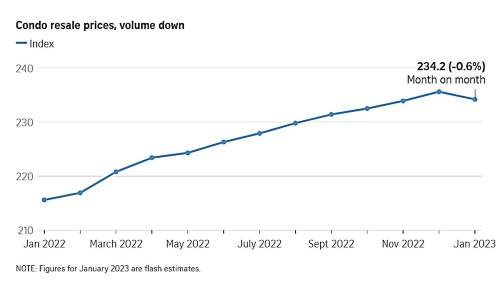

According to flash estimates released on Feb 27th, January 2023 private resale condo prices in Singapore fell 0.6% month-on-month as compared to a 0.7% in increase in December.

This marked the first decline in 28 months, led by lower prices in the city fringe (RCR) and suburban (OCR) areas – down 0.2% and 1.2% respectively. However, prices in the prime Core Central Region (CCR) rose by 2.5% in January from December.

Overall, condo resale prices are still higher on a year-on-year basis for all three regions:

- OCR: +9.7%.

- RCR: +7.8%.

- CCR: +6.4%.

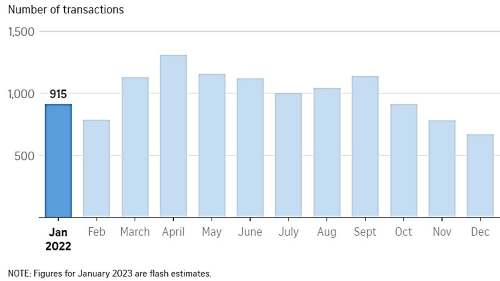

January Sales Volumes Fall for 4th Consecutive Month

Meanwhile, sales volumes have also fallen for the fourth consecutive month, with transactions dipping 22.6% month-on-month in January where an estimated 519 units were resold versus the 671 units in the previous month.

This can be largely due to slower sales during the Chinese New Year period. At the same time, homeowners may have also held off from selling amid rising rental prices and higher replacement cost.

Sales volumes were down 43.2% compared from a year ago. This was also 35.5% lower than the 5-year average volumes for the month of January.

Condo resale volumes have continued to decline since lending limits were tightened in September 2022, while rising interest rates have also tempered activity.

Resale Private Property Price Decline a “Blip”?

However, some property analysts believe this is a “temporary blip”, as there is still a steady demand for private residential properties among locals and foreigners, especially after China reopened its borders.

In addition, the recent Singapore Budget announcement to increase housing grants for first-time buyers of HDB resale flats may push up prices of public housing. This could potentially prompt more second-time homebuyers considering resale condos instead.

New Property Launches to Prop Up Property Prices

Meanwhile, an estimated 30 new projects are expected to be launched in 2023, double those launched in 2022.

Typically, new launches are sold at higher prices compared to older developments nearby. This could have a spillover effect on the resale private residential market. Also, given the recent en bloc of Meyer Park for $392.18 million, which translates to a land rate of $1,668 psf ppr, it will likely be launched above $3,000 psf.

For more information on upcoming property launches, please refer to the following:

- Newport Residences.

- TMW Maxwell.

- Blossoms By The Park.

- Tembusu Grand.

- The Continuum.

- Grand Dunman.

- Pinetree Hill.

- The Reserve Residences.

- Lentor Hills Residences.

- Lakegarden Residences.

- The Arden.

- J’Den.

- Altura EC.

Please click on the link for more property reviews.

For the latest updates, please WhatsApp Me.