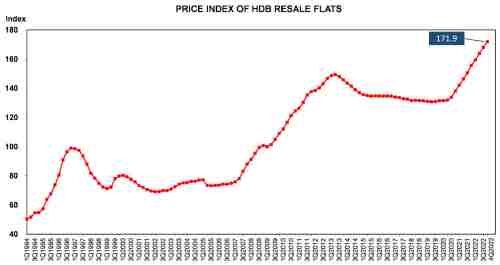

4th quarter 2022 resale HDB prices rose 2.3%, easing from 2.6% in the 3rd quarter. This was the slowest increase for the year.

Data from HDB also revealed that transactions during the same period fell by 12.6% compared to the preceding quarter, or 6,597 versus 7,546 transactions.

Compared to the 4th quarter of 2021, resale transactions fell by 16.9%. As for the whole of 2022, it declined by 10.1% to 27,896 cases from 31,017 cases.

The resale price index, which measures price movements in the resale market, rose for the 11th consecutive quarters to 171.9 in the 4th quarter.

For the whole of 2022, resale prices rose by 10.4%, easing from a 12.7% increase in 2021.

4th Quarter 2022 Resale HDB Prices Tempered by Property Cooling Measures

The government implemented a series of property cooling measures on 30 September 2022. These include a 15-month wait-out period for private homeowners who wish to buy resale HDB flats and a reduction in Loan-to-Value (LTV) limit for HDB loans from 85% to 80%.

The measures are aimed at curbing the hot HDB resale market, which has witnessed an increasing number of million-dollar HDB resale flats changing hands.

HDB Rental Transactions

Meanwhile, approved applications to rent out HDB flats increased by 3.5% in the 4th quarter of 2022 over the preceding quarter. However, they were 19.7% lower than the same period in 2021.

For the entire year, applications to rent out HDB flats dropped by 15.1% from 42,623 cases to 36,166 cases. At the end of the 4th quarter, 56,647 HDB flats were rented out, a slight increase of 0.5%.

Supply of BTO Flats

The Housing and Development Board (HDB) will be offering around 4,400 Build-to-Order (BTO) flats in areas such as Jurong West, Kallang Whampoa, Queenstown, and Tengah in February this year.

Additionally, between 3,800 and 4,800 flats will be offered in areas like Bedok, Kallang, Whampoa, Queenstown, Serangoon, and Tengah in the May BTO exercise.

However, these numbers are subject to change as project details will be firmed up closer to the launch dates, with HDB planning to offer up to 23,000 BTO flats this year.

From 2021 to 2025, HDB is prepared to launch up to 100,000 flats in total, if needed. But it will monitor housing demand and make adjustments where necessary, to ensure affordability and stability in the property market.

For the latest property market update, or if you require any assistance, please feel free to WhatsApp Me.

New Private Property Launches

Besides boosting the supply of BTO flats, the government have also released more sites under its land sales programme for private housing.

For the first half of 2023 under its Confirmed List, there are five private residential sites (including one executive condo) and two White sites, which can collectively yield about 4,090 private residential units (including 700 EC units).

Under its Reserve List, there are six private residential sites (including two EC sites), which can yield an additional 3,625 private residential units (including 855 EC units).

Meanwhile, there is a slew of private property launches coming up in the half of this year. These include the following:

- Newport Residences.

- TMW Maxwell.

- Terra Hill

- The Continuum

- Tembusu Grand

- Grand Dunman

- Pinetree Hill

- Botany At Dairy Farm

- Lentor Hills Residences

- The Arden

- J’Den

- Altura EC

For enquiry, please WhatsApp Me.