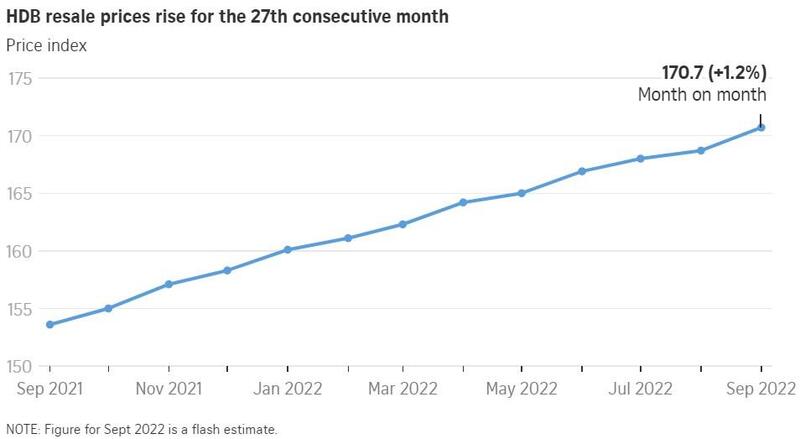

September HDB Resale Prices climb 1.2% for the 27th straight month, with a record of 45 million-dollar units transacted in a month. The pace is faster than the 0.4% increase in August.

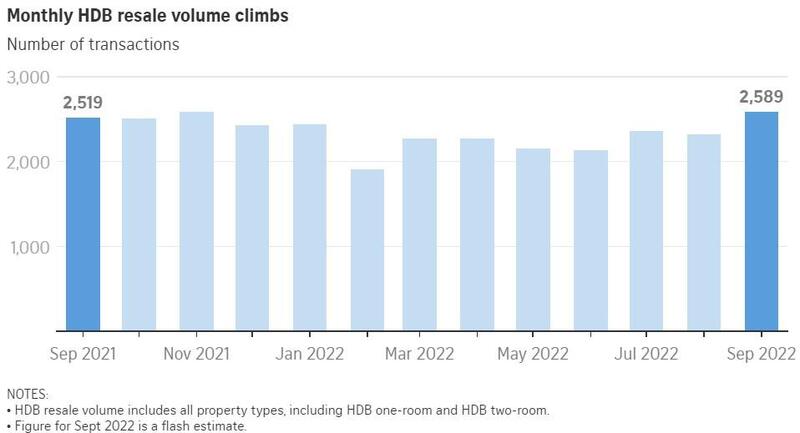

At the same time, the transaction volume has also increased to 2,589 units, up from 2,324 units in August.

New Property Cooling Measures Announced on 29 September 2022

Amid the exuberance of the HDB resale market despite rising interest rates, a new set of measures was announced by the government on 29 September to cool the market.

This includes a 15-month wait-out period for private property owners who wish to downgrade to buy HDB resale flats, and stricter criteria for assessing a home buyer’s loan amount. The latest measures are likely to moderate to the demand for public housing.

The curbs came about following a 7.8% rise in HDB resale flat prices in the first nine months of 2022, fueled by hot money inflow from private property owners into the HDB resale market, as well as pandemic-related disruptions in the construction sector.

Of the 45 million-dollar flats sold in September, 17 were executive apartments and maisonettes, compared to five such transactions in August.

As these executive houses are larger than standard HDB flats, they are sought after for their rarity and generous internal spaces.

In September, Punggol registered its first million-dollar deal – a five-room, 149 sqm apartment in Block 268C Punggol Field – which changed hands for $1.198 million. This is almost $200,000 cash-over-valuation (COV).

COV refers to the difference between the selling price of resale flats and HDB’ valuation, and it must be paid in hard cash. The 45 million-dollar HDB flats sold in September represented 1.7% of total HDB resale transactions for the month.

It is also the highest monthly number of such HDB resale flats sold since the 36 transacted in December 2021. This is a record year for million-dollar HDB transactions, with 277 units sold in 2022, surpassing 259 of such deals in the whole of 2021 with three months to spare.

In September, about 2,589 HDB resale flats changed hands, up 11.4% from August, with those in non-mature housing estates accounting for about 60% of the total transaction compared to 40% for mature estates.

Property market analysts have attributed this to several factors:

- Rising interest rates have put a squeeze on the budgets of some buyers, prompting them to look at HDB resale flats in non-mature estates.

- Sharp rise in private condo prices in the suburbs, which have breached the $2,000 psf threshold, have forced some buyers to re-assess their housing options.

- Buyers looking for older HDB flats that are bigger compared to current HDB flats being built.

- Buyers who are in urgent need of a place to stay amid the delay in the completion of BTO flats.

Please feel free to WhatsApp or Email me if you need more information about the real estate market or new property new launches in Singapore.