The following is a snapshot on Q3 2022 property prices.

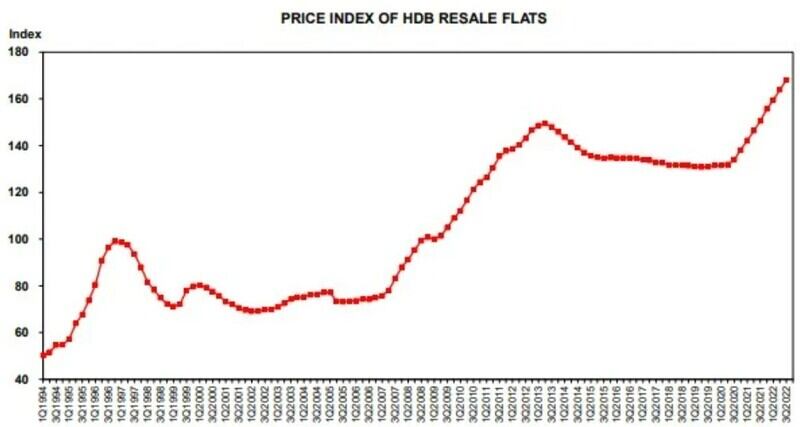

Prices in the HDB resale market edged up 2.6% in Q3 2022, a slower pace than the 2.8% rise recorded in Q2. This marked the 10th consecutive quarter of price increase amid the backdrop of higher inflation and interest rates.

This reflects growing caution over the economy while cost of living escalated, prompting buyers to be more wary of their expenditure, especially big-ticket items.

Singapore’s core inflation rose further to 5.3% in September, up from 5.1 % in August, edging towards a 14-year high.

The last time Singapore reported higher year-on-year core inflation growth was in November 2008, when it hit 5.5%.

Going forward, the price increase in HDB resale flats may moderate further following the latest round of property cooling measures imposed on 30 September. These include the tightening of LTV for HDB loans from 85% to 80%, raising the interest rate floor to 3% from 2.6% for HDB loan eligibility applications, and private homeowners buying HDB resale flats subjected to a 15-month wait after selling their properties.

Nevertheless, with private home prices having risen significantly where new suburban condo launches such as Amo Residence, Sky Eden, and Lentor Modern are selling above $2,000 psf, this has forced some to shift to HDB resale flats.

According to government data, there were 111 million-dollar HDB flat transactions in Q3 2022, 35.4% more than in Q2 2022. More million-dollar flats have also been seen in non-mature estates, with 7 in Q3 2022 compared to 4 in the previous quarter, as homes in matured estates become increasingly pricey.

It has also been observed that buyers are turning their attention to 5-room and larger flats. There were 75 transactions in Q1, 70 in Q2 and 105 in Q3. The first nine months of 2022 saw 250 5-room and larger flats sold compared to only 210 in the entire year of 2021.

Q3 2022 Property Prices: Private Homes

Meanwhile, the private property price index for Q3 2022 rose at a faster rate of 3.8% compared to Q2 (3.5%) – a new quarterly record high.

Private property prices increased by 8.2% in the first three quarters (Jan-September) of 2022. This is higher than the 5.3% growth over the same period in 2021 despite new property cooling measures imposed in December 2021.

The price growth was mainly driven by non-landed homes, which rose 4.4%, while landed home prices rose 1.6%.

Breaking down by market segments, the price increase was led by properties in the suburbs or Outside Central Region (OCR), up 7.5% – the steepest quarterly increase since Q3 2009 at 16.1%.

This is followed by the Rest of Central Region (RCR) and Core Central Region (CCR), up 2.8% and 2.3% quarter-on-quarter respectively.

Pipeline of New Private Condo Launches

The following is a list of upcoming new condo launches to look out for.

- Blossoms By The Park (One-North)

- Terra Hill (Pasir Panjang)

- Sceneca Residences (Tanah Merah)

- Botany At Dairy Farm (Dairy Farm Walk)

- The Arden (Bukit Panjang)

- Lentor Hills Residences

For project update, please WhatsApp Me.

Executive Condominium (EC)

With rising HDB resale prices, many HDB homeowners have taken the opportunity to upgrade to executive condominiums. At the same, with suburban mass market condos selling above $2,000 psf, this has caused a significant widening of the price gap against executive condos.

Hence, it is no surprise at the latest executive condo launch on 22 October 2022, Copen Grand sold 465 out of 639 units, representing 73% of total. The maximum 30% of the project allocated to second-time buyers during the launch was fully taken up.

Sold at an average price of $1,300 psf, with an additional 3% applied to those buying under the deferred payment scheme, this offers an irresistible entry price.

The next executive condo to be launched will be Tenet, located about 4 minutes’ walk from the Tampines North integrated transport hub. Given its convenient location near the upcoming Tampines North MRT station on the Cross Island Line (CRL), it is expected to see strong demand as well.

Meanwhile, North Gaia EC located at Yishun, which was launched on 24 April 2022, has been seeing steady demand.

Please reach out to me if you are interested to find out more about these ECs.