February 2023 HDB resale flat prices were flat after a 31-Month Climb.

February 2023 HDB Resale Flat Data

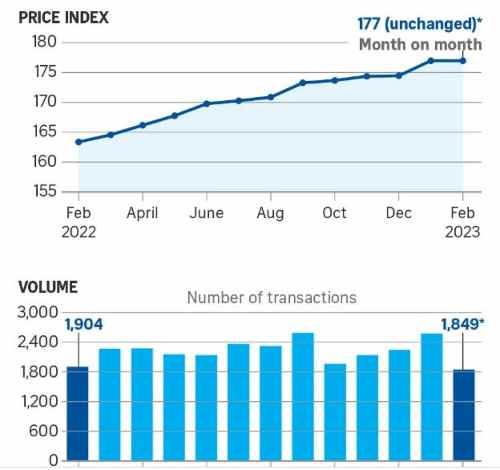

The number of sales decreased by 28.2% to an estimated 1,849 units in February, down from 2,575 units in January.

Prices of resale flats in mature and non-mature estates dipped marginally by 0.1% in February, while the prices of four-room flats, the most commonly transacted flat type, remained unchanged from the previous month.

Overall, prices were up 8.3% year on year.

February 2023 HDB Resale Flat Prices Affected By Chinese New Year Festivities

However, the latest data should not be interpreted as a sign that the market is cooling yet. This is because the decline in transactions in February could be attributed to fewer viewings and slower sales activities in January due to the Chinese New Year festivities.

Some property analysts expect prices to remain relatively stable and sales volume to pick up from March. The unchanged prices and fall in volume could also be seasonal because February is the shortest month, which also saw a dip from 2019 to 2022.

Nevertheless, market uncertainties amid rising interest rates and concerns over the global economy have lent an air of caution. But at the same time, the recent Budget 2023 announcement that resale HDB flat buyers will be getting more housing grants have led to more enquiries for 3-Room and 4-Room flats.

Those buying 4-Room or smaller HDB resale flats will receive up to $80,000 housing grant, up from $50,000, while those buying 5-Bedroom or larger flats will get $50,000, up from $40,000.

Meanwhile, stricter rules on not selecting Build-To-Order (BTO) units will take effect in August. First-time BTO applicants who do not choose a unit will have their first-timer privileges suspended for a year. They will subsequently be deemed second-timers in subsequent flat applications for a year.

This could push some buyers into the HDB resale market, propping it up in the process.

However, in the longer term, the ramp-up in BTO flat supply could draw some potential buyers back to the BTO market, especially those who are not in a hurry to move into their own homes.

Additionally, with the timeframe for completion of BTO flats reverting back to its pre-pandemic norm of 3-4 year from the current 4-5 years, this could draw potential buyers back to the BTO market as well.

Million-Dollar HDB Resale Flats Transactions Eased Further

In February, the number of million-dollar HDB resale flats dropped further to 24 units, down from 40 units in January. These 24 million-dollar units comprised 1.3% of the total resale volume in February. Among the million-dollar flats sold, there were five in Toa Payoh, four in Queenstown and three each in Woodlands and the central area.

The most expensive resale flat was a five-room 105 sq m unit at The Pinnacle@Duxton located at Cantonment Road. It was sold for $1.34 million and has 87 years left on its 99-year lease.

Sale of Private Properties (New Launches)

At the sale of Terra Hill on 25-25 February, 102 out of 270 residential units (about 37.78%) were sold at an average price of $2,650 psf.

Over at the Botany At Dairy Farm, it sold 187 out of 386 units (48%) at an average price of $2,070 psf during its sales on 4 March 2023.

Both were below the sales figures of previous new launches where more than 70% were achieved. This is unsurprising as potential property buyers and investors have turned cautious amid the uncertain global economic outlook and rising interest rates.

At the same time, a slew of upcoming property launches will help to mitigate the supply crunch experienced during the last 2-3 years, capping rising property prices to some extent. Some of the upcoming new launches include the following:

- The Continuum, a freehold condo near Paya Lebar and Dakota MRT stations.

- Tembusu Grand, a 99-year leasehold condo near the upcoming Tanjong Katong MRT station.

- Grand Dunman, a mega 99-year leasehold condo beside Dakota MRT station.

- Blossoms By The Park, a 99-year leasehold mixed-use development located at One-North.

- The Hill @ One-North, a 99-year leasehold mixed-use development in District 5.

- Pinetree Hill, a 99-year leasehold condo at Ulu Pandan in District 21.

- Skywaters Residences, a mixed-use development at Anson Road.

- The Arden, a 99-year leasehold condo at Phoenix Road in the Bukit Panjang housing estate.

- Lentor Hills Residences, a 99-year leasehold condominium near Lentor MRT station.

- The Reserve Residences, a 99-year leasehold integrated development in Beauty World.

- Altura, an executive condo at Bukit Batok near nature reserves.