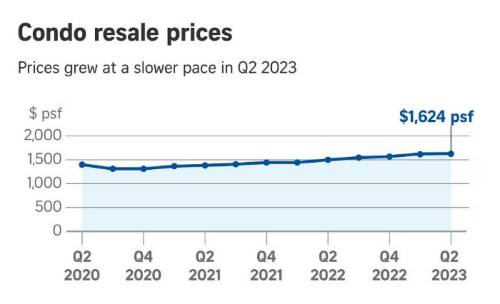

Q2 2023 resale condo prices inched up by 0.6%, marking the fifth consecutive quarterly increase. However, the pace of growth slowed compared to the previous quarter, where prices rose by 2.9%.

On a year-on-year basis, resale condo prices rose by 7.8% in the second quarter, based on data from the Urban Redevelopment Authority’s Realis property statistics portal.

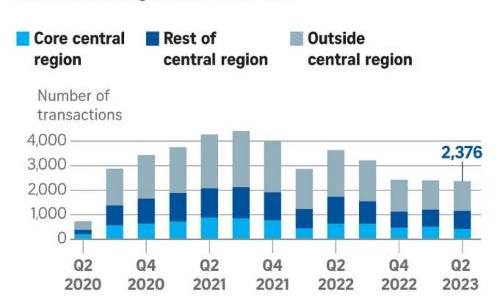

Resale volumes dipped by 1.5% in the second quarter, with 2,376 units changing hands, in contrast to the 2,413 units sold in the first quarter.

However, activity is expected to pick up in the second half of 2023 due to the completion of more condominium projects, which is expected to push housing supply to a seven-year high and potentially help to stabilise property prices.

Q2 2023 Resale Condo Prices In The 3 Main Regions

Q2 Condo Resale Volumes

Resale prices in the city fringes and suburbs saw increases of 2.7% and 2.8% respectively in the second quarter, while prices in core central Singapore experienced a decrease of 0.8%.

The suburbs accounted for the highest proportion of resale condo transactions (50.4%), followed by the city fringes (31.8%), and core central Singapore (17.8%). This data suggests that buyers may be turning their attention to areas outside the city centre due to relatively more affordable options.

The best-selling resale condos in the second quarter were The Bencoolen in Rochor, High Park Residences in Sengkang, and Petit Jervois in Tanglin.

The Bencoolen saw 31 units changing hands at an average price of $1,622 psf, followed by High Park Residences with 23 units at an average price of $1,491 psf, and Petit Jervois with 22 units at an average price of $2,597 psf.

About 30.1% of resale condos sold in the second quarter were priced between $1 million and below $1.5 million, with an additional 23.9% priced between $1.5 million and under $2 million, indicating a “sweet spot” for resale condos in the $1 million to $2 million range.

2023 Forecast of Resale Condo Market

The decline in fixed-rate loans for completed properties may have given the resale market a boost in the second quarter. For the whole of 2023, the market is forecast to increase by about 8% amid the completion of more homes.

In addition, high rents and upgrading from HDB owners are seen underpinning the resale private condo market, especially when HDB resale prices have outpaced private property prices.

Conclusion

In conclusion, the resale condo market demonstrated steady growth in prices during the second quarter of 2023, although at a slower pace than the previous quarter. While transaction volumes experienced a slight dip, analysts anticipate increased sales activity in the latter half of the year due to the completion of more condominium projects.

Buyers showed a preference for properties in the city fringes and suburbs, while the core central region experienced a decline in both prices and transaction volumes – signs of price sensitivity.

The “sweet spot” for resale condos appears to be in the price range of $1 million to $2 million. The market’s performance is influenced by factors such as loan rates, completion of housing projects, and the attractiveness of upgrading from HDB flats to condos.

Upcoming New Property Launches

- Newport Residences – A mixed-use development at Anson Road.

- TMW Maxwell – A mixed-use development redeveloped from the former Maxwell House.

- Marina View Residences – A mixed=use development next to Singapore Conference Hall.

- The Hill @ One-North – A mixed-use development in District 5.

- The Continuum – A freehold condo in District 15 by Hoi Hup & Sunway Developments.

- Tembusu Grand – A condo development by CDL & MCL Land in District 15.

- Grand Dunman – A mega condo development by SingHaiyi Group next to Dakota MRT.

- Pinetree Hill – A condo development at Pine Grove in District 21.

- LakeGarden Residences, a condo development by Wing Tai Holdings.

- The Arden – A condo development by Qingjian Realty at Bukit Panjang.

- J’Den – A mixed-use development by Capitaland in Jurong Lake District.

- Altura – An executive condo by Qingjian Realty and Santarli Construction at Bukit Batok.

- Lentor Hills Residences – A condo development by Intrepid, Guocoland, and TID Residential.

- The Myst – A condo development near Cashew MRT by CDL.