HDB resale flat prices in August 2022 increased for the 26th consecutive month, with 33 apartments sold for at least $1 million.

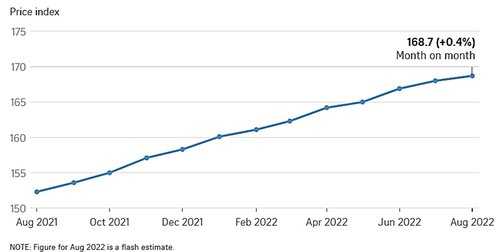

HDB Resale Price Index

According to recent data, HDB resale flat prices are up 10.8% year-on-year, increasing 0.4% in August compared to a 0.7% rise in July.

Eight of the 33 million-dollar flats sold last month were in Toa Payoh, seven were in Bukit Merah, and six were in Queenstown. The most expensive was a 1,259 sq ft 5-room apartment at The Peak @ Toa Payoh that sold for $1.35 million.

According to property analysts, more million-dollar HDB resale transactions are likely to be seen in the coming months. Despite rising interest rates, the sentiments in the HDB resale market are still positive.

Nevertheless, the rising prices and rate increases have led some buyers to seek properties in less-mature estate where prices are more reasonable. Hence, this likely contributed to their 0.2% price increase last month.

The highest price transacted in non-mature estates was a 2,067 sq ft executive apartment in Woodlands Avenue 1 that changed hands for $1.02 million.

The 33 million-dollar apartments represented 1.4% of all resale deals last month, matching the same number of million-dollar apartments sold in July.

Fewer HDB resale flats changed hands last month, easing by 1.7% to an estimated 2,323 units, reversing the 10.5 per cent rise in July.

Compared with August last year, the number of transactions was down by 15.5%. This was due to a mismatch in expectations between buyers and sellers, as well as having fewer buyers during the Hungry Ghost period.

At the same time, some potential buyers may have been drawn to the attractive HDB projects offered in August under the Build-To-Order (BTO) exercise that took place in popular mature towns such as Ang Mo Kio, Tampines, and Bukit Merah.

Price increases were observed in all flat types in both mature and non-mature estates, with prices of five-room units increasing the most by 0.8%. This could be partially attributed to the recovering Singapore economy, rise in household incomes, and demand from new HDB upgraders.

Of the proportion of resale flats transacted below $500,000, they accounted for about 42.8% of total volume, up from 39.6% the month before. In August, flats that sold for between $500,000 and just under $1 million made up about 55.8% of all transactions. This is down from 59% in July.

Outlook for HDB Resale Flat Prices

In the coming months, property analysts expect HDB resale prices to stay relatively firm as demand for completed homes outweighs the available supply. Although the supply of BTO flats has been increased, they will still take time to complete.

Given the strong employment and income growth, sellers are unlikely to drop their prices at the moment. As such, it won’t be surprising to see more million-dollar flats in mature estates in the future.

If you have any queries about property investment or Singapore’s real estate market, please feel free to WhatsApp or Email Us.