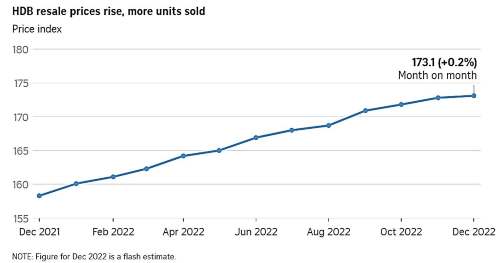

December 2022 HDB resale flat prices in Singapore climbed for the 30th consecutive month, albeit at a slower pace of 0.2% compared to November’s 0.6% increase.

Meanwhile, the price of HDB resale flats is expected to moderate further in 2023 due to the following factors:

- Property cooling measures

- Higher interest rates

- Economic uncertainties

- Price resistance from buyers

- Increase in suppy of BTO flats by HDB

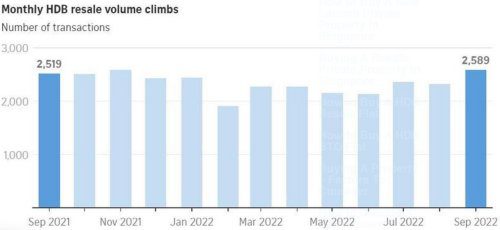

Nevertheless, the gradual recovery of transaction volume in November and December despite the traditionally slower year-end school holiday and festive season indicates underlying demand has remained firm. Hence, HDB resale prices are expected to rise further in 2023, with forecast of a 5% to 8% increase.

In 2022, HDB resale prices were up 9.4%, easing from a growth of 13.6% in 2021. At the same time, total resale volumes were 8.1% lower.

December 2022 HDB Resale Volume Up

The number of HDB resale flats sold in December rose 4.8% to an estimated 2,242 units from 2,140 units in November. However, compared with December 2021, transactions were down by 7.7%.

For the whole of 2022, the median HDB resale price hit $527,000, an 8.7% increase from 2021.

The prices of executive flats eased slightly by 0.4% in December, while other flat types continued to rise. Prices in non-mature estates increased by 0.3%, but those in mature estates remained unchanged.

Sale of Million-Dollar HDB Flats Up 42.9% in 2022

In December, there was a slight increase in the number of million-dollar HDB resale flats sold, with 28 units changing hands, up from 26 units in November. The number of million-dollar HDB flats sold comprises 1.2% of the total resale volume in December.

Among the million-dollar flats sold, five were in Bishan, and three each in Bukit Merah, Toa Payoh and the central area. The highest transacted was a 150 sq m executive maisonette in Toh Yi Drive, which sold for $1.3 million, indicating bigger flats are still in demand.

For the whole of 2022, a record 370 million-dollar flats were transacted compared to 259 such deals in the previous year, which is 42.9% higher.

Private Residential Property Launches

Meanwhile, the private residential market rose 8.4% in 2022, according to flash estimates released by the Urban Redevelopment Authority (URA), down from 10.6% in 2021.

Prices are likely to moderate further amid a slew of new property launches. However, due to the low inventory of unsold units, a sharp correction is not foreseen. The following are some of the upcoming property launches:

- Sceneca Residence – Next to Tanah Merah MRT station

- Botany At Dairy Farm – Near Hillview MRT station

- Lentor Hills Residences – Near Lentor MRT station

- Blossoms By The Park – Near Buona Vista & One-North MRT stations

- Terra Hill – Near Pasir Panjang MRT station

- The Hill @ One-North – Near Buona Vista & One-North MRT stations

- The Continuum – Near Paya Lebar & Dakota MRT stations

- Tembusu Grand – Near Tanjong Katong MRT station

For more info or updates, please feel free to WhatsApp Me.