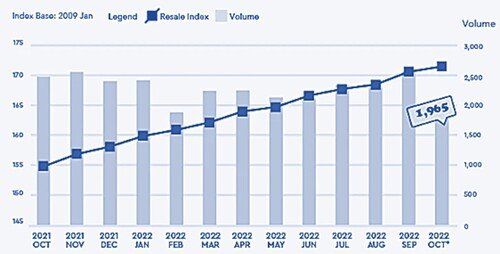

October 2022 HDB resale flat prices advanced for the 28th consecutive month, rising 0.5%. This brought the overall year-on-year price increase to 10.8%, lifting the median price of HDB resale flat to a record high of $545,000.

This is 35% higher than its pre-pandemic level in October 2019 when the median price was $405,000.

Breaking down by room types, three-room and four-room units rose by 0.4% and 0.7% respectively, five-room prices held steady, and executive flats fell 1%.

Despite the overall price increase, HDB resale volume dipped 24.1% month-on-month to an estimated 1,965 transactions in October 2022, the lowest recorded in the month of October since 2017. This could signal that price resistance is setting in amid rising interest rates and concerns over a possible recession going forward.

Despite the overall price increase, HDB resale volume dipped 24.1% month-on-month to an estimated 1,965 transactions in October 2022, the lowest recorded in the month of October since 2017. This could signal that price resistance is setting in amid rising interest rates and concerns over a possible recession going forward.

The decline in HDB resale volume also came after the latest round of property cooling measures that kicked in on 30 September. Measures include higher interest rate floors for both HDB and bank loans, a 5% reduction in the loan-to-value (LTV) limit for HDB loans, and a 15-month wait for private property owners before they can buy an HDB resale flat.

But it should be noted that it typically takes 8 weeks for an HDB sale to complete. Hence, the price impact of the 30 September cooling measures has yet to be factored in, although sentiment has taken a hit.

By room type, 41.9% of October’s transaction volume was in four-room units, 26.1% in five-roomers and 23.7% in three-roomers. Meanwhile, executive flats made up 6.8%, with other room types contributing to the rest.

In terms of areas, 57.7% of the volume is in non-mature estates, with the rest coming from mature estates.

October’s HDB resale transactions may also have been affected by the upcoming bumper launch of BTO flats across mature and non-mature estates. In November, HDB will offer about 9,5000 flats in Bukit Batok, Kallang Whampoa, Queenstown, Tengah and Yishun, followed by another 2,900 to 3,900 flats in February 2023.

Top October 2022 HDB Resale Transactions

The top resale transaction is a five-room Design, Build and Sell Scheme unit at The Peak @ Toa Payoh that was sold for nearly $1.4 million. Meanwhile, an executive flat at Yishun Avenue 4 was sold for about S$1.1 million, a record for a resale HDB flat in non-mature estates.

However, the number of million-dollar resale flats declined to 40 in October from 45 in September. Six of these flats were in the central like Bukit Merah, as well as Toa Payoh, followed by 4 units in Ang Mo Kio.

These million-dollar transactions make up 2% of the monthly sales in October, and about 1.4% of total HDB resale deals in the first 10 months of 2022.

Around 37.2% of these resale flats were resold at below $500,000 in October, compared with 39% a month earlier. About 60.8% of resale flats were sold at between $500,000 and just under a million dollars, compared with 59.2% in September.

Year-to-date, 317 million-dollar resale transactions were recorded, up 22% from the 259 units seen for the whole of 2021.

Upcoming New Property Launches

The following are some of the upcoming property launches, including an executive condo:

- Tenet EC

- Hill House

- Sceneca Residence

- Blossoms By The Park

- Botany At Dairy Farm

- The Arden

- Lentor Hills Residences

- Terra Hill