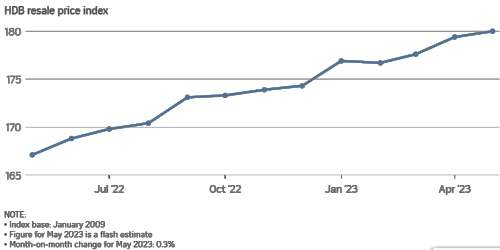

May 2023 HDB resale price growth slows while volume increased slightly.

The Housing and Development Board (HDB) resale market saw prices climb 0.3% in May, down from the 1.1% growth in April. Overall, May’s prices were up 7.7% from the same period a year ago.

Meanwhile, resale volume was up 3.2% from April, with 2,259 flats sold in May. Compared with the same period a year ago, sales were up by 4.8%.

The slower price growth and an uptick in sales can be attributed to a combination of factors – the effects of the cooling measures introduced in September 2022, the heightened supply of Build-To-Order (BTO) flats in 2023, and the increase in housing grants for eligible buyers.

Since September 30, 2022, private homeowners must wait 15 months after the sale of their home before they can buy a resale flat without housing grants. The criteria for HDB loans were also tightened.

The uptick in sales can also be attributed to the completion of new private residential units and executive condominium (EC) units in the first three months of 2023. This led to some owners selling their HDB flats as they received the keys to their newly completed homes, bumping up the resale stock.

According to data from the Urban Redevelopment Authority, 2,965 private residential units and 820 EC units were completed in the first quarter of 2023.

However, with more BTO projects being launched, this could take away some of the demand from the resale market. As a result, HDB resale transactions could dip in the coming months.

May’s data showed that prices were up by 0.7% in mature estates, and 0.3% in non-mature estates, from April. The price increase was noted for three-room and four-room flats and ECs, while prices for five-room flats fell by 0.6%.

About 62% of the resale flat transactions came from non-mature estates, with Woodlands, Sengkang and Punggol being the three most popular.

A breakdown of resale transactions showed that 36.1% in May were priced below $500,000, compared with 37.4% in April, while 62.4% were transacted at between $500,000 and just under $1 million, up from 60.9% in the previous month.

A total of 34 HDB resale flats were sold for at least $1 million in May, down from 37 such transactions in April. The highest transacted price was for a five-room unit at The Peak in Toa Payoh that was sold for $1.37 million.

Bedok saw its first five-room flat breaching the million-dollar mark – a unit from Belvia, a Design, Build and Sell Scheme project was sold for $1 million in May while another unit of the same flat development was sold for $1.028 million shortly after.

Going forward, the HDB resale price index is expected to grow between 3% 60 6% in 2023, down from 10.3% last year and 12.7% in 2021.

With the Singapore government ramping up the launch of BTO flats – 23,000 in 2023 and up to 100,000 by 2025 – the steep rise in HDB resale flats in the last two years is likely to be over. Meanwhile, below are some upcoming property launches for those looking to upgrade to private properties: